1. Preconditions for charge u/s. 45

Income under the head “Capital Gains” can be charged only if the following three conditions are satisfied

-

There must be a “capital asset” [for definition of “capital asset” refer S. 2(14)] :—

"Capital Asset” means––

-

Property of any kind held by an assessee, whether or not connected with his business or profession;

-

Any securities held by a Foreign Institutional Investor which has invested in such securities in accordance with the regulations made under the Securities and Exchange Board of India Act, 1992, but does not include––

-

Any stock-in-trade [other than the securities referred to in sub-clause (b).

-

Personal effects of the assessee;

-

Agricultural land in a rural area;

-

6½% Gold Bonds, 1977 or 7% Gold Bonds, 1980 or National Defence Bonds, 1980 issued by the Central Government;

-

Special Bearer Bonds, 1991 issued by the Central Government;

-

Gold Deposit Bonds issued under Gold Deposit Scheme 1999 and deposit certificates issued under the Gold Monetisation Scheme, 2015 (Finance Act, 2016).

Explanation 1 – "Property" includes any rights in or in relation to an Indian company, including rights of management or control or any other rights whatsoever.

Explanation 2 – (a) The expression “Foreign Institutional Investor” shall have the meaning assigned to it in clause (a) of the Explanation to section 115AD; (b) the expression “securities” shall have the meaning assigned to it in clause (h) of section 2 of the Securities Contracts (Regulation) Act, 1956.

-

There must be a “transfer” of such capital asset [for meaning of “transfer”, refer Ss. 2(47), 47 & 46(1)]; and

-

There must arise either profits or gains or loss out of such transfer.

2. Year of Chargeability

Capital Gains are generally charged to tax in the year in which “transfer” takes place (for exception to this general rule, refer column (4) of Table 3)

3. Mode of Computation

3.1 Income under the head Capital gains is to be computed as follows:

|

a)

|

In respect of capital assets other than depreciable assets

|

as per S. 48

|

|

b)

|

In respect of depreciable assets other than mentioned in (c)

|

as per S. 50

|

|

c)

|

In respect of depreciable assets of an undertaking engaged in generation or generation and distribution of power

|

as per S. 50A

|

|

d)

|

In respect of slump sale

|

as per S. 50B

|

3.2 Capital gains u/s. 48 are computed as follows:

|

a)

|

Full value of consideration received or accruing as a result of the transfer of capital asset [also refer column 5 of Table 3]

|

a

|

|

b)

|

Less Expenditure incurred wholly & exclusively in connection with transfer [Expenditure by way of Securities Transaction Tax is not allowable]

|

b

|

|

c)

|

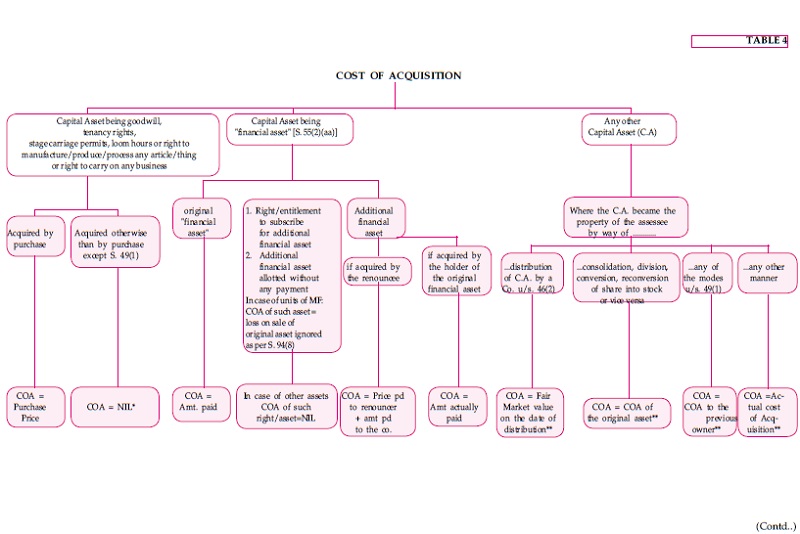

Less Cost of acquisition and cost of improvement (refer tree diagram below)

|

c

|

|

d)

|

*

|

d

|

|

|

Income/Loss chargeable u/s. 45 r.w.s. 48

|

[a-b

-(c-d)] |

* Section 51 – Where any sum of money, received as an advance or otherwise in the course of negotiations for transfer of a capital asset, has been included in the total income of the assessee for any previous year in accordance with the provisions of clause (ix) of sub-section (2) of section 56, then, such sum shall not be deducted from the cost for which the asset was acquired or the written down value or the fair market value, as the case may be, in computing the cost of acquisition.

Exceptions to S. 48

-

In case of a non-resident, Capital Gains on transfer of shares in or debentures of an Indian company are to be computed firstly by converting cost of acquisition, full value of consideration and expenses incurred in connection with transfer into originally utilised foreign currency and reconverting the capital gains so computed into Indian rupees.

Rule 115A prescribes the rates of conversion and reconversion for the purpose of calculation of capital gains in the above case. The rates of conversion and reconversion are as follows:

|

Cost of acquisition

|

The average of telegraphic transfer (TT) buying rate and TT selling rate (as on the date of acquisition) of the foreign currency utilised in the purchase of asset

|

|

Expenditure incurred wholly and exclusively in connection with transfer consideration

|

The average of TT buying rate and TT selling rate as on the date of transfer

|

|

Full value of consideration

|

The average of TT buying rate and TT selling rate as on the date of transfer

|

|

For reconverting the capital gains

|

TT buying rate as on the date of transfer

|

-

The benefit of indexation of cost will not be available for computation of Capital Gains on transfer of Bonds/Debentures

-

While calculating long-term capital gains (other than those covered under (a) and (b) above) cost of acquisition and cost of improvement are required to be indexed at prescribed indices (refer Table 3.2).

-

Finance Act, 2016 has inserted proviso to section 48 w.e.f. 1-4-2017 stating that while computing capital gains arising ot a non-resident assessee on redemption of rupee denominated bond of an Indian company subscribed by him, the gain arising on account of appreciation of rupee against a foreign currency shall be ignored for the purpose of computation of full value of consideration.

-

For computing long term capital gain arising on transfer of Sovereign Gold Bond issued by the RBI under the Sovereign Gold Bond Scheme, 2015, the cost of acquisition shall be indexed.

3.3 Capital gains u/s. 50 are computed as follows:

|

a)

|

Opening W.D.V. of the Block of Assets

|

‘a’

|

|

b)

|

Full value of consideration received or accruing as a result of transfer or transfers of asset falling within the concerned block of assets during the relevant previous year

|

‘b’

|

|

c)

|

Expenditure incurred wholly and exclusively in connection with such transfer or transfers. This deduction would not be available in a case where the entire block ceases to exist as such, for the reason that all the assets in that block are transferred during the year.

|

’c’

|

|

d)

|

Actual cost of any asset falling within the concerned block of assets acquired during the relevant previous year.

|

‘d’

|

|

|

Resultant figure

|

a+c+d-b |

If the resultant figure is negative, the same is chargeable as deemed short-term capital gains u/s. 50.

If the resultant figure is positive and the entire block ceases to exist as such (for the reason that all the assets in that block are transferred during the year) the resultant figure indicates deemed short-term capital loss (refer CBDT Circular No. 469 dated

23-9-1986 — reported in 162 ITR (Stat) 21, 30).

If the resultant figure is positive and the block continues to exist (for the reason that at least one asset in the block continues to be owned by the assessee) then there will be no gains or losses and the assessee will be entitled to claim depreciation on the resultant figure.

3.4 Capital Gains u/s. 50B

Profit arising on slump sale of one or more undertakings would be chargeable to tax as Long-Term Capital Gain in the year of transfer if such undertakings have been owned and held by the assessee for at least 36 months before the date of transfer or as Short-Term Capital Gain if held for a shorter period.

The networth (as defined) of the undertakings would be regarded as the cost of acquisition and improvement. No indexation would be allowed in respect of such cost.

3.5 Indexation

In case the capital asset is a long-term capital asset, the cost of acquisition is to be increased by cost inflation index. The prescribed cost inflation index is given in column (2) of Table 2 below. Column (4) gives the multiplying factor in case of capital asset sold in financial year 2014-15.

For example, if cost of acquisition of an asset acquired in F.Y. 1994-95 is

₹ 50,000, its indexed cost of acquisition in F.Y. 2015-16 would be ₹ 2,08,687 (i.e., 50,000 x 4.173745)

4. Exempt Capital Gains

Refer sections 10(33), 10(37), 10(38), sections 54 to 54GB and section 115F

Finance Act, 2016 has inserted a proviso to section 10(38) whereby clause (b), relating to security transaction tax, shall not apply to a transaction undertaken on a recognised stock exchange located in any International Financial Services Centre and where the consideration for such transaction is paid or payable in foreign currency.

5. Rate of Tax on Capital Gains

TABLE 1

|

Sr. No.

|

Capital Asset

|

Minimum Holding Period for "Long-Term"

|

|

1

|

Listed security in a recognised stock exchange in India (other than a unit)

|

12 months

|

|

2

|

Unlisted security

|

12 months

|

|

3

|

Units of Unit Trust of India

|

12 months

|

|

4

|

Unit of an equity oriented fund

|

12 months

|

|

5

|

Units of a Mutual Fund specified u/s. 10(23D)

|

36 months

|

|

6

|

Any other Capital Asset

|

36 months

|

Proviso section 2(42A) states that capital gain arising on unlisted shares of a company and units of a Mutual Fund specified under clause (23D) of section 10 transferred during the period beginning on the 1st day of April, 2014 and ending on the 10th day of July, 2014 will be considered as short-term if the said shares/units were held for not more than twelve months.

Capital Gains on Specific Transfers

|

Section

|

Particulars of transfer

|

Capital Gains assessable in the hands of

|

Year in which chargeable

|

Amount deemed to be the full value of consideration for the purpose of S. 48

|

|

45(1A)

|

Moneys/other assets received from insurance co. towards damage/destruction of C.A. due to certain specified natural calamities

|

The person receiving the money/assets

|

Year in which moneys/other asset is received from insurance co.

|

Value of moneys/FMV of assets received from insurance co.

|

|

45(2)

|

Conversion of C.A. into stock-in-trade

|

The owner of such asset

|

Year in which sale or transfer of stock-in-trade takes place

|

FMV of the asset on date of conversion

|

|

45(2A)

|

Transfer of Securities made by depository.

(Refer note 1)

|

The beneficial owner of the securities

|

Year in which such securities are transferred

|

Amount of consideration received

|

|

45(3)

|

Transfer of C.A. by a person to firm/AOP/BOI as his capital contribution or otherwise

|

The partner or the member so transferring

|

Year in which asset is so transferred

|

The amount recorded in the books of the firm / AOP / BOI

|

|

45(4)

|

Transfer of C.A. by way of distribution thereof on dissolution of firm/AOP/BOI or otherwise

|

The firm/ AOP/BOI

|

Year of distribution

|

FMV on the date of distribution

|

|

45(5)

|

Transfer of C.A. by compulsory acquisition under any law OR transfer where consideration determined/ approved by Central Govt./RBI

(a) Initial compensation

(b) Enhanced compensation

|

The transferor

The transferor

|

Year in which initial compensation is first received

Year in which enhanced compensation is first received

Proviso inserted w.e.f. 1-4-2015 – any amount of compensation received in pursuance of an interim order of a court, Tribunal or other authority shall be deemed to be income chargeable in the year in which the final order of such court, Tribunal or other authority is made.

|

Amount of initial compensation as reduced by order of any Court/Tribunal/ other authority

Enhanced amount (cost of acquisition and improvement are deemed to be NIL) as reduced by order of any Court/Tribunal or other authority

|

|

45(6)

|

Transfer of units referred to in S. 80CCB(2) by way of repurchase

|

The transferor

|

Year in which repurchase takes place

|

The repurchase price

|

|

46(2)

|

Distribution of assets of a Company to its share holders on its liquidation

|

The share holder

|

Year in which the share holder receives any money or other assets

|

Moneys received from the Co. + Market value of other assets on the date of distribution less amount assessed as deemed dividend u/s. 2(22)(c)

|

|

46A

|

Purchase by a company of its own shares/specified securities (buy back of shares)

|

The share holder or the holder of the specified securities

|

Year in which such shares or other specified securities purchased by the company

|

Amount received from the company

|

|

Proviso to s. 47(iii)

|

Shares, debentures, warrants allotted to employees under Employees Stock Option Plan or Scheme framed in accordance with guidelines issued by the Central Government

|

The employee

|

Year in which shares, debentures, warrants are transferred under a gift or an irrevocable trust to the employee

|

FMV on the date of its transfer

|

|

50B

|

Slump sale of Capital assets or business undertaking

|

The transferor

|

Year in which slump sale takes place

|

The value received/receivable as the sale

|

|

50C

|

Transfer of land or building

|

The transferor

|

Year in which asset is transferred

|

Higher of :

-

sale consideration

-

value adopted/assessed/assessable by State Government for stamp duty valuation

|

Note : 1. As per Circular No. 768, dated 24th June, 1998, FIFO method shall be followed in case dematerialised securities. Where the investor has more than one security account, FIFO method shall be followed account wise.

-

As per Section 55A the AO may refer to the Valuation Officer for ascertaining the fair market value of the asset under following circumstances:

-

Where in view of the AO the value of the asset claimed by the assessee in accordance with the estimate made by a registered valuer, is less than is FMV or (w.e.f. 1-7-2012, section 55A, clause (a) is amended as follows:

Where in view of the AO, the value of the asset claimed by the assessee in accordance with the estimate made by a registered valuer is at variance with its fair market value)

Where in view of the AO the value of the asset claimed by the assessee is less than the FMV by so much percentage or by so much amount as may be prescribed or

-

Having regard to the nature of the asset and other relevant circumstances, it is necessary to do so.

-

As per newly introduced section 50D (with effect from 1st April, 2013), where the consideration received or accruing as a result of the transfer of a capital asset by an assessee is not ascertainable or cannot be determined, then, for the purpose of computing income chargeable to tax as capital gains, the fair market value of the said asset on the date of transfer shall be deemed to be the full value of the consideration received or accruing as a result of such transfer.

-

The definition of agricultural land has been amended and divided into three categories based on population and shortest aerial distance. Notification by Central Government now not required.

* Provision deeming cost of acquisition of self generated goodwill as Nil not applicable to professional firms and cases of notional transfers; e.g., when a person becomes a partner [CBDT Cir. No. 495 of 22-9-1987 168 ITR (St) 87, 105, 106.]

** In case of any capital asset (other than goodwill, trademark, brand name, tenancy rights, stage carriage permit, loom hours or right to manufacture etc.), acquired by the assessee (or the previous owner) before 1-4-1981, the fair market value of the asset as on 1-4-1981 may, at the option of the assessee, be treated as cost of acquisition.

Note: Where the cost to the previous owner cannot be ascertained the cost of acquisition to the previous owner means the fair market value on the date on which the capital asset became the property of the previous owner. [Sec.55(3)] The provisions of section 49(2AAA) are inserted by Finance Act, 2010.

Finance Bill, 2015 inserted sub-section (2AD) to section 49 which states that where the capital asset, being a unit or units in a consolidated scheme of a mutual fund, became the property of the assessee in consideration of a transfer referred to in clause (xviii) of section 47, the cost of acquisition of the asset shall be deemed to be the cost of acquisition to him of the unit or units in the consolidating scheme of the mutual fund.

The Finance Bill, 2015 as passed by the Lok Sabha proposes that the period of holding in case of shares which are acquired on redemption of GDRs as referred to in section 115AC(1)(b) shall be reckoned from the date on which a request for redemption is made by the assessee.

The cost of acquisition shall be computed in accordance with sub-section (2ABB) proposed to be inserted in section 49 by the Finance Bill, 2015 as passed by the Lok Sabha.

It is proposed that cost of acquisition of shares acquired by a non-resident on redemption of GDRs shall be the price of such shares as prevailing on any recognised stock exchange on the date on which a request for redemption is made by the assessee.

Exempt Capital Gains

Exemption under the head Capital Gains

TABLE 5

|

Section

|

Asset

|

Assessee

|

Holding Period of Original Assets

|

Whether Reinvestment Necessary — Time Limit

|

Other Conditions/ Incidents

|

Quantum

|

|

(1)

|

(2)

|

(3)

|

(4)

|

(5)

|

(6)

|

(7)

|

|

54

|

Residential House Property

|

Individual/ HUF

|

3 years

|

Yes — In one Residential House in India, within 1 year before, or 2 years after the date of transfer (if purchased) or 3 years after the date of transfer (if constructed).

|

See Notes 1, 2,

10, 11, 12 & 19

|

The amount of gains, or the cost of new asset, whichever is lower

|

|

54B

|

Agricultural Land except those Exempted u/s.- 10(37)

|

Individual / HUF (see Note 17)

|

Use for 2 years

|

Yes — In Agricultural Land, within 2 years after the date of transfer.

|

Must have been used by assessee or his parents for agricultural purposes See Notes

1, 2 and 10

|

As above

|

|

54D

|

Industrial Land or Building or any right therein

|

Any Assessee

|

Use for 2 years

|

Yes — In Industrial Land, Building, or any right therein within 3 years after the date of transfer.

|

Must have been compulsorily acquired. See Notes

1, 2, 3 and

10

|

As above

|

|

54EC

|

Any Long-term Capital Asset (LTCA)

|

Any Assessee

|

Refer table 1 at page __

|

Yes — Whole or any part of capital gain in bonds redeemable after 3 years and issued on or after 1-4-2006 by NHAI or REC and notified by the Govt.– within 6 months from the date of transfer.

|

See Notes 10, 14 and

15 Investment made by an assessee in the long-term specified asset, during the financial year in which the original asset or assets are transferred and in the subsequent financial year does not exceed 50 lakh rupees.

|

The amount of gain or the cost of new asset whichever is lower subject to ₹ 50,00,000 per assessee during any financial year for investments made on or after 1-4-2007. Also investment in bonds notified before 1-4-2007 would be subject to conditions laid down in notification including limiting conditions (i.e.,

₹ 50 lakhs per assessee)

|

|

54EE

|

Any Long-term Capital Asset (inserted by Finance Act, 2016)

|

Any Assessee

|

Refer table 1 at page __

|

Yes-— Whole or any part of capital gain in unit or units, issued before the 01.04.2019, of such fund as may be notified by the Central Government

|

Investment made on or after the

1-4-2016, in the long-term specified asset by an assessee during any financial year does not exceed 50 lakh rupees

|

Investment made by an assessee in the long-term specified asset, from capital gains arising from the transfer of one or more original assets, during the financial year in which the original asset or assets are transferred and in the subsequent financial year does not exceed

₹ 50 lakh

|

|

54F

|

Any Capital Asset (not being a residential house)

|

Individual, HUF

|

Refer Table 1 at page ___

|

Yes — In one Residential House in India, within 1 year before, or 2 years after the date of transfer (if purchased), or 3 years after the date of transfer (if constructed).

|

See Notes 2, 4,

5, 10, 11,

12, 16

|

If the cost of the specified asset is not less than Net Consideration of the original asset, the whole of the gains. If the cost of the specified asset is less than the Net Consideration, the proportionate amount of the gains.

|

|

54G

|

Industrial land or building or plant or machinery

|

Any Assessee

|

—

|

Yes — In similar assets and expenses on shifting of original asset, within 1 year before, or 3 years after the date of transfer.

|

See Notes 1, 2 and

6

|

The amount of gains, or the aggregate cost of new asset and shifting expenses, whichever is lower.

|

|

54GB

|

Residential property being a house or a plot of land

|

Individual / HUF

|

5 years

|

Yes — In subscription of equity shares before due date of filing return of an eligible company and the company within 1 year utilise the amount for purchase of new asset

|

See Note 18

|

If the cost of the specified asset is not less than Net Consideration of the original asset, the whole of the gains. If the cost of the specified asset is less than the Net Consideration, the proportionate amount of the gains.

|

|

54GA

|

Industrial land or building or plant or machinery

|

Any Assessee

|

—

|

Yes — In similar assets and expenses on shifting of original assets to a Special Economic Zone – within 1 year before or 3 years after the date of transfer.

|

See Notes 1, 2 and

7

|

The amount of gains, or the aggregate cost of new asset and shifting expenses, whichever is lower

|

|

115F

|

Foreign Exchange Asset

|

Non-Resident Indian (Individual)

|

Refer Table 1 at page __

|

Yes — In 'Specified Assets' or Specified Savings Certificates of Central Government, within 6 months after the date of transfer

|

See Notes 8, 9 and

13

|

Same as u/s. 54F above.

|

Notes:

-

If the new asset is transferred, within a period of 3 years from the date of purchase/construction, the cost shall be reduced, in the year of transfer, by the gains exempted earlier.

-

If the gains are not reinvested as specified, before the due date of filing the return u/s. 139(1), then the amount not so reinvested is required to be deposited on or before that date in an account in a specified bank/institution and utilised for the purchase/construction of the relevant asset in accordance with the notified scheme within specified time limit in order to continue availing of the benefit of exemption [For the notified scheme, See 172 ITR (St.) 91].

-

Industrial land or building must have been used for the purposes of the business of the undertaking. New asset must be purchased/constructed for the purposes of shifting/reestablishing/setting up industrial undertaking.

-

The assessee must not own more than one residential house other than the new house on the date of the transfer of the original asset.

-

The assessee must neither purchase within two years after or construct within three years after the day of transfer, any other residential house other than the one in which reinvestment is made nor transfer the new asset within 3 years from the date of its acquisition/construction, otherwise the amount of gains earlier exempted shall be deemed to be LTCG in the year of such transfer.

-

The industrial undertaking must have been situated in an urban area and the transfer must have been effected as a result of shifting to a non-urban area.

-

The industrial undertaking must have been situated in an urban area and the transfer must have been effected as a result of shifting to a Special Economic Zone as defined in clause (za) of the Special Economic Zones Act, 2005.

-

‘Foreign Exchange Asset’ means any of the assets listed in Note 9 below which assessee has acquired or purchased with, or subscribed to in convertible foreign exchange.

-

A 'Specified Asset' u/s. 115F means :

-

Shares in an Indian company;

-

Debentures issued by Indian company which is not a pvt. company;

-

Deposits with an Indian company which is not a private company;

-

Any security of the Central Government as defined in S. 2(2) of the Public Debt Act;

-

Other notified assets.

-

In case of compulsory acquisition of asset under any law, time for reinvestment or deposit in specified assets, of sale proceeds or capital gains as the case may be, as prescribed by Ss. 54, 54B, 54D, 54EC and 54F shall be reckoned from the date of receipt of compensation as per provisions of S. 54H.

-

Board Cir. No. 471 dtd. 15-10-1986 (162 ITR (St) 41) has clarified that cases of allotment of flats under the self financing scheme of the Delhi Development Authority (DDA) should be treated as cases of ‘construction’ for the purposes of Ss. 54 and 54F.

Similarly, the Board Cir. No. 672 dtd. 16-12-1993 (205 ITR (St) 47) has clarified that allotment of flats/houses by co-op. societies and other institutions, whose schemes of allotment and construction are similar to those of DDA (as mentioned in para 2 of aforesaid Cir. No. 471), would be treated as ‘construction’ for the purposes of Ss. 54 and 54F.

-

Board Cir. No. 667 dt. 18-10-1993 (204 ITR (St) 103) has clarified that for the purpose of computing exemption u/s. 54 or 54F, the cost of the plot together with cost of the building will be considered as cost of new asset, provided the acquisition of the plot and also the construction thereon are completed within the period specified in these sections.

-

Where new asset is transferred within 3 years from date of its acquisition, or converted into money or any loan/advance is taken on securities of specified bond, the amount of gains earlier exempted shall be deemed to be LTCG in the year of such transfer or conversion.

-

Cost of specified asset shall not be considered for:

-

Where new asset is transferred within 3 years from date of its acquisition or converted into money or any loan/advances is taken on the security of specified assets, amount of gains earlier exempted shall be deemed to be LTCG in year of such transfer or conversion.

-

Where new asset is transferred within one year from date of its acquisition, amount of gains earlier exempted shall be deemed to be LTCG in the year of such transfer.

-

The benefit of exemption under section 54B extended to HUF with effect from 1st April, 2013.

-

Under section 54GB

18.1 "Eligible company" means a company which fulfils the following conditions, namely:—

It is a company incorporated in India during the period from the 1st day of April of the previous year relevant to the assessment year in which the capital gain arises to the due date of furnishing of return of income under sub-section (1) of section 139 by the assessee;

-

It is engaged in the business of manufacture of an article or a thing;

-

It is a company in which the assessee has more than 50% share capital or more than 50% voting rights after the subscription in shares by the assessee; and

-

It is a company which qualifies to be a small or medium enterprise under the Micro, Small and Medium Enterprises Act, 2006;

18.2 "New asset" means new plant and machinery but does not include—

-

Any machinery or plant which, before its installation by the assessee, was used either within or outside India by any other person;

-

Any machinery or plant installed in any office premises or any residential accommodation, including accommodation in the nature of a guest house;

-

Any office appliances including computers or computer software;

-

Any vehicle; or

-

Any machinery or plant, the whole of the actual cost of which is allowed as a deduction (whether by way of depreciation or otherwise) in computing the income chargeable under the head “Profits and gains of business or profession” of any previous year.

18.3 As per the section, the amount of the net consideration, which has been received by the company for issue of shares to the assessee, to the extent it is not utilised by the company for the purchase of the new asset before the due date of furnishing of the return of income by the assessee under section 139, shall be deposited by the company, before the said due date in an account in any such bank or institution as may be specified and shall be utilised in accordance with any scheme which the Central Government may, by notification in the Official Gazette, frame in this behalf and the return furnished by the assessee shall be accompanied by proof of such deposit having been made

18.4 If the equity shares of the company or the new asset acquired by the company are sold or otherwise transferred within a period of five years from the date of their acquisition, the amount of capital gain arising from the transfer of the residential property which was not charged to tax, shall be deemed to be the income of the assessee chargeable under the head “Capital gains” of the previous year in which such equity shares or such new asset are sold or otherwise transferred, in addition to taxability of gains, arising on account of transfer of shares or of the new asset, in the hands of the assessee or the company, as the case may be.

18.5 The exemption is available in case of any transfer of residential property made on or before 31st March, 2017.

18.6 The time period has been extended from 31st March 2017 to 31st March, 2019 in case the investment is made in an ‘eligible start-up’. (inserted by Finance Act, 2016 w.e.f. 1-4-2017 (term ‘eligible start-up – as defined in Explanation below section 80-IAC(4).

18.7 Section 54GB shall be effective from 1st April, 2013 and would accordingly apply from A.Y. 2013-14 and subsequent years.

NO TRANSFER FOR THE PURPOSES OF CAPITAL GAIN

Following transactions are not regarded as transfer for the purpose of Capital Gain (S. 47).

Distribution/Transfer of a Capital Asset

-

On total or partial partition of H.U.F. [S. 47(i)]

-

Under a gift/an irrevocable trust (except shares, debentures or warrants issued under ESOP/ESOS) or under a will [S. 47(iii)].

-

By a company to its Indian subsidiary company if Parent company held all the shares of Indian subsidiary company

[S. 47(iv)] (see notes 1 and 2).

-

By a subsidiary company to the Indian holding company if the Indian holding company held all the shares of the subsidiary company. [S. 47(v)] (see notes 1 and 2).

-

By the amalgamating company to the Indian amalgamated company in a scheme of amalgamation. [S. 47(vi)].

-

Being shares held in an Indian company by the amalgamating foreign company to the amalgamated foreign company in the scheme of amalgamation if [S. 47(via)]

-

At least 25% of shareholders of the first company remains shareholders of the later company, and

-

There is no capital gains tax on such transfer in the country of first company

-

A capital asset by a banking company to a banking institution in a scheme of amalgamation sanctioned and brought into force by the Central Government u/s. 45(7) of the Banking Regulation Act, 1949 [S. 47(viaa)].

-

(viab) any transfer, in a scheme of amalgamation, of a capital asset, being a share of a foreign company, referred to in Explanation 5 to clause (i) of sub-section (1) of section 9, which derives, directly or indirectly, its value substantially from the share or shares of an Indian company, held by the amalgamating foreign company to the amalgamated foreign company, if—

-

At least twenty-five per cent of the shareholders of the amalgamating foreign company continue to remain shareholders of the amalgamated foreign company; and

-

Such transfer does not attract tax on capital gains in the country in which the amalgamating company is incorporated;

-

(vicc) any transfer in a demerger, of a capital asset, being a share of a foreign company, referred to in Explanation 5 to clause (i) of sub-section (1) of section 9, which derives, directly or indirectly, its value substantially from the share or shares of an Indian company, held by the demerged foreign company to the resulting foreign company, if,—

-

The shareholders, holding not less than three-fourths in value of the shares of the demerged foreign company, continue to remain shareholders of the resulting foreign company; and

-

Such transfer does not attract tax on capital gains in the country in which the demerged foreign company is incorporated:

Provided that the provisions of sections 391 to 394 of the Companies Act, 1956 shall not apply in case of demergers referred to in this clause;

-

By the demerged company to the resulting company if the resulting company is an Indian company [S. 47(vib)].

-

Being share or shares held in an Indian company by the demerged foreign company to the resulting foreign company, if

-

The shareholders holding not less than 3/4th in the value of shares of the demerged foreign company continue to remain shareholders of the resulting foreign company.

-

There is no capital gain tax on such transfer in the country in which the demerged foreign company is incorporated [S. 47(vic)].

-

Transfer by a predecessor co-operative bank to a successor co-operative bank in a business reorganisation. [S. 47(vica)].

-

Transfer of shares of a predecessor co-operative bank against shares of successor co-operative bank in a business reorganisation [S. 47(vicb)].

-

Transfer or issue of shares in case of a demerger to shareholders of demerged company by resulting company [S. 47(vid)] (In the case of a demerger, there is a requirement under section 2(19AA)(iv) that the resulting company has to issue its shares to the shareholders of the demerged company on a proportionate basis. It is proposed to amend the provisions of section 2(19AA) so as to exclude the requirement of issue of shares where resulting company itself is a shareholder of the demerged company. The requirement of issuing shares would still have to be met by the resulting company in case of other shareholders of the demerged company.)

-

Being shares held in the amalgamating company by a shareholder in a scheme of amalgamation against the allotment of shares in the Indian amalgamated company “except where the shareholder itself is the amalgamated company”

[S. 47(vii)].

-

Being bonds or shares referred to in S. 115AC(1), made outside India by a non-resident to another non-resident. [S. 47(viia)].

-

Clause (viib) - any transfer of a capital asset, being a Government Security carrying a periodic payment of interest, made outside India through an intermediary dealing in settlement of securities, by a non-resident to another non-resident.

Explanation.—For the purposes of this clause, “Government Security” shall have the meaning assigned to it in clause (b) of section 2 of the Securities Contracts (Regulation) Act, 1956;

-

Clause (viic) (inserted by Finance Act, 2016) w.e.f. 1-4-2017 - any transfer of Sovereign Gold Bond issued by the Reserve Bank of India under the Sovereign Gold Bond Scheme, 2015, by way of redemption, by an assessee being an individual

-

Being items of national importance specified in S. 47(ix) trf. to a University, National Museum, etc.

-

By conversion of bonds, debentures, etc. into shares or debentures of same company. [S. 47(x)].

-

Conversion of Foreign Currency Exchangeable Bonds referred to in S. 115AC(1)(a) into shares or debentures of any company. [S. 47(xa)]

-

Being membership of a recognised stock exchange, on or before 31.12.1988, in exchange of shares by a person other than a company to a company “Membership of recognised stock exchange” is defined by Explanation to S. 47(xi).

-

Being land of Sick Industrial co., under a scheme of SICA 1985, where such co. is managed by its workers co-operative.

[S. 47(xii)].

-

Transfer of a capital asset where an AOP or a BOI is succeeded by a company in the course of demutualisation or corporatisation of a recognised stock exchange in India under a scheme approved by SEBI provided all the assets and liabilities of the AOP/BOI are taken over by the successor company. [S. 47(xiii)]

-

Any transfer of a capital asset, being share of a special purpose vehicle to a business trust in exchange of units allotted by that trust to the transferor. [ S. 47(xvii)F]

-

Explanation.— For the purposes of this clause, the expression “special purpose vehicle” shall have the meaning assigned to it in the Explanation to clause (23FC) of section 10.

-

Clause (xviii) – any transfer by a unit holder of a capital asset, being a unit or units, held by him in the consolidating scheme of a mutual fund, made in consideration of the allotment to him of a capital asset, being a unit or units, in the consolidated scheme of the mutual fund:

Provided that the consolidation is of two or more schemes of equity oriented fund or of two or more schemes of a fund other than equity oriented fund.

Amendment also made in section 2(42A) whereby period of holding of the units of the consolidated scheme shall include the period for which the units in consolidating schemes were held by the assessee.

-

Sale/Transfer of any Capital Asset. where a firm/Sole Proprietary Concern (SPC) is succeeded by a company provided given hereafter conditions are complied. [Ss. 47(xiii/xiv)]

IMPORTANT CONDITIONS FOR FIRMS

-

All partners become shareholders in ratio of capital.

-

Aggregate shares of old partners not to reduce below 50% of the total voting power for min. 5 years.

-

All assets and liabilities are taken over by new company.

-

Partners not to receive any benefit (other than shares) as a consideration.

IMPORTANT CONDITIONS FOR SOLE PROPRIETARY CONCERN (SPC)

-

Proprietor’s shares not to reduce below 50% for minimum 5 yrs.

-

Conditions c & d of firms also applicable to SPC.

-

Clause (xix) inserted by Finance Act, 2016 – any transfer by a unit holder of a capital asset, being a unit or units, held by him in the consolidating plan of a mutual fund scheme, made in consideration of the allotment to him of a capital asset, being a unit or units, in the consolidated plan of that scheme of the mutual fund.

-

Transfer of a membership right in a recognised stock exchange for acquisition of shares, and trading or clearing rights under a scheme of demutualisation or corporatisation approved by SEBI. [S. 47(xiiia)]

-

Sale/transfer of capital asset where a private company or unlisted public company is converted into a limited liability partnership (LLP) provided following conditions are fulfilled: (see notes 2 and 3.) (S. 47(xiiib)).

IMPORTANT CONDITIONS FOR CONVERSION INTO LLPS

All the assets and liabilities of the company before conversion are taken over by the new LLP.

-

All the shareholders of the company become the partners of the LLP. The profit sharing ratio and capital contribution are in the same proportion as their share holding in the company.

-

The shareholders do not receive any additional benefit.

-

Aggregate profit sharing ratio of the old shareholders not to reduce below 50% for min. 5 years.

-

The total assets, turnover or gross receipts of the company in any three years preceding the year of conversion do not exceed sixty lakhs.

-

No amount is paid to the partners out of the accumulated profits as on the date of conversion for three years from the date of conversion.

-

The total value of the assets as appearing in the books of account of the company in any of the three previous years preceding the previous year in which the conversion takes place does not exceed five crore rupees (inserted by Finance Act, 2016)”.

-

Transfer in a scheme of lending of any securities subject to the guidelines issued by SEBI, established under sec. 3 of SEBI Act, 1992 (15 of 1992) (or RBI constituted under sec. 3(1) of the RBI Act, 1934) [S. 47 (xv)].

-

Transfer of a capital asset in a transaction of reverse mortgage under a scheme made and notified by the Central Government [S. 47(xvi)] (retrospective from A.Y. 2008-09).

-

Section 46(1) : Where assets of the company are distributed to the shareholders on liquidation of company, such distribution shall not be regarded as transfer by company.

Notes:

-

If there is any transfer of a capital asset as a stock-in-trade after 29-2-1998 then clauses (iii) and (iv) given above will not apply.

-

Please refer S. 47A for withdrawal of exemption in certain cases.

Back to Top

|