Foreign Exchange Management Act

|

1. Introduction

The Foreign Exchange Management Act, 1999 (FEMA) deals with cross border investments, foreign exchange transactions and transactions between residents and non-residents. It has come into force from June 1, 2000.

The operation of FEMA is akin to any other commercial law. However as compared to most other commercial laws FEMA is one of the smallest, having only 49 Sections. If guidelines, rules etc. are followed, then the person can undertake most transactions without any approvals. If proposed transactions fall outside the guidelines, one will have to obtain necessary prior approvals. The consequence of any violation is a penalty and if the penalty is not paid within the specified time, then there can be prosecution.

FEMA extends to the whole of India. It also applies to all branches, offices and agencies outside India, which are owned or controlled by a person resident in India, in this respect FEMA can be said to acquire extra-territorial jurisdiction.

It is important to note that RBI/GOI issues various Notifications, Directions, Press Notes, Guidance, etc. from time-to-time to administer FEMA. However, in case of conflict between any of them the relevant FEMA Notification will prevail.

What FEMA tries to govern?

|

Sr. No.

|

Types of Asset / Transaction

|

Owned or entered by

|

|

A)

|

Currency / Security / Properties outside India

|

Person Resident in India (PRI)

|

|

B)

|

Currency / Security / Properties in India

|

Person Resident Outside India (PRO)

|

A Person Includes:

- An individual

- A Hindu Undivided Family (HUF)

- A Company

- A firm

- An association of persons or body of individuals, whether incorporated or not

- Every artificial judicial person not falling in any of the above sub-clauses

- Any agency, office or branch owned or controlled by such person.

2. Residential Status under FEMA

Resident:- If an individual stays in India for more than 182 days during the preceding financial year, he will be treated as a person resident in India. There are a few exceptions as under:

- If a person goes/stays outside Indiafor (a) taking up employment, or (b) carrying on business or vocation, or (c) for any other purpose for an uncertain period; he will be treated as a person resident outside India (non-resident). (It has been clarified that students going abroad for further studies will be regarded as non-residents.)

- If a person who is residing abroad comes to/stays in India only for (a) taking up employment, or (b) carrying on business or vocation, or (c) for any other purpose for an uncertain period; he will be treated as a person resident in India.

The term financial year means a twelve-month period beginning from April 1 and ending on March 31 next year.

Following persons (other than individuals) will be treated as persons resident in India:

- Person or body corporate which is registered or incorporated in India.

- An office, branch or agency in India, even if it is owned or controlled by a person resident outside India.

- An office, branch or agency outside India, if it is owned or controlled by a person resident in India.

The definition is however inadequate to define residential status of a firm, an HUF, a trust or any entity which does not have to be registered.

Conversely, a Non-Resident means a person who is not a resident in India.

3. Capital & Current Account Transactions

Capital Account Transaction means a transaction which:

- Alters foreign assets and foreign liabilities (including contingent liabilities) of Indian residents.

- Alters Indian assets and Indian liabilities of non-residents.

- Is a specified transaction as mentioned in section 6.

Essentially this is an economic definition and not an accounting or legal definition. It is intended to cover cross-border investments, cross-border loans and transfer of wealth across borders. RBI has been empowered to regulate capital account transactions. Unless the transaction is permitted as per regulations, Foreign Exchange (FX) cannot be drawn for the same.

Capital account transactions though liberalized to a great extent, continue to be regulated – by RBI in respect of transactions involving debt instruments and by the Government of India in respect of other transactions. Unless permitted by way of notifications and rules or specific approvals, transactions on capital account cannot be undertaken. But there are two very important purposes for which no restrictions can be imposed, by RBI, viz.:

- Drawing of foreign exchange for the repayment of any loans and;

- Replenishing depreciation of direct investments in the ordinary course of business. (Section 6)

Current Account Transaction means all transactions, which are not capital account transactions. Specifically, it includes:

- Business transactions between residents and non-residents.

- Short-term banking and credit facilities in the ordinary course of business.

- Payments towards interest on loans and by way of income from investments.

- Payment of expenses of parents, spouse or children living abroad or expenses on their foreign travel, medical and education.

- Scholarships/Chairs, etc.

Primarily there are no restrictions on current account transactions. A person may sell or draw foreign exchange freely for his current account transactions, except in a few cases where limits have been prescribed (Section 5). The Central Government has the power to regulate current account transactions. Unless the transaction is restricted, FX can be drawn for the same.

Current Account Transactions: Unless the transaction falls within the below mentioned restrictions, FX can be drawn for the same without any limit.

Broad categories of current account transactions can be classified as under:

- Transactions for which FX withdrawal is totally prohibited such as payment for lotteries, transactions with residents of Nepal and Bhutan, etc.

- Transactions for which FX can be withdrawn only with prior approval of Government, such as specified transactions by PSUs, lump sum knowhow payments exceeding US $ 2 million, etc. However, payments from EEFC, RFC (D) and RFC A/c do not require any approval.

- Transactions for which FX can be withdrawn only with prior approval of Government even if payment is made from EEFC A/c.

- Transactions for which FX can be withdrawn only with prior approval of RBI even if payment is made from EEFC A/c.

Residents are permitted to remit US $ 250,000 for any current and capital account purpose (except those transactions which are prohibited altogether), without any limit. See Table below for Current Account Transactions at a brief.

The details of restrictions on Current Account Transactions are as follows:

|

Payment / Withdrawal of FX which require prior approval of RBI, except where the payment is made from the RFC or RFC (D) or EEFC Account of the remitter

|

Payment / Withdrawal of FX which require prior approval of RBI, except where the payment is made from the RFC or RFC (D) Account of the remitter

|

Transactions which are prohibited

|

|

Release of exchange exceeding the limits under LRS (presently US $ 250,000) in one calendar year, for one or more private visits to any country (except Nepal and Bhutan).

|

Commission to agents abroad for sale of residential flats/commercial plots in India, exceeding US $ 25,000 or 5% of the inward remittance (whichever is higher) per transaction.

|

Travel to Nepal & Bhutan

|

|

Exchange facilities exceeding the limits under LRS for persons going abroad for employment.

|

Payment for purchase of Trade Mark(s) / Patent(s).

|

Transactions with person resident in Nepal & Bhutan

|

|

Exchange facilities for emigration exceeding the limits mentioned under LRS or the amount prescribed by country of emigration.

|

Donations in excess of US $ 5,000 by Indian corporates & non-corporates (other than individuals) – Companies, partnership firms, trusts etc.

|

Remittance out of lottery winnings

|

|

Release of foreign exchange, exceeding the limits under LRS to a person, irrespective of period of stay, for business travel/ attending a Conference /specialized training/ maintenance expenses of a patient going abroad for medical treatment / check-up abroad / for accompanying as attendant to a patient going abroad for medical treatment/Check-up.

|

Remittance exceeding US $ 100,000 or 5% of the investment brought into India, whichever is higher, by an entity in India by way of reimbursement of pre-incorporation expenses in India

|

Payment of commission on exports under Rupee State Credit Route, except commission up to 10% of invoice value on exports of tea and tobacco.

|

|

Release of exchange for meeting expenses for medical treatment abroad exceeding the estimate from the doctor in India or hospital/doctor abroad. However, an amount up to the limits under LRS or its equivalent can be released without insisting on any estimate from a hospital/doctor.

|

Remittance towards cash calls to the operator for the purpose of oil exploration in India either by credit to the foreign currency or Rupee account in India subject to the condition that the payment is made as per the production sharing agreement and the copy is available on records of the AD.

|

Remittance for purchase of lottery tickets, banned / prescribed magazines, football pools, sweepstakes, etc.

|

|

Remittance for maintenance of close relatives abroad,

-Exceeding the net salary (after deduction of taxes, contributions and other deductions) of a person who is resident but not permanently resident in India and (a) is a citizen of a foreign state other than Pakistan or (b) is a citizen of India who is on deputation to the office or branch or subsidiary or joint venture in India of such foreign company.

-Exceeding US $ 100,000 per year per recipient.

|

Donations by Indian corporates, exceeding 1% of the foreign exchange earnings during the previous 3 financial years or US $ 5 million, whichever is less, for Creation of Chairs in reputed educational institutes or Donations to funds (not being an investment fund) promoted by educational institutes or Donation to technical institution or body or association in the field of activity of the donor Company.

|

Payment of commission on exports made towards equity investment in Joint Ventures / Wholly Owned Subsidiaries abroad of Indian companies.

|

|

Release of exchange for studies abroad exceeding the estimates from the institution abroad or the limits under LRS per academic year, whichever is higher.

|

|

Remittance of income from racing / riding or any other hobby

|

| |

Payment related to “Call Back Services” of telephones.

|

|

Remittances exceeding US $ 1million per project, for any consultancy services procured from outside India.

|

|

Remittance of interest income on funds held in NRSR Scheme Account.

|

|

Remittances exceeding US $ 10 million per project, consultancy services procured from outside India by Indian companies executing infrastructure projects.

|

|

Remittance towards participation in lottery schemes involving money circulation or for securing prize money / awards, etc.

|

The following payments will require prior approval from the Government of India, except where the payment is made from the RFC or RFC(D) or EEFC Account of the remitter: -

| |

Purpose of Remittance

|

Approval to be obtained from

|

|

1.

|

Cultural Tours

|

Ministry of HRD (Department of Education and Culture)

|

|

2.

|

Advertisement in foreign print media for the purpose other than promotion of tourism, foreign investments and international bidding (exceeding US $ 10,000) by a State Government or its PSU

|

Ministry of Finance (Department of Economic Affairs)

|

|

3.

|

Remittance of Freight of vessel chartered by a PSU

|

Ministry of Surface Transport (Chartering Wing)

|

|

4.

|

Payment of import through ocean Transport by a Government Department or a PSU on c.i.f. basis

|

Ministry of Surface Transport (Chartering Wing)

|

|

5.

|

Multi-modal transport operators making remittance to their agents abroad

|

Registration certificate from the Director General of Shipping

|

|

6.

|

Remittance of hiring charges of Transponders

(a) TV Channels

(b) Internet service providers

|

Ministry of Information and Broadcasting

Ministry of Communication and Information Technology

|

|

7.

|

Remittance of container detention charges exceeding the rate prescribed by Director General of Shipping

|

Ministry of Surface Transport (Director General of Shipping)

|

|

8.

|

Remittance of prize money/sponsorship of sports activity abroad by a person other than International/National / State Level Sports bodies, if the amount involved exceeds US $ 100,000

|

Ministry of HRD (Department of Youth Affairs & Sports)

|

Remittance for membership of P&I Club would require prior approval from the Ministry of Finance except where the payment is made from RFC or RFC (D) Account of the remitter.

4. Bank Accounts in INDIA

Non-residents have been allowed to maintain Bank accounts in India, both in INR and Foreign currency. There are basically 3 types of accounts that can be maintained in India by a Person Resident outside India;

- Non Resident (Ordinary) Account – NRO A/c

- Non Resident (External) Rupee Account – NRE A/c

- Non Resident (Foreign Currency) Account – FCNR A/c

|

Particulars

|

NRO A/c

|

NRE A/c

|

FCNR A/c

|

|

Who can open an account

|

Any Person resident outside India (Individuals/Entities of Bangladesh /Pakistan Nationality /ownership require RBI approval)

|

NRIs & PIOs (Individuals / entities of Bangladesh / Pakistan nationality / ownership require RBI approval)

|

NRIs & PIOs (Individuals / entities of Bangladesh / Pakistan nationality / ownership require RBI approval)

|

|

Currency

|

INR

|

INR

|

Permissible Foreign Currency

|

|

Repatriable / Non-Repatriable

|

Non-Repatriable (Except by NRI/PIO under USD 1 million per F.Y. scheme)

|

Repatriable

|

Repatriable

|

|

Type of Account

|

Current, Savings, Recurring or Fixed Deposit Accounts

|

Current, Savings, Recurring or Fixed Deposit Accounts

|

Term Deposits

|

|

Joint accounts

|

Jointly with residents on ‘former or survivor’ basis. NRIs and/or PIOs may hold NRO accounts jointly with other NRIs and/or PIOs.

|

In names of two or more NRI/PIOs or with resident relative(s) on “former or survivor” basis.

|

In names of two or more NRI/PIOs or with resident relative(s) on “former or survivor” basis.

|

|

Major Permissible Debits

|

Local rupee payments, Transfer to other NRO A/c, Remittance outside India of current income in India (net of taxes)

|

Local disbursements, remittance outside India, transfer to other NRE / FCNR account and Investment in India

|

Local disbursements, remittance outside India, transfer to other NRE / FCNR account and Investment in India

|

|

Major Permissible Credits

|

Remittance in permitted foreign currency, Deposit by Account holder during temporary visit to India, Transfer from other NRO A/c , Dues in India of Account Holder, Rupee loans/Gift from resident relative under LRS etc.

|

Remittance in permitted foreign currency, proceeds of foreign currency / bank notes tendered during temporary visit to India, transfer from other NRE / FCNR account, Current Income, interest on bank balances & investments.

|

Remittance in permitted foreign currency, proceeds of foreign currency / bank notes tendered during temporary visit to India, transfer from other NRE / FCNR account, Current Income, interest on bank balances & investments.

|

|

Taxability of Interest

|

Taxable

|

Non-Taxable

|

Non-Taxable

|

Even Residents have been allowed to maintain foreign currency accounts in India as under:

i. EEFC Account

A person is permitted to credit the under-mentioned amounts out of his foreign exchange earnings to his Exchange Earners Foreign Currency (EEFC) Account: -

| |

Entity or person

|

Limit in %

|

|

1.

|

Status Holder Exporter (as defined in the EXIM Policy in force)

|

100

|

|

2.

|

Individual professionals **

|

100

|

|

3.

|

100% EOU Unit in EPZ/STP/EHTP

|

100

|

|

4.

|

Any other person

|

100

|

** Professionals mean Director on Board of overseas company; Scientist / Professor in Indian University / Institution; Economist; Lawyer/Doctor/Architect/Engineer/Artist/Cost/Chartered Accountant/Any other person rendering professional services in his individual capacity, as may be specified by the Reserve Bank from time-to-time. Professional earnings including director's fees, consultancy fees, lecture fees, honorarium and similar other earnings received by a professional by rendering services in his individual capacity.

However, amounts received to meet specific obligations of the account holder cannot be credited (e.g., equity investment from a non-resident investor). The balances do not earn any interest.

These funds can be used for several current account purposes. For many transactions, where there are restrictions under the current account rules, funds in EEFC account can be used without restrictions. However, EEFC account holders are permitted to purchase foreign exchange only after utilizing fully the available balances in the EEFC accounts.

Individuals can open EEFC account jointly with any of their ‘close relative’ on ‘former or survivor basis’ but the joint relative cannot operate the account.

Units in SEZ are permitted to open, hold and maintain a Foreign Currency Account with an authorised dealer in India.

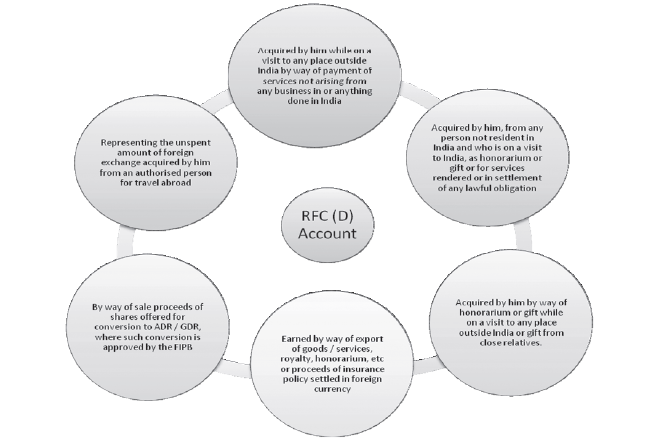

ii. Resident Foreign Currency (Domestic) Account – RFC (D) A/c

A person resident in India can open, hold and maintain a Resident Foreign Currency (Domestic) Account and credit the account with foreign exchange in the form of currency notes, bank notes and travelers cheques: -

Balances in this account do not earn interest. However, there is no ceiling on the balance that can be held in the account. Balances in the account can be used for all permitted current account and capital account transactions.

iii. Resident Foreign Currency Account – RFC A/c

Resident Indians can also open RFC account. This account is different from RFC (D) account. This account is primarily for non-residents who return to India. In RFC A/c, following items can be deposited:

- Pension or any other superannuation or other monetary benefits from employer outside India.

- Amount received on conversion of the assets if those assets were acquired when such person was a non-resident.

- Amount received as gift or inheritance from a person who was a non-resident and has become a resident.

- Proceeds of insurance policies settled in foreign currency that is issued by Insurance Companies in India.

There are no restrictions on use of funds. They can be used for meeting expenses and making investments abroad. RFC account can be maintained in the form of current or savings or term deposit accounts.

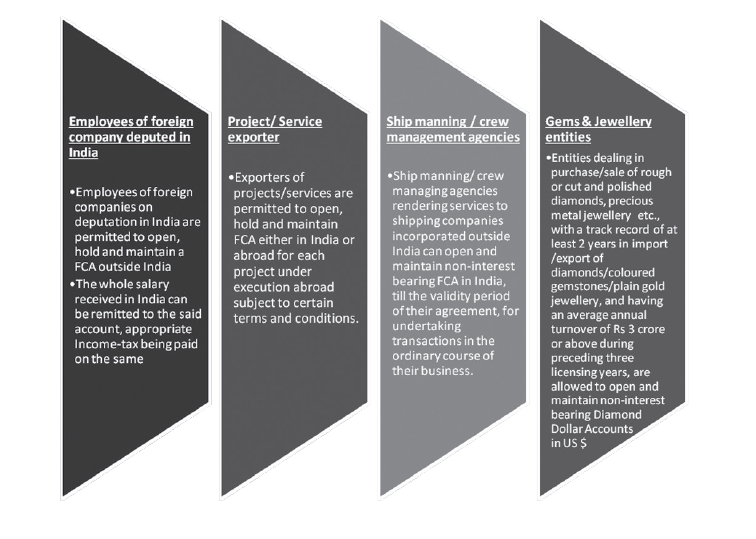

Other Foreign Currency Accounts by Specific Persons:

Any passenger bringing in foreign exchange on his arrival in India in the form of currency notes, bank notes or travellers cheques exceeding US $ 10,000 or its equivalent and / or the value of foreign currency notes exceeding US $ 5,000 or its equivalent is required to file a declaration in Form CDF with the Custom Authorities. A person resident in India is permitted to

carry only ₹ 10,000/- during his visit abroad (except Nepal and Bhutan).

Temporary Foreign Currency Accounts In India

Organizers of International Seminars, Conferences, Conventions, etc., who have been permitted by the concerned Administrative Ministry of the Government of India to hold such seminars, etc. are permitted to open temporary foreign currency accounts in India. The account is to be operated for receipt of delegate fees from abroad and payment of expenses including payment to special invitees from abroad. The said account has to be closed immediately after the conference/event is over.

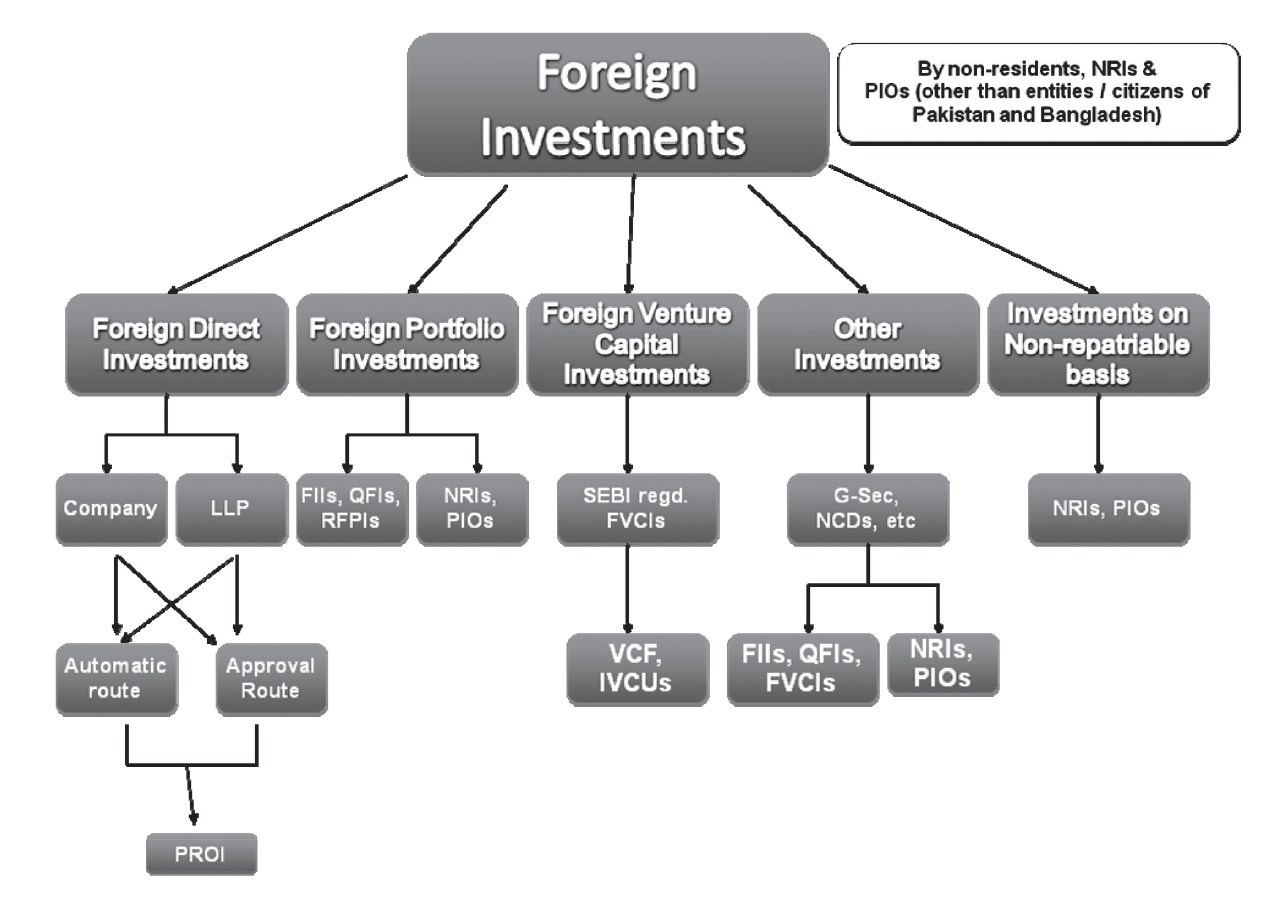

5. Investment in India

Foreign Investment in India

I. Foreign Direct Investment

The Industrial Policy governs the Foreign Direct Investment in India. Both – FEMA and industrial Policy (including consolidated FDI Policy) – should be read together to have a full picture. Sectoral limits for Foreign Direct Investments and Investments by NRIs are almost at par excepting the sector of Housing and Real Estate Development, and Domestic Airlines. Various avenues and policy for foreign investment are covered in brief. For FDI purposes an NRI means an individual resident outside India who is a citizen of India.

Investment is generally allowed in an Indian company, which in turn does actual business. Branches, liaison offices and project offices can be opened for limited purposes. In SEZs, non-residents can invest as a branch/unit, Joint Venture or a Wholly Owned Subsidiary on automatic basis. Investment in a proprietorship, partnership or Association of Persons, is subject to RBI permission in certain cases.

Investment can be made by an incorporated entity, or individuals. Unincorporated entities cannot invest. However, citizens and incorporated entities of Pakistan are permitted to invest under the FDI Scheme only after obtaining prior permission from the FIPB. The Indian Company in which the investment is proposed should not be engaged/should not engage in sectors/activities pertaining to space and atomic energy and sectors/activities prohibited for foreign investment. Citizens and incorporated entities of Bangladesh can invest only after obtaining prior approval of FIPB.

Gist of FDI:-

|

Eligibility

|

Person Resident Outside India

|

|

Eligible Instruments

|

Equity Shares, Convertible Debentures, Convertible Preference Shares, Partly paid Equity Shares and warrants issued by an Indian Company subject to Company’s Act, 2013 & SEBI guidelines

|

|

Lock in Period

|

One Year or as per prescribed FDI guidelines, whichever is higher

|

|

Modes of Investment

|

Issuance of fresh Shares or Transfer of Existing shares

|

Investment in India can be made in almost ANY sector without any approval from any authority. This is known as the “Automatic route”. Even for the small list of sectors or investment exceeding permissible sectoral caps, which are not under the “automatic route”, a specific approval should be taken from Secretariat of Industrial Assistance (SIA)/Foreign Investment Promotion Board (FIPB)/ Government of India/ Department of Economic Affairs (DEA).

List of activities which require prior permission

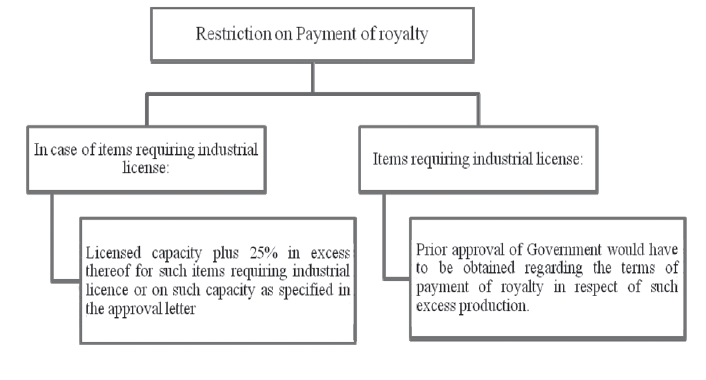

- Foreign investment exceeding 24% in case of items which are reserved for MSME.

- The investment is not within the sectoral guidelines.

- The investment in certain sectors, though within the sectoral guidelines, requires prior approval of the Government e.g., sectors where an industrial licence is required – cigars and cigarettes manufacture.

In case the foreign investment falls within the above-restricted list or does not fall within the sector specific investment limits prescribed for automatic approval, an approval needs to be obtained from SIA / FIPB by satisfying them about the benefits to India. Powers of SIA / FIPB are discretionary.

FDI is prohibited in the following activities/sectors:

- Lottery Business including Government /private lottery, online lotteries, etc.

- Gambling and Betting including casinos etc.

- Chit funds

- Nidhi company

- Trading in Transferable Development Rights (TDRs)

- Real Estate Business or Construction of Farm Houses

- Manufacturing of cigars, cheroots, cigarillos and cigarettes, of tobacco or of tobacco substitutes

- Activities / sectors not open to private sector investment e.g., Atomic Energy.

Foreign technology collaboration in any form including licensing for franchise, trademark, brand name, management contract is also prohibited for Lottery Business and Gambling and Betting activities.

FDI is also permitted in LLPs

- Entry Route – Automatic route in LLP’s operating in sectors/ activities where 100% FDI is allowed through Automatic Route and there are no FDI linked performance conditions.

- Capital Contribution- An LLP can receive foreign capital contribution only by cash consideration, received by inward remittance, through normal banking channels or by debit to NRE/FCNR account of the person concerned, such account being maintained with an authorized dealer/bank.

- Investment in LLPs by Foreign Portfolio Investors (FPIs) and Foreign Venture Capital Investors (FVCIs) is not permitted.

- LLPs are not permitted to avail External Commercial Borrowings (ECBs).

FDI in LLP is subject to compliance of the LLP Act, 2000

Reporting Requirements

With a view to promoting ease of reporting of transactions under foreign direct investment, the Reserve Bank of India, under the aegis of the e-Biz project of the Government of India has enabled the filing of the following returns with the Reserve Bank of India viz.

- Advance Remittance Form (ARF) – used by the companies to report the foreign direct investment (FDI) inflow to RBI; and

- FCGPR Form – which a company submits to RBI for reporting the issue of eligible instruments to the overseas investor against the abovementioned FDI inflow.

- FCTRS – which the non-resident has to submit to the AD at the time of transfer of shares / debentures between a resident and a non-resident along with other necessary documents.

The Forms are to be digitally signed. The forms are required to be filed online. The certificates and other documents to be filed will have to be scanned and uploaded together.

An Indian Company should report the following through e-biz portal:-

- Details of the investment from outside India not later than 30 days from the date of receipt along with Copies of FIRCs evidencing the receipt of the remittance along with the KYC report.

- Reporting of issue of shares in the Form FC-GPR not later than 30 days from the date of issue of shares

- Reporting of transfer of shares in the Form FC-TRS

- Reporting of non-cash (Details of issue of shares against conversion (full/partial) of ECB)

- Reporting of FCCB/ADR/GDR issues within 30 days from the date of closing the issue.

- A Company Secretary’s certificate also has to be filed in the specified format confirming fulfilment of various legal requirements.

- A Chartered Accountant’s or statutory auditor’s certificate indicating the manner of arriving at the price at which the securities have been issued, is also required to be submitted.

- Thereafter, every year before July 15, Annual return on Foreign Liabilities and Assets has to be filed directly with the Director, Balance of Payment Statistical Division, RBI detailing all investments by way of direct / portfolio /

re-invested earnings / others in the Indian company during the preceding financial year.

Allotment of shares has to be done within 60 days from the date of receipt of inward remittance or debit to NRE / FCNR (B) account, as the case may be.

II. Registered Foreign Portfolio Investor (RFPIs)

RFPIs such as Pension Funds, Investment Trusts, Asset Management Companies, etc., who have obtained registration from SEBI, are permitted to invest on full repatriation basis under FDI Policy as well as under in the Indian Primary & Secondary Stock Markets (including OTCEI) including in unlisted, dated Government Securities, Treasury Bills, ‘to be listed’ debt securities, Units of Domestic Mutual Funds and commercial paper without any lock-in period.

Limits on Investments are:

- The total holdings of all RFPIs in any Company will be subject to a ceiling of 24% of its total paid-up capital. The Company concerned can raise this ceiling of 24% up to the sectoral cap/statutory ceiling as applicable.

- A single RFPI cannot hold more than 10% of the paid-up capital of any Company.

- A RFPI may trade in all exchange trade derivative contracts approved by SEBI from time-to-time subject to the limits as prescribed in by SEBI.

III. Foreign Venture Capital Investor (FVCI)

FVCIs can invest in securities, issued by an Indian Company engaged in sectors which are permitted for the same and even those securities which are not listed on recognized stock exchange at the time of issue of such securities. They can also invest in securities issued by a Start-up enterprise irrespective of their sector/activity. A registered Foreign Venture Capital Investor (FVCI) may, through the Securities and Exchange Board of India, apply to the Reserve Bank for permission to invest in Indian Venture Capital Undertaking (IVCU) or in a VCF or in a scheme floated by such VCFs. The domestic VCF must however be registered with SEBI. The registered FVCI may purchase equity/equity linked instruments/debt/debt instruments, debentures of an IVCU or of a VCF through Initial Public Offer or Private Placement or in units of schemes/funds set up by a VCF. The amount of consideration for investment in VCFs/IVCUs shall be paid out of inward remittance from abroad through normal banking channels or out of funds held in an account maintained with the designated branch of an authorised dealer in India. There is no limit on investments. However, if the FVCI intends to invest in a IVCU which is registered as Trust then the FVCI has to obtain prior permission of the Government. Form FC-GPR – Part ‘A’ has to be filed with RBI, through the company’s bankers, within 30 days of allotment of securities. Form FC-TRS will be applicable in case of transfer of shares between a resident and non-resident.

IV. International Financial Institutions

Multilateral Development Banks, which are specifically permitted by the Government to float rupee bonds in India, are permitted to purchase Government dated securities.

V. Investments by Non-Resident Employees of Indian Companies, etc.

An Indian Company can issue shares up to 5% of its paid-up capital to its employees or employees of its overseas joint venture or wholly owned subsidiary resident outside India, under a SEBI approved Employees Stock Options Scheme. These shares cannot however be issued to employees who are citizens of Pakistan.

VI. Investments by NRIs / PIOs

NRI can invest in shares and convertible debentures of Indian companies. OCB are barred from investments. They can invest as any other foreign company i.e., additional investment facilities available to NRIs now cannot be exercised through OCB. However, OCB who have existing investments in India can be granted case-by-case approval by RBI for additional investments.

Foreign investment policy for foreigners applies equally to NRI for Repatriable investment. There are only two sectors – Real Estate Development and Domestic Airlines – where investment facilities are different for NRI and foreigners.

|

Investment by NRIs

|

Repatriation Basis

|

Non-Repatriation Basis

|

|

Permitted Instruments

|

All instruments permitted under FDI for other non residents, Government dated Securities (Other than Bearer Securities), Treasury bills, Units of domestic Mutual Funds, bonds issued by PSUs in India, shares in Public sector enterprise disinvested by GOI

|

All the instruments permitted under FDI for other non-residents, Government Securities, Treasury Bills, Units of Domestic Mutual Funds, Units of money market mutual funds

|

|

Prohibited Instruments

|

Investment in small saving schemes (including PPF)

|

Investment in small saving schemes (including PPF)

|

|

Deposit of sale proceeds

|

No restrictions

|

To be deposited in NRO Account

|

RBI has granted general permission to NRI / PIO to acquire shares from other NRI / PIO.

NRIs from Nepal are also permitted to make direct investments on repatriation basis if they remit funds in foreign exchange.

Portfolio Investment in companies, other than those engaged in the print media sector, listed on Stock Exchanges permitted up to 5% for each NRI subject to overall ceiling of 10% of the company's capital. The company concerned can increase this limit of 10% to 24%.

NRI may invest in exchange traded derivative contracts approved by SEBI from time-to-time out of INR funds held in India on non-repatriation basis subject to the limits prescribed by SEBI.

NRIs are permitted to invest up to 100% in PSE Capital/PSU Bonds, Government Securities (other than Bearer Securities), units of UTI & instruments of domestic Mutual Funds (referred to in Section 10 (23D) of the Income-tax Act, 1961).

Purchase of shares by NRIs from existing resident shareholders is permitted under the automatic route if the specified conditions are satisfied.

NRI/PIO can invest on non-repatriation basis in all sectors except plantations, nidhis, chit funds and real estate trading. In such cases restrictions placed on investments made on repatriation basis will also not apply.

NRIs can repatriate their investments which were originally made on non-repatriation basis under the automatic route if:

- The original investment was made in foreign exchange under the FDI Scheme, and

- The sector / activity in which the investment was made is proposed to be converted into repatriable equity and is under the automatic route for FDI.

If the above two conditions are not met approval will have to be obtained from FIPB for conversion of non-repatriable equity into repatriable equity.

NRIs are now permitted to credit the sale proceeds of FDI investment in their NRE/FCNR (B) accounts, provided the investment was received by way of remittance from abroad or by way debit to NRE/FCNR (B) account of the investor.

VII. Conversion into equity

An Indian company can issue, subject to certain terms and conditions, equity shares / preference shares under the Approval Route:

- By way of conversion of ECB (other than import dues deemed as ECB or Trade Credit), lump sum technical knowhow fees, royalty or any other funds payable by the investee company, remittance of which does not require prior permission of the Government of India or RBI.

- By way of conversion of monies payable against import of capital goods/machineries/equipment (other than second-hand machineries).

- Against receipt of money from overseas investor towards pre-operative/pre-incorporation expenses (including payments of rent, etc.).

VIII. Investments Facilities in Brief

|

Avenues of Investment

|

Instruments

|

Category of Investors

|

|

Public/Private Limited Companies

|

Shares/Compulsorily Convertible Debentures/Compulsorily Convertible Preference shares

|

Non-Resident Indians/Non-resident/Non-Resident Incorporated Entities/Foreign Institutional Investors

|

|

Public Limited Companies

|

NCDs

|

NRIs

|

|

Trading Companies

|

Shares/Compulsorily Convertible Debentures/Compulsorily Convertible Preference shares

|

Non-residents

|

|

MSME Units

|

Shares/Compulsorily Convertible Debentures/Compulsorily Convertible Preference shares

|

Non-residents

|

|

EOU or Unit in Free Trade Zone or in Export Processing Zone

|

Shares/Compulsorily Convertible Debentures/Compulsorily Convertible Preference shares

|

Non-residents

|

|

Public/Private Ltd. Companies

|

Right Share

|

Existing shareholders / Renouncees

|

|

Under Scheme of amalgamation/ merger

|

Shares/Compulsorily Convertible Debentures/Compulsorily Convertible Preference shares

|

Existing shareholders

|

|

Employees Stock Option

|

Shares/Compulsorily Convertible Debentures/Compulsorily Convertible Preference shares

|

Employees resident outside India

|

|

ADR/GDR

|

Receipts

|

Non-residents

|

|

Portfolio Investment Scheme

|

Shares/Compulsorily Convertible Debentures/Compulsorily Convertible Preference shares

|

RFPIs & NRIs

|

|

Investment in Derivatives

|

Exchange Traded Derivatives

|

RFPIs (on repatriation basis) & NRIs (on non-repatriation basis)

|

|

Govt. Securities

|

Govt. dated Securities/Treasury Bills, Units of Domestic Mutual Funds, Bonds issued by PSUs and shares of Public Sector Enterprises being divested

|

NRIs & RFPIs

|

|

Indian VCU or VCF or in a Scheme floated by VCF

|

SEBI Registered VCF/VC Units

|

SEBI Registered Foreign Venture Capital Investor

|

6. Acquisition and transfer of Immovable property in India

Immovable property in India can be acquired / transferred by following persons:

Table A

|

Indian Nationals Resident In India

|

Indian Nationals Resident Outside India

|

Persons Of Indian Origin Resident Outside India

|

|

No restrictions

|

- Can acquire any immovable property other than agricultural land/plantation/farm house

- Can transfer/sell immovable property including agricultural land/plantation/farm house to an Indian National resident in India

- Can transfer/sell any immovable property other than agricultural land/plantation /farm house to a PIO/Indian National resident outside India/ Person resident in India

|

- Can acquire any immovable property other than agricultural land /plantation /farm house out of foreign currency funds or by way of gift

- Can acquire any immovable property including agricultural land / plantation/farm house by way of inheritance

- Can sell any immovable property other than agricultural land/ plantation/farm house to a person resident in India

- Can gift any residential or commercial property to a person Resident in India or to a PIO/Indian National Resident outside India

- Can sell/gift any agricultural land/plantation/farm house to an Indian National resident in India

|

Notes:

- Persons of Indian Origin do not include citizens of Pakistan, Bangladesh, Sri Lanka, Afghanistan, China, Iran, Nepal or Bhutan.

- NRI/PIO can borrow money from banks/approved housing finance companies for acquisition/repairs/renovation/ improvement of residential accommodation in India.

- NRI/PIO can repatriate equivalent to the amount of foreign exchange remitted into India at the time of purchase.

- Payment by NRI/PIO for purchase of immovable property cannot be by way of foreign currency notes or travellers cheques.

- NRI/PIO employees of Indian companies in India or their branches outside India can also take loans from their employers for purchasing housing property in India or abroad or for any other purpose other than for utilizing in the following activities: -

- Chit fund business

- Nidhi company

- Agricultural or plantation activity or in real estate business or construction of farm houses

- Trading in TDR

- Investment in capital market including margin trading and derivatives.

Table B

|

Foreign Citizens Resident In India

|

Foreign Citizens Resident Outside India

|

Indian Branch / Office of Foreign Concern

|

|

No restrictions, except in the case of Nationals of Pakistan, Bangladesh, Sri Lanka, China, Iran, Nepal, Afghanistan, & Bhutan who will require prior permission from RBI in all cases except where the immovable property is acquired by way of lease for less than 5 years

|

Can acquire and transfer only after prior permission from RBI

Foreign Embassy/Diplomat/Consulate General:

Can acquire and sell immoveable property other than agricultural land/plantation property/farm house only after obtaining prior permission from the Ministry of External Affairs, Government of India and the consideration for acquisition is remitted from abroad

|

Can acquire immovable property which is required for carrying on its activities, a declaration in Form IPI will have to file with RBI within 90 days of such acquisition (the above procedure is not applicable to a liaison office). Repatriation of sale proceeds requires prior RBI approval

|

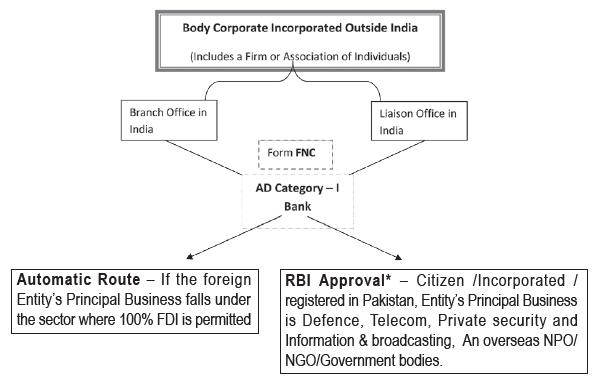

7. Branch / Liaison / Project Office in INDIA

* A citizen of or is registered/incorporated in Bangladesh, Sri Lanka, Afghanistan, Iran, China, Hong Kong or Macau opening a BO/LO/PO in Jammu and Kashmir, North East region and Andaman and Nicobar Islands also need to obtain prior permission of RBI.

Branch Offices/ Liaison Offices

|

Branch Office

|

Liaison Office

|

|

|

Track Record

|

A Profit Making track record during the immediately Five Financial years in the home country

|

A Profit Making track record during the immediately Three Financial years in the home country

|

|

Net Worth**

|

Not less than USD 100,000 or its equivalent.

|

Not less than USD 50,000 or its equivalent.

|

|

Permissible Activities

|

- Export & Import of goods – only on wholesale basis.

- Rendering professional or consultancy services.

- Carrying out research work, in areas in which the parent company is engaged.

- Promoting technical or financial collaborations between Indian companies and parent or overseas group company.

- Representing the parent company in India and acting as buying/selling agent in India.

- Rendering services in information technology and development of software in India.

- Rendering technical support to the products supplied by parent/group companies.

- Foreign airline/shipping company.

|

- Representing in India the parent company / group companies.

- Promoting export / import from / to India.

- Promoting technical/financial collaborations between parent/group companies and companies in India.

- Acting as a communication channel between the parent company and Indian companies.

|

** Total of paid-up capital and free reserves, less intangible assets as per the latest Audited Balance Sheet or Account Statement certified by a CPA or a Registered Account Practitioner

Branch Office in SEZ

RBI has granted General Permission to foreign companies for establishing branch/unit in Special Economic Zones (SEZ) to undertake manufacturing and service activities, subject to the following conditions:

- BO must function in those sectors where 100 per cent FDI is permitted;

- BO must comply with part XXII of the Companies Act, 2013;

- BO must function on a standalone basis.

Branches of Foreign Banks

Foreign banks do not require separate approval under FEMA, for opening branch office in India provided they have obtained necessary approval under the provisions of the Banking Regulation Act, 1949, from Department of Banking Operations & Development, Reserve Bank.

Liaison Offices of Foreign Insurance Companies/Banks

Foreign Insurance companies can establish Liaison Offices in India only after obtaining approval from the Insurance Regulatory and Development Authority (IRDA).

Foreign banks can establish Liaison Offices in India only after obtaining approval from the Department of Banking Regulations (DBR), Reserve Bank of India.

The Hon’ble Supreme Court vide its interim orders dated July 4, 2012 and September 14, 2015 has directed RBI not to grant any permission to any foreign law firm, on or after the date of the said interim order, for opening of LO in India. However, foreign law firms which have been granted permission prior to the date of interim order for opening LOs in India may be allowed to continue provided such permission is still in force.

UIN & PAN

BO / LO are granted a Unique Identification Number by RBI. They are, upon setting-up office, required to obtain PAN under Income-tax Act, 1961. The BO can freely remit profits earned from India, subject to payment of applicable taxes.

Annual Activity Certificate

Every BO / LO is required to file an Annual Activity Certificate (AAC) at the end of March 31 along with the audited Balance Sheet with RBI, through its Bank as well as with the Director General of Income Tax (International Taxation), Drum Shape Building, I. P. Estate, New Delhi – 110 002, on or before September 30 of that year. The certificate is to be obtained from a Chartered Accountant.

Project Offices

RBI has granted general permission to those foreign companies to establish Project Offices in India who have secured a contract from an Indian company to execute a project in India, and:

- The project is funded directly by inward remittance from abroad; or

- The project is funded by a bilateral or multilateral International Financing Agency; or

- The project has been cleared by an appropriate authority; or

- A company or entity in India awarding the contract has been granted Term Loan by a Public Financial Institution or a bank in India for the project.

However, if the above criteria in respect of funding are not met, the foreign entity has to approach the Central Office of RBI for approval to set up a Project Office (PO) in India.

PO can, subject to certain conditions, open two non-interest bearing foreign currency accounts. Similarly, PO can, subject to certain conditions, make remittances pending winding up/ completion of the project.

Every BO/LO/PO has to file the following report (in the prescribed format) with the Director General Police (DGP) of the State whether the BO/LO/PO is located:

- A report within five working days of the LO/BO/PO becoming functional; if there is more than one office of such a foreign entity, in such cases to each of the DGP concerned of the State where it has established office in India.

- A report has to be filed on annual basis along with a copy of the Annual Activity Certificate/Annual Report required to be submitted by LO/BO/PO concerned, as the case may be.

- A copy of report filed as above should also be filed with the Bank by the LO/BO/PO concerned.

Trade Transactions – Import & Export

I. Import of Goods & Services

The import of goods and services in India has to be in conformity with the Foreign Trade Policy and FEMA (Current Account Transaction) Rules, 2000.

Remittance for Import payments

Remittance for making payments for imports into India is allowed by AD category I bank for all bona fide trade transactions only after ensuring that the requisite details are made available.

Obligation of Purchaser of foreign exchange

- For import of goods into India which shall be in conformity with the FTP, a resident person may make payment through an international card held by him or through international credit/ debit card in rupees against charged slip signed by the importer or as prescribed by Reserve Bank of India.

- Any person resident in India may also make payment as under :

- In rupees towards meeting expenses on travel to and from and within India of a person resident outside India who is on a visit to India;

- By means of a crossed cheque or a draft as consideration for purchase of gold or silver in any form imported by such person in accordance with the laws in force;

- A company or resident in India may make payment in rupees to its non-whole time director who is resident outside India and is on a visit to India for the company’s work and is entitled to payment of sitting fees or commission or remuneration, and travel expenses to and from and within India, in accordance with the provisions contained in the company’s Memorandum of Association or Articles of Association.

Time Limit for Settlement

- For normal Profits – Remittance to be completed before six months from the date of shipment, except where amounts are withheld towards guarantee of performance. If payment is delayed due to disputes or financial problems, AD bank may permit for its settlement but interest thereon will be payable for a period of up to 3 years from date of shipment.

- For deferred payment arrangements – They are treated as trade credits up to 5 years for which guidelines in Master Direction for ECB and Trade credit is to be followed.

- For Import of Books – No restrictions on time Limit.

Third party payment for Imports

Payment to third Party for import of goods is permitted subject to following conditions-

- Firm irrevocable purchase order/tripartite agreement should be there

- Payment should be made to the third party should be mentioned on the invoice and bill of entry.

Importer should comply with the related extant instructions including those on advance payment made for imports.

Import of foreign exchange/ Indian Rupees

General or special permission from Reserve bank is required to bring foreign currency in India.

- Import of Foreign Exchange

- Foreign Exchange in any form other than currency notes, bank notes and travellers’ cheque can be sent into India without any limitation.

- A person may bring into India foreign Exchange without any limitation provided the person makes declaration to the custom authorities if the aggregate value of currency notes, bank notes or travellers’ cheques brought in exceeds USD 10,000 at any one time or the aggregate value of foreign currency notes brought in exceeds USD 5,000.

- Import of Indian currency

- Any person resident in India may bring into India while returning from any place outside India except from Nepal and Bhutan up to an amount not exceeding ₹25,000.

- From Nepal and Bhutan, a person may bring Indian rupees for any amount in denominations up to ₹100.

Advance Remittances

AD Category – I bank may allow advance remittance for import of goods without any ceiling subject to the following conditions:

- An unconditional, irrevocable standby Letter of Credit or a guarantee from an international bank of repute situated outside India or a guarantee of an AD Category–I bank in India, if such a guarantee is issued against the counter-guarantee of an international bank of repute situated outside India needs to be obtained if advance remittance exceeds USD 2,00,000.

- The requirement of the bank guarantee / standby Letter of Credit may not be insisted upon for advance remittances up to USD 5,000,000 (US Dollar five million) in cases where the importer (other than a Public Sector Company or a Department/Undertaking of the Government of India/State Government/s) is unable to obtain bank guarantee from overseas suppliers and the AD Category – I bank is satisfied about the track record and bona fidesof the importer.

- A Public Sector Company or a Department/Undertaking of the Government of India / State Government/s which is not in a position to obtain a guarantee from an international bank of repute against an advance payment, is required to obtain a specific waiver for the bank guarantee from the Ministry of Finance, Government of India before making advance remittance exceeding USD 100, 000.

II. Export of Goods & Services

The DGFT announces various policies & procedures to be followed for exports from India, from time-to-time. AD Category – I banks shall conduct export transactions in conformity with the Foreign Trade Policy and the Rules framed by the Government of India and the Directions issued by Reserve Bank from time-to -time.

Realization and repatriation of proceeds of export of goods / software / services

- Period of Realization and repatriation of export proceeds shall be 9 months from date of export for all exporters.

- 15 months- if the goods are exported to warehouse established outside India.

Authorised Dealers are allowed to extend time up to a further period of 6 months beyond 9 months, if the exporter submits a declaration that the export proceeds will be realized within the extended time.

Manner of receipt and payment

- The export proceeds shall be received through the AD Bank in the manner provided in FEM (Manner of Receipt and Payment) regulations.

- Online payment has been allowed by AD Category-I bank for repatriation of export related remittances. However export proceeds should not exceed USD 10,000.

Third Party Payments for exports

Subject to following conditions, third party payments for exports is permitted –

- Firm irrevocable order backed by a tripartite agreement should be in place.

- It should be routed through banking channel only.

- Remittance to third party should be declared in the export declaration form by the exporter

- Responsibility to realize and repatriate the export proceeds from such third party is of the exporter.

- Invoice and bill of entry should contain that the related payment has to be made to (name) third party.

- Payments may be received from an open cover country if the shipment is made to Group II Restricted Cover country like Sudan, Somalia.

Permission for Export Write-off by AD

Conditions

- The relevant amount has remained outstanding for one year or more;

- The aggregate amount of write off allowed during the financial year does not exceed 10% of the total export proceeds realised by the exporter through the concerned AD Category – I banks during the previous financial year;

- Satisfactory documentary evidence is furnished in support of the exporter having made all efforts to realise the dues;

- The case falls under any of the undernoted categories:

- The overseas buyer has been declared insolvent and a certificate from the official liquidator indicating that there is no possibility of recovery of export proceeds produced.

- The overseas buyer is not traceable over a reasonably long period of time.

- The goods exported have been auctioned or destroyed by the Port/Customs/Health authorities in the importing country.

- The unrealised amount represents the balance due in a case settled through the intervention of the Indian Embassy, Foreign Chamber of Commerce or similar Organisation.

- The unrealised amount represents the undrawn balance of an export bill (not exceeding 10% of the invoice value) remained outstanding and turned out to be unrealizable despite all efforts made by the exporter.

- The cost of resorting to legal action would be disproportionate to the unrealised amount of the export bill or where the exporter even after winning the Court case against the overseas buyer could not execute decree for reasons beyond his control.

- Proportionate exports incentives are surrendered and Exporter is not on Caution List.

Export of Currency

For export of Indian currency, permission from Reserve Bank is required unless any general permission is granted under the regulation as under –

- Any person resident in India may take outside India (other than Nepal and Bhutan) an amount not exceeding ₹ 25,000

- Any person resident outside India, not being a citizen of Pakistan or Bangladesh and also not a traveler coming from or going to Pakistan or Bangladesh, and visiting India may take outside India up to an amount not exceeding ₹25,000.

Advances against exports

- The exporter is under an obligation to ensure that the shipment of goods is made within one year if he receives advance payment from a buyer outside India and the document covering the shipment are routed through AD Category I bank.

- In case of exporter’s inability to make the shipment no refund of unutilized portion of advance received or towards payment of interest shall be made after the expiry of one year without the prior approval of RBI.

9. Borrowings from Non-Residents

External Commercial Borrowings [ECB]

ECB is an important component of India’s overall external debt. ECB refers to commercial loans raised by eligible resident entities from recognised non-resident entities and should conform to parameters such as minimum maturity, permitted and non-permitted end-uses, maximum all-in-cost ceiling, etc. The parameters apply in totality and not on a standalone basis.

ECB cannot be raised by Individuals, partnership firms & LLP. Start-up enterprises have been permitted to access loans under ECB subject to eligibility conditions. Entities engaged in micro-finance activities can raise ECB:

- If they have a satisfactory borrowing relationship for at least 3 years with a bank in India.

- If they have a certificate of due diligence on ‘fit and proper’ status from a bank in India.

ECB can be raised in any freely convertible foreign currency as well as in Indian Rupees. Change of currency of ECB from one convertible foreign currency to any other convertible foreign currency as well as to INR is freely permitted. Change of currency from INR to any foreign currency is, however, not permitted.

Depending on the currency of borrowing and maturity period ECB is divided in the following three tracks:

|

Track I

|

Medium term foreign currency denominated ECB with minimum average maturity of 3/5 years.

|

|

Track II

|

Long-term foreign currency denominated ECB with minimum average maturity of 10 years.

|

|

Track III

|

Indian Rupee (INR) denominated ECB with minimum average maturity of 3/5 years.

|

ECB can be in the following forms:

- Loans including bank loans.

- Securitised instruments – floating rate notes and fixed rate bonds, non-convertible (except those issued to Registered Foreign Portfolio Investors (RFPI), optionally convertible or partially convertible preference shares / debentures.

- Buyers’ credit/Suppliers’ credit.

- Foreign Currency Convertible Bonds (FCCB).

- Financial Lease.

- Foreign Currency Exchangeable Bonds (FCEB) – only Approval Route.

The various Parameters for raising loans through ECB under the different Tracks are mentioned hereunder:

A. Minimum Average Maturity

|

Track I

|

Track II

|

Track III

|

|

Up to US $ 50 million or equivalent – 3 Years

|

10 years

(Irrespective of the amount of borrowing)

|

Same as that of Track I

|

|

Beyond US $ 50 million or equivalent – 5 Years

|

|

For eligible borrowers (Irrespective of the amount of borrowing) – 5 Years

|

|

Foreign Currency Convertible Bonds (FCCB) / Foreign Currency Exchangeable Bonds (FCEB)** (Irrespective of the amount of borrowing) – 5 Years

|

|

** The call and put option, if any, for FCCBs shall not be exercisable prior to 5 years.

|

B. Eligible Borrowers

|

Track I

|

Track II

|

Track III

|

|

SIDBI, Units in SEZs

|

All entities under Track I

|

All entities under Track II

|

|

Shipping and airlines companies.

|

Real Estate Investment Trusts (REITs) – Falling under the framework of SEBI

|

All NBFC’s – Falling under the purview of RBI & NBFC-Micro Finance Institutions (NBFC-MFI)

|

|

Companies in manufacturing and software development sectors.

|

Infrastructure Investment Trusts (INVITs) – Falling under the framework of SEBI

|

Not for Profit companies registered under the Companies Act, 1956/2013,

|

|

Exim Bank (only under the approval route).

|

|

Developers of Special Economic Zones (SEZ) / National Manufacturing and Investment Zones (NMIZ).

|

|

Infrastructure Companies, Non-Banking Financial Companies – Infrastructure Finance Companies (NBFC-IFC),

|

|

Companies engaged in, R&D, training (excluding education institutes), companies supporting infrastructure, companies providing logistics services.

|

|

NBFC-Asset Finance Companies (NBFC-AFC),

|

|

Societies, trusts and co-operatives (registered under the respective Acts.

|

|

Holding Companies and Core Investment Companies (CIC).

|

|

Non-Government Organizations (NGO) engaged in micro finance activities.

|

C. Recognized Lenders

|

Track I

|

Track II

|

Track III

|

|

International banks.

|

All the Recognized Lenders under Track I, excluding overseas branches / Subsidiaries of Indian Banks

|

All Recognized lenders under Track II

|

|

International capital markets.

|

NBFCs-MFIs, other eligible MFIs, not for profit companies and NGOs can raise ECB from overseas organizations and individuals.

|

|

Export credit agencies

|

|

|

Suppliers of equipment.

|

|

Foreign equity holders.

|

|

Multilateral financial institutions / regional financial institutions and Government owned (either wholly or partially) financial institutions.

|

|

Overseas branches /subsidiaries of Indian banks.

|

|

Overseas long-term investors, Prudentially regulated financial entities, Pension funds, Insurance companies, Sovereign Wealth Funds, Financial institutions located in International Financial Services Centres in India

|

D. All-in-Cost (AIC)

|

Track I

|

Track II

|

Track III

|

|

Is prescribed through a spread over the benchmark:

ECB with minimum average maturity period of 3 to 5 years – 300 basis points per annum over 6 month LIBOR or applicable bench mark for the respective currency.

ECB with average maturity period of more than 5 years – 450 basis points per annum over 6 months LIBOR or applicable bench mark for the respective currency.

|

The maximum spread over the benchmark will be 500 basis points per annum.

Remaining Conditions are same as they apply under Track I

|

In line with the market conditions.

|

Note: Penal interest, if any, for default or breach of covenants should not be more than 2 per cent over and above the contracted rate of interest

E. Permitted End-Use

|

Track I

|

Track II

|

Track III

|

|

ECB can be utilized for capital expenditure by way of Import of capital goods, payment towards import of services, technical know-how and license fees (Being a part of capital goods), Local sourcing of capital goods, New project, Modernization /expansion of existing units, ODI in JV/ WOS, Acquisition of shares of PSUs at any stage of disinvestment under the disinvestment programme of the GOI, Refinancing of existing trade credit/ ECB raised for import of capital goods/ provided the residual maturity is not reduced and Payment of capital goods already shipped / imported.

|

The ECB proceeds can be used for all purposes excluding :

- Real estate activities

- Investing in capital market -Using the proceeds for equity investment domestically;

- On-lending to other entities with any of the above objectives;

- Purchase of land

|

NBFCs can use ECB proceeds only for:

- On-lending for any activities, (Including infrastructure sector as permitted by RBI)

- providing hypothecated loans to domestic entities for acquisition of capital goods/equipment; and

- Leasing out or hire purchase of capital goods/equipment to domestic entities

|

|

Import of second hand goods as per the DGFT guidelines & On-lending by Exim Bank – Approval Route

|

|

Developers of SEZs/ NMIZs -Providing infrastructure facilities within SEZ/ NMIZ.

|

|

ECB proceeds can be used for general corporate purpose (including working capital) -ECB is raised from the direct / indirect equity holder or from a group company for a minimum average maturity of 5 years.

|

|

NBFCs-MFI, other eligible MFIs, NGOs, not for profit companies registered under the Companies Act, 1956/2013 - On-lending to self-help groups /micro-credit /bonafide micro finance activity (including capacity building)

|

|

Holding Companies and CICs – On-lending to infrastructure Special Purpose Vehicles (SPVs).

|

|

For other eligible entities, ECB proceeds can be used for all purposes excluding the ones prohibited in Track II

|

|

NBFC-IFCs & NBFCs-AFCs – Financing infrastructure.

|

|

|

|

Shipping and airlines companies - Import of vessels and aircrafts respectively.

|

|

|

|

Units of SEZs - For their own requirements

|

|

|

|

SIDBI - On-lending to the borrowers in the MSME sector

|

|

|

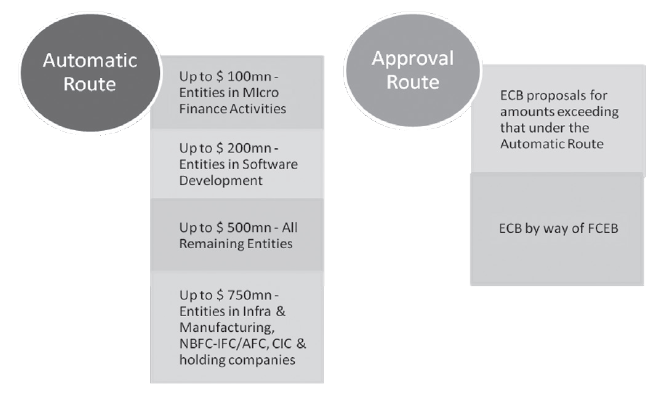

Automatic & Approval Route under ECB

Notes:

- Although ECB may have been raised under the Automatic Route, any draw-down as well as payment of any fees / charges for raising an ECB can happen only after obtaining LRN from RBI.

- For computation of individual limits under Track III, exchange rate prevailing on the date of agreement has to be considered.

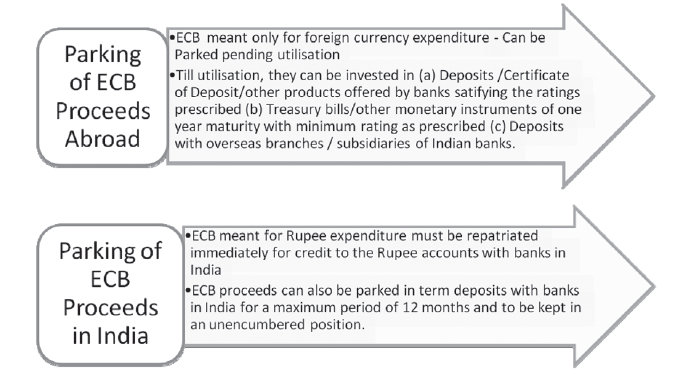

Parking of ECB Proceeds Abroad

TRADE CREDITS

Trade Credits (TC) refer to credits extended for imports directly by the overseas supplier, bank and financial institution for maturity of less than five years. Trade Credits can be supplier’s trade credits or buyer's trade credits.

Supplier's Trade Credit – credit for imports into India extended by the overseas supplier.

Buyer's Trade Credit – loans from overseas bank or financial institution.

Amount and Maturity

Automatic Route - Up to US $ 20 million per import transaction

Approval Route - Beyond US $ 20 million per import transaction

For import of permissible non-capital goods the maturity period is up to one year from the date of shipment or the operating cycle whichever is less. For import of permissible capital goods the maturity period is up to five years from the date of shipment. No roll-over/extension will be permitted beyond the permissible period. The maturity period is the same for transactions under the Automatic Route or the Approval Route.

All in-cost ceiling for Trade Credits is 350 basis points over 6 months LIBOR for the respective currency of credit or applicable benchmark. It includes arranger fee, upfront fee, management fee, handling/processing charges, out of pocket and legal expenses, if any.

Borrowings through Loans / Deposits

- Indian Companies, other Body Corporates, Indian Proprietary Concerns and Firms can accept fresh deposits from NRI only if the deposit is by way of debit to the NRO account of the lender and the amount deposited does not represent inward remittances or transfer from NRE/FCNR (B) Accounts into the NRO Account of the lender. However, they are permitted to hold and renew on maturity existing deposits received by them on repatriation as well as non-repatriation basis.

- Resident Individualsare permitted to avail of interest free loans up to US $ 250,000 from their NRI / PIO relative(s) (as defined under the Companies Act, 2013) subject to certain conditions.

- Special permission of the RBI will be required in case where deposits / loans do not fulfil the specified criteria or where the deposits/loans are on repatriation basis in the case of proprietary concerns and firms.

- Banks can grant loans without any ceiling but subject to usual margin requirements (in Indian Rupees in India and in foreign currency in India or overseas) against NRE and FCNR (B) deposits either to the depositors or third parties in India or overseas.

- Resident entities/companies in India, with prior approval of the Government of India, can issue tax-free, secured, redeemable, non-convertible bonds in Rupees to persons resident outside India and use such borrowed funds for the following purposes:

- For on lending/re-lending to the infrastructure sector; and

- For keeping in fixed deposits with banks in India pending utilisation by them for permissible end-uses.

10. Overseas Direct Investments

Meaning

It means investment outside India by entities by way of contribution to capital or subscription to Memorandum of Association of a foreign entity or purchase of existing shares of a foreign entity either by market purchase or private placement or through stock exchange but does not include portfolio investment.

Eligible Entities

- A company incorporated in India; or

- A body created under an Act of Parliament; or

- Partnership firm registered under the Indian Partnership Act, 1932;

- A Limited Liability Partnership (LLP), registered under the Limited Liability Partnership Act, 2008.

- Any other entity in India as may be notified by the Reserve Bank.

HUFs, AOPs, etc. are not allowed to invest abroad. Proprietary concern and Unregistered Partnership firm can invest abroad only after obtaining prior approval from RBI.

General Prohibitions

Investments in Real Estate Business (buying and selling of real estate or trading in Transferable Development Rights (TDRs) but does not include development of townships, construction of residential/commercial premises, roads or bridges) and Banking requires prior approval of RBI.

General Permissions

- Reserve Bank of India has granted general permission to residents for purchase/acquisition of securities and sale of shares/securities so acquired :

- - Out of funds held in RFC account; and

- - As bonus shares on foreign securities held in accordance with the provisions of the Act or rules or regulations made thereunder.

- General permission has also been granted to a person who is not permanently resident in India for purchase of securities out of foreign currency resources outside India as also for sale of securities so acquired

- A Resident individual (single or in association with another resident individual or with an ‘Indian Party’) satisfying the criteria as prescribed, may make ODI in the equity shares and compulsorily convertible preference shares of a JV or WOS outside India. The limit of ODI by the resident individual shall be within the overall limit prescribed by the RBI under the Liberalised Remittance Scheme, as prescribed by it from time-to-time.

Joint Ventures / Wholly Owned Subsidiaries Abroad

Indian investments abroad in Joint Ventures (JV) and Wholly Owned Subsidiaries (WOS) are permitted by RBI.

Investments can be made under the automatic route up to 400% of the net worth (subject to a maximum investment of ₹ 1 billion. Investment exceeding ₹ 1 billion will be under the approval route) of the Indian party as on the date of the last audited balance sheet, in which case prior permission is not required, or the approval route, in which case prior permission from RBI is required. There are various options available for investment under both the routes.

Note: For arriving at the net worth of an Indian party, the net worth of its holding company or its subsidiary may be taken into account to the extent it (the holding / subsidiary company) has not undertaken overseas investment and has issued a letter of disclaimer in favour of the Indian party.

Eligible Instruments

Investment can be in equity, loans, or by way of guarantees. Further, these guarantees can be – corporate or personal / primary or collateral and can be given by the Promoter Company / group company / sister concern / associate company in India. The amount and period of guarantee should be specified upfront. Form ODI will have to be filed with RBI for all guarantees given. All the guarantees will be considered while computing the overall limit of 400% of the net worth.

Investment in Compulsory Convertible Preference Shares will be treated at par with equity shares.

General Guidelines:

- Investments can be made in existing companies or new companies or for acquiring overseas business.

- Registered Trusts and Societies engaged in manufacturing / educational/ hospital sector in India can invest in a JV / WOS outside India, in the same sector, after obtaining prior permission of RBI.

- The foreign entity can be engaged in any industrial, commercial, trading, agriculture, service industry, financial services such as insurance, mutual funds, etc. However, any overseas entity having equity participation directly / indirectly of Indian parties cannot offer financial products linked to Indian Rupee (e.g., non-deliverable trades involving foreign currency, rupee exchange rates, stock indices linked to Indian market, etc.) without obtaining specific approval of RBI since the Indian Rupee is currently not fully convertible and such products could have implications for the exchange rate management of the country.

- Investment in an overseas JV/WOS can be by way of drawal of foreign exchange from an AD Bank in India, or capitalization of exports of goods and services. For contribution by way of exports, no agency commission will be payable to the WOS/JV.

- Investment under automatic route will not be permitted to parties on RBI Caution List, or who have defaulted to the banking system in India and whose names appear on the Defaulter’s list.

- Share certificates/other documents where share certificates are not issued should be submitted within the specified time and dividends, royalties, etc. due to Indian investor should be repatriated to India in accordance with the prevailing time limits.

- Authorised dealers have been permitted to release FX for feasibility studies prior to actual investment.

- In case of partial/full acquisition of an existing foreign company, where the investment is more than US $ 5 million or investment by way of swap of shares, irrespective of the amount, valuation of the shares of the company shall be made by a Category-I Merchant Banker registered with SEBI or an Investment Banker / Merchant Banker outside India registered with the appropriate regulatory authority in the host country. In all other cases valuation can be by a Chartered Accountant or a Certified Public Accountant. Approval of the (FIPB) will also be a prerequisite for investment by swap of shares in cases where FDI is not permitted under the Automatic Route.

- In the event of changes proposed in the JV/WOS regarding activities, investment in another concern / subsidiary or alterations of share capital, there are reporting requirements to RBI.

- Disinvestment can be either under the automatic route or approval route. All such proposals should be accompanied by a Chartered Accountant's valuation report. The Indian Party is required to submit details of such disinvestment through its designated AD within 30 days from the date of disinvestment

- Resident Indian does not need permission to accept appointment as Director on boards of overseas company or to act as Trustee of an overseas Trust.

- Investment in Nepal can be made in Indian Rupees only. Investment in Bhutan can be made either in freely convertible currencies or in Indian Rupees. However, if investment is made in freely convertible currencies then all dues receivable on such investments as well as their sale/ winding up proceeds are required to be repatriated to India also in freely convertible currencies. An Indian Party can invest in an entity in Pakistan under the Approval Route.

- Entities setting up Branch/JV/WOS overseas for trading in Commodities Exchanges Overseas will have to obtain clearance from the Forward Markets Commission.

- Shares held in the overseas JV/WOS or Step Down Subsidiary (SDS) can be pledged by way of security for availing fund based and/or non-fund based facilities for itself or the JV/WOS from a Bank in India or abroad.

- Creation of charge on movable/immovable property and other financial assets of the Indian entity and their group companies allowed under approval route within the overall limit of 400% of the net worth.

- An Indian Party cannot invest in an overseas entity either set up or acquired directly or indirectly abroad, located in countries identified by the Financial Action Task Force (FATF) as “non co-operative countries and territories.”

Annual Performance Report

Annual Performance Report (APR) in Form ODI through the designated AD should be submitted on or before December 31 every year for pre/post commencement of commercial operation. Audited Annual Accounts, Directors' Report of the Overseas Company are also required to be submitted. APR is to be certified by the Statutory Auditors of the Indian Investor company in case the host country does not mandate audit of accounts.

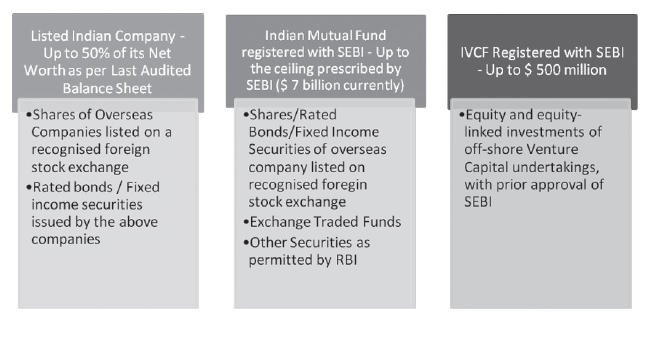

Investments by Employees