A. SUBSTANTIVE PROVISIONS

1. Section 92(1) provides that:

- There must be “income arising”;

- Such income must arise “from” an “international transaction”;

- Such income “shall” be computed having regard to the “arm’s length price”.

2. The Finance Act, 2012 extended the scope of applicability of Transfer Pricing Provisions to “specified domestic transactions” where the aggregate value of such transaction exceed ₹ 50 million. The Finance Act, 2015 has raised the limit to ₹ 200 million.

3. Allowance for any expenses or interest arising from an international transaction or specified domestic transaction is also to be determined having regard to arm’s length price. Further, the application of arm’s length price results in reducing the chargeable income or increasing the loss from an Indian Income-tax perspective, then the income, expense, interest or other allocation or apportionment of expenses need not be calculated at such arm’s length price.

4. Section 92(2) provides that cost sharing arrangements between “associated enterprises” (“AEs”) arising from international transaction as well as specified domestic Transfer Pricing will also be subject to the arm’s length rule.

5. The term “international transaction” is defined in section 92B. The salient features of this definition are as under :

- Use of word “means” shows that it is an exhaustive definition;

- The term “transaction” is defined in an inclusive manner in section 92F(v);

- The transaction has to be between two or more “associated enterprises” (“AEs”). “Associated enterprise” is defined in section 92A;

- All or any one of the AEs must be a “non-resident”. The section states “either or both

of whom are non-resident”. Section 2(30) defines the term non-resident and for the purposes of section 92 includes a resident but not ordinarily resident;

- The transaction may be in the nature of commercial transaction such as:

- Purchase, sale, transfer, lease or use of tangible or intangible property including building, transportation vehicle, machinery, equipment, tools, plant, furniture, commodity or any other article, product or thing; or

- The purchase, sale, transfer, lease or use of intangible property, including the transfer of ownership or the provision of use of rights regarding land use, copyrights, patents, trade marks, licences, franchises, customer lists, marketing channel, brand, commercial secret, know-how, industrial property right, exterior design or practical and new design or any other business or commercial rights of similar nature; or

- Capital financing, including any type of long-term or short-term borrowing, lending or guarantee, purchase or sale of marketable securities or any type of advance, payments or deferred payment or receivable or any other debt arising during the course of business; or

- Provision of services including provision of market research, market development, marketing management, administration, technical service, repairs, design, consultation, agency, scientific research, legal or accounting service; or

- A transaction of business restructuring or reorganisation, entered into by an enterprise with an associated enterprise, irrespective of the fact that it has bearing on the profit, income, losses or assets of such enterprises at the time of the transaction or at any future date; or

- Any other transaction having a bearing on profits, income, losses or assets of an AE.

- Cost sharing arrangement, that is, a mutual agreement or arrangement between AEs for the allocation or apportionment of, or contribution to any cost or expense incurred in connection with a “benefit, service or facility” provided to the AE.

The expression intangible property shall include:

- Marketing related intangible assets, such as, trade marks, trade names, brand names, logos;

- Technology related intangible assets, such as, process patents, patent applications, technical documentation such as laboratory notebooks, technical know-how;

- Artistic related intangible assets, such as, literary works and copyrights, musical compositions, copyrights, maps, engravings;

- Data processing related intangible assets, such as, proprietary computer software, software copyrights, automated databases, and integrated circuit masks and masters;

- Engineering related intangible assets, such as, industrial design, product patents, trade secrets, engineering drawing and schematics, blueprints, proprietary documentation;

- Customer related intangible assets, such as, customer lists, customer contracts, customer relationship, open purchase orders;

- Contract related intangible assets, such as, favourable supplier, contracts, licence agreements, franchise agreements, non-compete agreements;

- Human capital related intangible assets, such as, trained and organised work force, employment agreements, union contracts;

- Location related intangible assets, such as, leasehold interest, mineral exploitation rights, easements, air rights, water rights;

- Goodwill related intangible assets, such as, institutional goodwill, professional practice goodwill, personal goodwill of professional, celebrity goodwill, general business going concern value;

- Methods, programmes, systems, procedures, campaigns, surveys, studies, forecasts, estimates, customer lists, or technical data;

- Any other similar item that derives its value from its intellectual content rather than its physical attributes.

6. Section 92B(2) deems a transaction between two unrelated enterprises to be an international transaction between two associated enterprises under certain circumstances. The Finance No. 2 Act, 2014 has amended the aforesaid provision. Presently any transaction entered into by an enterprise (say A) with a person other than an associated enterprises (say B) is deemed to be a transaction between two associated enterprises if there exists a prior agreement between B and the associated enterprise (say C). It is now clarified that where either A or C or both are non-residents, irrespective of whether B is a resident or non-resident, the transaction between A and B will be deemed to be an international transaction between two associated enterprises.

7. Section 92BA defines the term “Specified Domestic Transaction”. The salient feature of this definition are as under:-

- Use of word “means” shows that it is an exhaustive definition;

- The term “transaction” is defined in an inclusive manner in section 92F(v);

- It covers any of the following transactions (other than an international transaction):-

- Payment of expenditure to a person referred to in section 40A(2)(b);

- Any transaction relating to transfer of goods or services between two undertaking or units of the same entity referred to in section 80A (dealing with deductors under section 10A/10AA/10B/10BA or in any other provisions of Chapter VIA) or section 80-IA(8);

- Any business transacted between the assessee and any other person as referred to in section 80-IA(10);

- Any transaction referred to in any other section under chapter VIA or section 10AA to which the provisions of section 80-IA(8) or section 80-IA(10) are applicable;

- Any other transaction as may be prescribed.

8. The term “arm’s length price” is defined in section 92F(ii) to mean—

- The price which is applied; or

- Is proposed to be applied

- In a transaction between persons other than AEs;

- In uncontrolled conditions.

9. Section 92C provides the mechanism of determining the "arm’s length price" by any of the following five methods, being the most appropriate method taking in to consideration the nature or class of the transaction functions performed or such other factors as laid down in rule 10B:

a. Comparable uncontrolled price method:

- Comparison of price charged or paid for property transferred or services provided in a comparable uncontrolled transaction;

- Used mainly in respect of transfer of goods, provision of services, intangibles, loans, provision of finance.

b. Resale-price method:

- Considers the price at which property purchased or services obtained by the enterprise from an AE is resold or are provided to an unrelated enterprise.

- Used mainly in case of distribution of finished goods or other goods involving no or little value addition.

c. Cost-plus method:

- Considers direct and indirect costs of production incurred by an enterprise in respect of property transferred or services provided and an appropriate mark-up.

- Used mainly in respect of provision of services, joint facility arrangements, transfer of semi finished goods, long-term buying and selling arrangements.

d. Profit-split method:

- Considers combined net profit of the AEs arising from the international transaction and is split amongst them;

- Used mainly in report of transactions involving integrated services provided by more than one enterprise, transfer of unique intangibles, multiple inter-related transactions, which cannot be separately evaluated.

e. Transactional net margin method:

- Considers net profit margin realised by the enterprise from an international transaction entered into with an AE.

- Used in respect of transactions for provision of services, distribution of finished products where resale price method cannot be adequately applied, transfer of semi-finished goods.

f. Any other method as prescribed by the CBDT. The CBDT notified the “Other Method” vide Rule 10AB of the Income tax Rules 1962 on May 23, 2012 with effect from April 1, 2012. The other method shall be any method which takes into account the price which has been charged or paid, or would have been charged or paid, for similar uncontrolled transaction, with or between non-associated enterprises, under similar circumstances, considering all relevant facts.

g. The Rules for determination of the arm’s length price in respect of domestic transfer pricing regulations are not separately prescribed. It seems that the aforesaid rules will

mutas mutandis apply to domestic transfer pricing transactions.

The most appropriate method from the above method shall be applied for determination of the arm’s length price in the manner laid down in Rule 10C.

Where the variation between the arm’s length price determined and the price at which the international transaction or specified domestic transaction has been undertaken (transfer price) does not exceed such percentage as may be notified by the Central Government which shall not exceed 3% of the transfer price, then the transfer price is deemed to be the arm’s length price.

The Finance No. 2 Act, 2014 has provided that where more than one price is determined, the arm’s length price shall be computed in such manner as prescribed. Subject to the Rules to be notified the Finance Minister in his budget speech had announced that an inter-quartile range concept for determination of the arm’s length price in addition to the arithmetic mean concept will be introduced. Detailed rules in this regard will be prescribed

10. The term “enterprise” is defined in section 92F(iii) to mean a “person” including a “permanent establishment” of a person who is, or has been or is proposed to be “engaged in” certain specified activities. These activities are in relation to :

- Production storage, supply, distribution, acquisition or control of:

- Articles or goods; or

- Know-how, patents, copyrights, trade marks, licences, franchises or any other business or commercial rights of similar nature; or

- Any data, documentation, drawing or specification relating to any patent, invention, model, design, secret formula or process:

- of which the other enterprise is the owner; or

- in respect of which the other enterprise has exclusive rights; or

- provision of services of any kind; or

- carrying out any work in pursuance of a contract; or

- investment or

- providing loan or

- business of acquiring, holding, underwriting or dealing with shares, debentures or other securities of any other body corporate.

Such activity or business may be carried on directly or through one or more of the units or divisions or subsidiaries, which may be located at the same place where the enterprise is located or at a different place(s).

11. The term “Permanent Establishment” is defined to include a fixed place of business through which the business of the enterprise is wholly or partly carried on.

12. An “enterprise” is an AE :

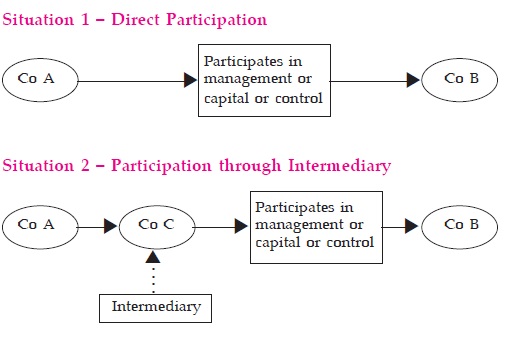

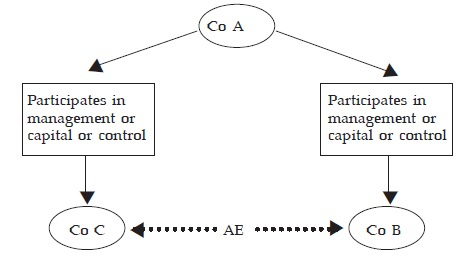

- Which participates directly or indirectly in the management or control or capital of the other enterprise. This can be explained as under:

- If any person who participates in the management or control or

capital of an enterprise also participates in the management or

control or capital of the other enterprise. This can be explained

as under:

13. In respect of international transaction in the following circumstances, two enterprises shall be deemed to be AEs if at any time during the year:

| A holds at least 26% of the voting power of B; or

|

(A & B are AEs) |

| A holds at least 26% of the voting power of B & C; or

|

(B & C are AEs) |

| A advances a loan to B, constituting at

least 51% of the book value of total assets of B; or |

(A & B are AEs) |

| A guarantees at least 10% of the total borrowings of B; or

|

(A & B are AEs) |

| A appoints, more than half the directors of B; or one or more executive directors of B; or

|

(A & B are AEs) |

| A appoints, more than half the directors of B & C; or one or more executive directors of B & C; or

|

(B & C are AEs) |

| The manufacture or processing of goods or articles or business carried on by A is wholly dependent on the use IPRs (know how etc.) belonging to B or in respect of which B has exclusive rights; or

|

(A & B are AEs) |

| At least 90% of the raw materials and consumables required for the manufacturing or processing of goods or articles carried out by A, are supplied by B or by persons specified by B, and the prices and other conditions relating to the supply are influenced by B; or |

(A & B are AEs) |

| The goods manufactured or processed by A are sold to B or persons specified by B, and the prices and other conditions relating thereto are influenced by ‘B’; or

|

(A & B are AEs) |

| Where A is controlled by B (an individual) a transaction between A and C, if C is controlled by B or his relative or jointly by B and his relative; or

|

(A & C are AEs) |

| Where A is controlled by B HUF, a transaction between A and C, if C is controlled by a member of B HUF or by a relative of a member of B HUF or jointly by such member and his relative; or

|

(A & C are AEs) |

| Where A is a firm, AOP or BOI and B holds at least 10% interest in A; or

|

(A & B are AEs) |

| There exists any relationship of mutual interest between A and B as may be prescribed.

|

(A & B are AEs) |

Sub-section 2 of Section 92(A) clarifies that mere participation by A in the management, control or capital of B or the commonality of control, management or capital of A and B per se may not be sufficient to make A and B associated enterprises unless one or more of the conditions specified in paragraph 10 above are satisfied.

14. The expenditure in respect of payment made to the following person by an assessee say C will be subject to domestic transfer pricing regulations :—

| Where C is an individual |

Any relative of C |

| Where C is a company |

Any director of C |

| Where C is a firm

|

Any partner of C |

| Where C is an AOP or HUF

|

Any member of AOP or HUF |

| Where C is carrying on any

business or profession |

- Any individual having a substantial interest in C or

any relative of such individual;

- Any company, firm or AOP or HUF having a substantial interest in C or any director, partner or member of such company, firm, AOP or HUF or any relative of such director, partner or member of AOP or HUF or any other company carrying on business or profession in which the first mentioned company has a substantial interest;

- Any company, firm, AOP or HUF of which a director, partner or member has a substantial interest in the business or profession of C or any director, partner or member of such company, firm, AOP or HUF or any relative of such director, partner, or member.

|

Further the following person would also be covered

- Any person say D carrying on a business or profession, —

- Where C being an individual, or his relative has a substantial interest in the business or profession of D

- Where C being a company, firm, AOP or HUF, or any director, partner, member of C, or any relative of C’s director, partner or member, has a substantial interest in the business or profession of D.

- A person shall be deemed to have a substantial interest in a business or profession, if,—

- In a case where the business or profession is carried on by a company, such person is, at any time during the previous year, the beneficial owner of shares (not being shares entitled to a fixed rate of dividend whether with or without a right to participate in profits) carrying not less than 20% of the voting power; and

- In any other case, such person is, at any time during the previous year, beneficially entitled to not less than 20% of the profits of such business or profession.

15. Section 92C(3) provides that an Assessing Officer (“AO”), after having provided an opportunity to the assessee of being heard, may determine the arm’s length price, on the basis of material or information in his possession, if he is of the opinion that,

- The price charged or paid in an international transaction or specified domestic transaction has not been determined in accordance with the transfer pricing provisions, or

- If any information and document relating to an international transaction or specified domestic transaction has not been maintained in accordance with the provisions, or

- If the information and data used in computation of arm’s length price is not reliable or correct, or

- If the assessee has failed to furnish, within the specified time, any information or document which he was required to furnish by a notice under section 92D(3).

Under such circumstances, the A.O. may compute the total income of the assessee having regard to the price so determined.

In cases where the total income is enhanced as a result of such computation of income, no deduction under sections 10A, 10AA or section 10B or under Chapter VI-A is allowed in respect of the amount of income by which the total income of the assessee is enhanced.

Further, in cases where the total income of an AE is computed by the A.O. on determination of arm’s length price paid to another AE from which tax has been deducted or was deductible under Chapter XVIIB, the income of the other associated enterprise shall not be recomputed by reason of such determination.

16. The AO also has powers to refer the computation of arm’s length price to a Transfer Pricing Officer (TPO) with previous approval of the CIT. The TPO would then pass an order determining the arm’s length price after hearing the assessee. Thereafter, the A.O. will compute the total income having regard to the arm’s length price determined by the TPO (S. 92CA). The MOF has issued instructions (No. 3/2003) dated 20th May, 2003 giving guidelines on references to TPO, the role of TPO and related issues. The text thereof is reproduced on the CD. The Assessing Officer while completing their assessment in respect of assessments involving transfer pricing are now bound to compute the total income of the asseessee in conformity with the arm’s length price determined by the TPO.

TPO are empowered to determine arm’s length price of an international transaction noticed by him in the course of transfer pricing proceedings, even where the transfer pricing report was not furnished by the assessee.

Section 92CB provides for the determination of arm’s length price subject to safe harbour rules. Safe harbour is defined to mean circumstances in which the Income Tax authorities shall accept the transfer price declared by the assessee. The Central Board of Direct Taxes introduced the safe harbour rules on September 18, 2013. Rules 10TA to 10TG contain the procedure for adopting the safe harbour, the transfer price to be adopted, the compliance procedure etc. The safe harbour margin/price which have been prescribed based on which the transfer price declared by an eligible assessee shall be accepted by the Transfer Pricing Officer is contained in the CD enclosed herewith.

17. The jurisdiction of the transfer pricing officer (TPO) is extended to determine the arm’s length price in respect of international transactions not referred to him by the Assessing Officer and which comes to his notice during the transfer pricing assessment proceedings.

18. TPO permitted to exercise powers of survey under section 133A of the Act.

19. Section 94A inter alia provides that if an assessee enters into a transaction where one of the parties to the transaction is a person located in a “notified jurisdictional area” then all the parties to the transaction to be deemed to be associated enterprises and any transaction entered into with them to be regarded as an international transaction and transfer pricing provisions to apply accordingly

B. PROCEDURAL PROVISIONS

- Every person who has entered into an “international transaction or specified domestic transaction” shall keep and maintain the prescribed information and documents [Sec. 92D(1)] which shall be maintained for the prescribed period [Sec. 92D(2)].

- The A.O./CIT may require an assessee, in the course of any proceedings under the Act, to furnish the prescribed information or documents within 30 days from date of receipt of the notice. The A.O. may on application, extend the period by which such information and documents should be furnished by a further period of 30 days. [Sec. 92D(3)].

- Every person who has entered into an international transaction or specified domestic transaction is required to obtain an accountant’s report in prescribed format before the specified dates; i.e., November 30th.

- The time limit for passing orders by the Assessing Officer where a reference is made to the TPO for determining the arm’s length price in an international transaction or specified domestic transaction has been increased to 12 months as under:

| In respect of normal assessment

|

From 24 months to 36 months from the end of the assessment year in which the income was first assessable |

| In case of re-opened assessments

or under |

From 12 months to 24 months

from the end of the financial year in which the notice under

section 148 was served |

| In case of order under section

254 section 263 section 264 |

From 12 months to 24 months from end of the financial year

inwhich the order under section or 254 is received by the

Chief Commissioner or Commissioner or order under section 264 is passed by the Chief Commissioner or Commissioner of Income tax |

| In case of a search cases |

From 24 months to 36 months from the end of the financial year in which the last authorisation for search under section 132 or requisition under section 132A was executed |

C. ADVANCE PRICING AGREEMENT (APA)

The Finance Act, 2012 introduced sections 92CC and 92CD to provide for a framework for Advance Pricing Agreement (APA) with effect from July 1, 2012. The salient features of the APA mechanism

inter alia include the following :-

- CBDT can enter into any APA with any person undertaking an international transaction.

- Such APAs includes determination of the arm’s length price or specify the manner in which arm’s length price to be determined, in relation to an international transaction.

- The manner of determination of arm’s length price in such cases shall be any method as prescribed under Rule 10C with necessary adjustments or variations.

- The arm’s length price of any international transaction, which is covered under such APA, be determined in accordance with the APA

- The APA will be valid for such previous years as specified in the agreement but not exceeding five consecutive previous years.

- The APA will be binding only on the person and the Commissioner (including Income Tax authorities subordinate to him) in respect of the transaction in relation to which the agreement has been entered into.

- The APA will not be binding if there is any change in law or facts having bearing on such APA.

- CBDT can declare with the approval of Central Government, any APA as void

ab initio, if it finds that the APA has been obtained by the person by fraud or misrepresentation of facts.

- For the purpose of computing any limitation period the period beginning with the date of such APA and ending on the date of order declaring the agreement void ab initio to be excluded. However, if after the exclusion of the aforesaid period, the period of limitation referred to in any provision of the Act is less than sixty days, such remaining period to be extended to sixty days.

- The CBDT will prescribe a scheme which will provide for the manner, form, procedure and any other matter generally in respect of the APA.

- If an application is made by a person for entering into such an APA, all assessment proceedings shall be deemed to be pending in case of such a person.

- Where a person who has entered into an APA and prior to entering into an APA has furnished a return of income for the previous year to which the APA applies, such person is required to furnish a modified return within a period of three months from the end of the month in which the said APA was entered.

- If the assessment or reassessment proceedings for an assessment year to which the APA applies are pending on the date of filing of modified return, the Assessing Officer shall proceed to complete the assessment or reassessment proceedings in accordance with the APA taking into consideration the modified return so filed. The period of limitation of completion of proceedings in such case to be extended by one year.

- If the assessment or reassessment proceedings for an assessment year to which the APA applies has been completed before the expiry of period allowed for furnishing of modified return, and a modified return is filed, the Assessing Officer can assess or reassess or recompute the total income in accordance with the APA. The period of limitation for completion of such assessment or reassessment to be one year from the end of the financial year in which the modified return is furnished.

- The Finance No. 2 Act, 2014 has introduced a roll-back mechanism. It has been provided that the APA may provide for determining the arm’s length price or specify the manner in which the arm’s length price is to be determined in relation to the international transaction during any period not exceeding 4 previous years preceding the first previous year for which the APA applies. The CBDT has prescribed detailed rules

vide Notification No. 23/2015 dated 14th day of March, 2015 for rollback mechanism. Some of the salient features of the mechanism are:-

- Definition of “rollback year” to mean any previous year, falling within the period not exceeding four previous years, preceding the first of the previous year covered by APA.

- The Agreement shall contain rollback provision subject to:-

- The international transaction is same as the international transaction to which the agreement (other than the rollback provision) applies.

- The return of income along with Form 3CEB for the relevant rollback years have been furnished by the applicant

before the due date.

- The applicant has requested for applicability of rollback provision for all rollback years in which said international transaction has been undertaken.

- The applicant has made an application seeking rollback in Form 3CEDA.

- The rollback provision shall not be provided for a rollback year if:

- The determination of arm’s length price of the said international transaction for the said year has been subject matter of an appeal before the Appellate Tribunal and the Appellate Tribunal has passed an order disposing of such appeal at any time before signing of the agreement;

- The application of rollback provision has the effect of reducing the total income or increasing the loss, as the case may be, of the applicant as declared in the return of income of the said year. The fee for applying for roll back is an additional amount of ₹ 0.5 million along with the application in prescribed in Form No. 3 CEDA.

- Time limit for making the application for roll back:-

- Where an application has been filed prior to the 1st day of January, 2015, Form No. 3CEDA may be filed at any time on or before the 31st day of March, 2015 or the date of entering into the agreement whichever is earlier.

- Where an agreement has already been entered into before the 1st day of January, 2015, Form No. 3CEDA may be filed at any time on or before the 31st day of March, 2015 and the agreement may be revised to provide for rollback provision in the said agreement.

The aforesaid period has been extended to June 30, 2015 vide CBDT Notification No. 33/2015 dated April 1, 2015.

The Central Board of Direct Taxes vide notification No. 36 of 2012 dated August 30, 2012 notified the APA Scheme. Rules 10F to 10T and Rule 44GA deal with the APA scheme.

Some of the salient features of the APA Scheme are as under:

- Any person who has undertaken or is contemplating to undertake a international transaction shall be eligible to enter into an APA.

- Unilateral, bilateral and multilateral APAs may be entered into.

- For unilateral APA, application will have to be filed with the Director General of Income Tax (International Taxation), for bilateral and multilateral APA, application to be filed with the Competent Authority.

- Pre-filing consultation is available in Form 3CEC to the DGIT at New Delhi. An anonymous pre-filing can be done where the name of the applicant assessee need not be given. However, the name of the authorised representative appearing on behalf of the assessee will have to be given.

- After conclusion of the hearing of pre-filing application, the assessee if it so desires may file the final APA application. The final APA application is to be filed in Form 3CED with the DGIT, New Delhi on payment of the fees.

- The hearing of the APA is a continuous process and involves site visit i.e. (at the premises of the applicant).

- In respect of one time transaction cases, APA can be filed before undertaking the transaction. However, in case of international transaction of a continuing nature it shall be made before the first day of the previous year relevant to the first assessment year for which the application is made.

- The applicant may withdraw the application of the APA in Form 3CEE at any time before the finalisation of terms of the APA. No refund of the fees will be granted in such cases.

- The APA will be entered into by the CBDT with the assessee after approval from the Central Government.

- The APA may be revised if –

- There is a change in the critical assumptions or failure to meet the conditions contained in the APA;

- There is a change in law that modifies any matter covered in the APA but is not of a nature which renders the APA to be non-binding;

- The term “critical assumptions” is defined in the Rule 10F(f) to mean factors and assumptions that are so critical and significant that neither party entering into any agreement will continue to be bound by the agreement, if any factors or assumptions are changed.

- The assessee who has entered into an APA is required to file an annual compliance report to the DGIT in Form 3CEF within 30 days of the due date of filing the income tax return for that year or within 90 days of entering into the APA whichever is later. The DGIT shall forward the copy to the CIT and the TPO having jurisdiction over the assessee.

- The TPO will carry out a compliance audit for each year covered in the agreement. The time limit for completion of the same is 6 months from the end of the month in which the annual compliance report is filed.

- The APA may be cancelled if –

- The compliance audit has resulted in finding of failure on part of the assessee to comply with the terms of the APA

- Failure to file the annual compliance report in time

- Annual compliance report contains material errors

- Assessee does not agree to the revision of the APA

- For bilateral and multilateral APAs, the AE would be required to initiate the APA process in the other country.

D. PENAL PROVISIONS

1. Section 271(1)(c)

As per Explanation 7 to section 271(1)(c)

- Where in case of an assessee who has entered into an international transaction or specified domestic transaction

- Any amount is added or disallowed in computing the total income under section 92C(4)

- Then the amount so added or disallowed shall be deemed to represent the income in respect of which particulars have been concealed or inaccurate particulars have been furnished

- Unless the assessee proves to the satisfaction of the Assessing Officer or the Commissioner (Appeals) or the Commissioner that the price charged or paid in such transaction was computed in accordance with the provisions contained in section 92C and in the manner prescribed under that section, in good faith and with due diligence.

The amount of penalty provided for is

- Not less than the amount of tax sought to be evaded; and,

- Not more than three times the amount of tax sought to be evaded, by reason of the concealment as aforesaid.

2. Section 271AA

If the assessee –

- Fails to keep and maintain the prescribed information and documents or;

- Fails to report any international transaction which is required to be reported, or;

- Maintains or furnishes any incorrect information or documents.

penalty equal to 2% of the value of each international transaction and value each specified domestic transaction may be leviable.

3. Section 271BA

Failure to furnish the accountant’s report may attract penalty of ₹ 1,00,000/-.

4. Section 271G

Failure to furnish the required information and documents may attract penalty of 2% of the value of the international transaction and value each specified domestic transaction for each failure. The power to levy this penalty has also been conferred to the Transfer Pricing Officer.

5. Section 273B

The penalties u/ss. 271AA, 271BA and 271G may not be levied if the assessee establishes reasonable cause for the said failures.

E. TRANSFER PRICING RULES

The Central Government has notified rules for giving effect to the provisions of sections 92C, 92D and 92E of the Act. The relevant rules 10A to 10E together with the forms prescribed under the said rules are given in the CD.

The gist of the said rules is as under:

1. Rule 10A defines terms used in the rules for determining arm’s length price; i.e., uncontrolled transaction, property, services and transaction.

2.1 Rule 10B(1) elaborates the manner of determining arm’s length price under each of the methods described in section 92C(1).

2.2 Rule 10B(2) lays down parameters to be considered in comparing an international transaction with an uncontrolled transaction; i.e.,

- Contractual terms

- Specific characteristics of property transferred or services provided

- Functions performed, risk assumed and assets employed

- Market conditions, which may include location and size of market, government regulations in force, level of competition, etc.

2.3 Rule 10B(3) provides for adjustment to eliminate differences when there are material factors affecting the prices between an international transaction and an uncontrolled transaction.

2.4 Rule 10B(4) provides that for the purpose of comparing international transaction and uncontrolled transaction the data for the relevant financial year or immediately preceding two years be used. The Finance Minister in his Budget speech announced that multiple year data can be used instead of one year data for comparable analysis. However, detailed rules in this will be prescribed

3. Rule 10C recognises that there cannot be a single method which may be appropriate under all circumstances. It lays down various factors to be considered for determining the most appropriate method in a particular international transaction.

4.1 Rule 10D(1) prescribes the information and documents required to be maintained by every person who has entered into international transaction.

4.2 Rule 10D(2) grants exemption from maintaining prescribed information and documents, if the aggregate value as recorded in the books of account of international transactions entered into by the tax-payer does not exceed rupees one crore.

4.3 Rule 10D(3) requires that the information specified in Rule 10D(1) shall be supported by authentic documents.

4.4 Rule 10D(4) requires that the information and documents be contemporaneous. Rule 10D(5) requires that such information and documents be kept for eight years from the end of relevant assessment year.

5. Rule 10E prescribes Form 3CEB as the report u/s. 92E which shall be furnished by every person who has entered into an international transaction.

Back to Top

|