|

Generally, gifts received are not regarded as Income chargeable to Tax. However, by virtue of section 2(24)(xiii) r.w.s. 56(2)(v) after 1-9-2004 any sum of money exceeding ₹ 50,000 received without consideration by an individual or an HUF from any person is chargeable to tax as Income under the head Other Sources, subject to following exceptions: (a) Receipts from certain relatives; as defined in the section. (Refer Chart) (b) Receipts on occasion of marriage of the individual. (c) Receipts under a will or inheritance. (d) Receipts in contemplation of death of the payer.

Sec. 56(2)(v) has been amended by the Taxation Laws (Amendment) Act, 2006 so as to exempt also the receipts from (i) local authority, (ii) institutions exempt u/s. 10(23C) and (iii) trusts/institutions registered u/s. 12AA.

Sec. 56(2) has been further amended and w.e.f. 1-10-2009, the scope of gift is increased by adding immovable property or any property besides sum of money [S. 56(2)(vii)] excluding stock-in-trade, raw material, consumable stores or any other trading assets List of Property – (to be treated as Gift)

- immovable property being land or building or both;

- shares and securities;

- jewellery;

- archaeological collections;

- drawings;

- paintings;

- sculptures;

- any work of art;

Valuation of Gift in case of

- Immovable Property (being land or building or both)

56(2)(vii)(b) – Immovable Property – Without Consideration

|

If SDV≤50,000

|

If SDV > 50,000

|

|

Donor

|

Donee

|

Donor

|

Donee

|

|

Provisions not applicable

|

Not considered as transfer u/s 47(iii) – No Capital Gain

|

SDV is income from other Sources u/s 56(2)(vii).

COA will be SDV.

Holding period will be counted from acquisition of property by donee.

|

56(2)(vii)(b) – Immovable Property – Inadequate Consideration

|

If SDV≤50,000

|

If SDV > 50,000

|

|

Donor

|

Donee

|

Donor

|

Donee

|

|

Provisions not applicable

|

Sec 50C will be applicable if Land & Building is capital Assets for Donor and Sale Consideration for Donor will be SDV. Capital Gain will be SDV less COA.

Sec 43CA will be applicable if Land & Building is not a capital Assets for Donor and Sale Consideration for Donor will be SDV. Income from PGBP will be SDV less COA.

|

Difference of SDV and Consideration is income from other Sources u/s 56(2)(vii). At the time of further sale COA will be SDV and holding period will be counted from acquisition of property.

|

It is also provided that in a case where the date of the agreement to purchase the property fixing the consideration and the date of registration are different, the taxability will be determined with reference to the stamp duty value on the date of agreement and not registration. This exception will apply only where at least part of the consideration has been paid by any mode other than cash, on or before the date of such agreement.

(ii) Any other property:

56(2)(vii)(c) – Movable Property Without Consideration

|

If FMV≤50,000

|

If FMV > 50,000

|

|

Donor

|

Donee

|

Donor

|

Donee

|

|

Provisions not applicable

|

Not considered as transfer u/s 47(iii) – No Capital Gain

|

Fair Market Value (FMV) shall be income from other Sources u/s 56(2)(vii). COA will be FMV. Holding period will be counted from the date of acquisition of property by donee.

|

56(2)(vii)(c) – Movable Property Inadequate Consideration

|

If FMV≤50,000

|

If FMV > 50,000

|

|

Donor

|

Donee

|

Donor

|

Donee

|

|

Provisions not applicable

|

Not considered as transfer u/s 47(iii) – No Capital Gain

|

Difference of FMV and Consideration is income from other Sources u/s 56(2)(vii). At the time of further sale COA will be FMV and holding period will be counted from acquisition of property

|

w.e.f. 1-6-2010 following items added:–

- Bullion

- Receipt of shares of a closely-held company without consideration or inadequate consideration by firm or closely held company from closely held company is taxable.

S. 50(2) (viia)

- Provision not applicable in case of the following restructuring:

- Transfer of shares of Indian company by amalgamating foreign company to amalgamated foreign company

- Transfer of shares of Indian company by demerged foreign company to resulting foreign company

- Transfer by share holder of co-operative bank in a business reorganisation of a co-operative bank.

- Transfer by share holder of shares of amalgamating company

- Transfer or issue by the resulting company, in a scheme of demerger,

- Receipt of shares of a closely-held company by a firm (including LLP) or a closely-held company taxable if transfer is without consideration or for inadequate consideration.

- Fair market value less consideration is taxable, subject to difference of more than ₹ 50,000.

- Amount taxed to be treated as cost of acquisition in the hands of recipient.

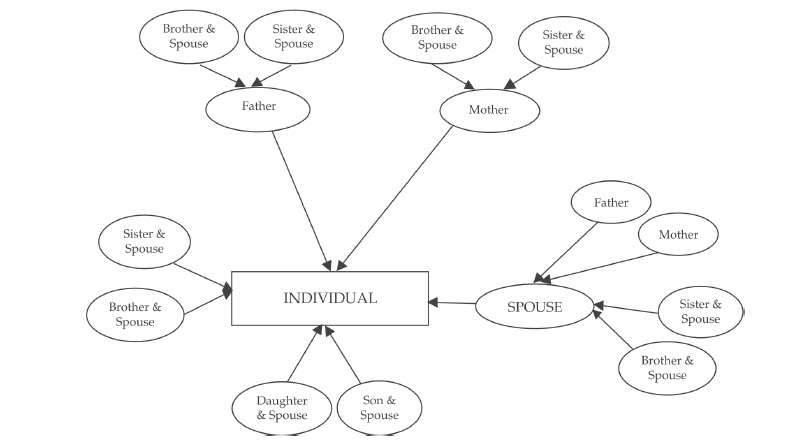

Gift of more than ₹ 50,000/- can be received from below mentioned relatives without any taxes

Notes:

- Applicable for Gift received from Spouse and Parent-in-Law of female individual.

- The individual can receive gifts without attracting tax also from lineal ascendants and descendants of the individual/spouse of the individual, other than those mentioned in the above chart.

Valuation rules for determining ‘fair market value of gifts’

Background

The Finance (No. 2) Act, 2009 has inserted clause (vii) in section 56(2) of the Income-tax Act (‘the Act’) to tax an Individual or a Hindu Undivided Family (HUF) who is receiving any asset which is in the nature of shares and securities, jewellery, archaeological collections, drawings, paintings, sculptures or any work of art (specified assets) without consideration or for inadequate consideration i.e. consideration which is less than fair market value (FMV) by an amount exceeding ₹ 50,000. Further, the Finance Act, 2010 introduced similar provisions to tax receipt of shares of a closely-held company by a firm or another closely held company w. e. f. 1-6-2010. For the purpose of determining fair market value, Rules 11U and 11UA were introduced. With the applicability of the Act, Rules are also applied accordingly.

Synopsis of the Rules

The rules 11U and 11UA prescribes the different methods for the purpose of valuation of specified assets.

The FMV of the specified asset needs to be determined on a date on which such specified assets are received by the assessee.

The determination of FMV, under this rule, will be only for the purpose of section 56 of the Act.

Notification No. 23/2010, which came into force from 1st October, 2009. Further, specified assets received from relative are not covered by the provisions of section 56(2)(vii) of the Act.

Methods of Valuation

1. Valuation of specified assets (other than shares & securities)

|

Description of the property

|

Basis for determination of FMV

|

|

Specified assets other than shares and securities

|

Estimated price which specified asset will fetch if sold in the open market on the valuation date

|

|

In case if specified assets are received by the way of purchase on the valuation date from the Registered Dealer (means a dealer who is registered under Central Sales Tax Act, 1956 or General Sales Tax Law for time being in force in any State including value added tax laws).

|

FMV is the Invoice Value of the asset

|

|

In case if specified assets are received by any other mode and the value of the specified assets exceeds ₹ 50,000

|

The assessee may obtain the report of registered valuer in respect of the price it would fetch if sold in the open market on the valuation date

A registered valuer is a person who is entitled to function as registered valuer for - the purpose of the Wealth Tax Act.

|

2. Valuation of Shares & Securities

- Valuation of Quoted Shares & Securities

|

Description of the property

|

Basis for determination of FMV

|

|

If quoted shares and securities are received by way of transaction carried out through any Recognised Stock Exchange (RSE)

|

Transaction value recorded in such RSE

|

|

If quoted shares and securities are received by way of transaction carried out other than through any RSE.

|

Lowest price quoted on any RSE on the valuation date

If in case there is no trading on the valuation date, then, FMV will be lowest price on the date immediately preceding the valuation date when trading happened

|

- Valuation of Unquoted Shares

|

Description of the property

|

Basis for determination of FMV

|

|

Unquoted Equity Shares

|

Value as per the balance sheet (including notes thereto) on

the valuation date in terms of the following formula:

(A - L) x PV

PE

Where,

A = Book value of assets in balance sheet less advance income-tax paid, any amount which does not represent the value of any asset, including debit balance in profit & loss account

|

|

|

L = Book value of liabilities in balance sheet less

- paid-up equity capital;

- amount set aside for undeclared dividend;

- reserves, other than towards depreciation;

- credit balance in profit & loss account;

- amount of provision for tax, other than

advance income-tax paid in excess of tax payable

with reference to book profits (minimum alternate

tax);

- provision towards unascertained

liabilities;

- provision towards contingent liabilities.

PE = Total amount of paid-up equity share capital

PV = Paid-up value of such equity shares received

|

- Valuation of Unquoted Shares other than equity shares

|

Description of the property

|

Basis of determination of FMV

|

|

Unquoted shares and securities other than equity shares in a company which are not listed in any RSE

|

Price it would fetch if sold in open market on the valuation date & the assessee is required.

To obtain a report from a Merchant Banker or a Chartered Accountant in support of the FMV

|

Applicable w.e.f. A.Y. 2013-14

Sec 56(2)(viib) applies to Closely held company :

Where a closely held company receives any consideration from resident person for issue of shares that exceeds the face value of shares, then the consideration received in excess of the fair market value of the shares shall be taxable under the head Income from other sources.

- Fair market value to be determined in accordance with the prescribed method or as substantiated by the company to the satisfaction of the AO whichever is higher.

- Provision does not appliy to amount received by venture capital undertaking from a venture capital fund or venture capital company.

Retrospective amendment for gifts received by HUF

Any sum or property received without consideration or inadequate consideration by HUF from its members would also be excluded from taxation. w.e.f.

1-10-2009 [Refer amendment made to sec. 56(2)(vii)] but is subject to clubbing provisions u/s 64(2)

Newly introduced section 56(2)(ix) applicable from Asst. Year 2015-2016

Where any sum of money received as an advance or otherwise in the course of negotiations for transfer of Capital Assets, is forfeited and the negotiations do not result into transfer of such capital asset, then such sum shall be chargeable under this section as “Income from other sources”.

Back to Top

|