1. Basic Concepts

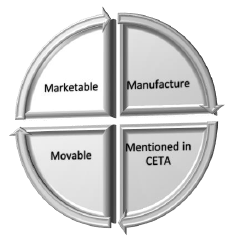

Basic pre-requisites for levy of Central excise duty:

- There should be production or manufacture of goods in India

- Such excisable goods should be specified in the Schedule to Central Excise Tariff Act, 1985 (CETA)

- The term “goods” in turn would indicate that they are movable as well as marketable

2. Manufacture

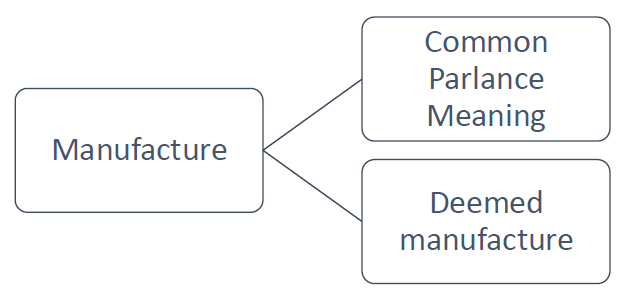

The most important term ‘Manufacture’ is defined inclusively under Section 2 (f) of the Central Excise Act, 1944 (CEA) as under:

“Manufacture” includes any process, -

- incidental or ancillary to the completion of a manufactured product;

- which is specified in relation to any goods in the Section or Chapter notes of the First Schedule to the Central Excise Tariff Act, 1985 (5 of 1986) as amounting to manufacture; or

- which, in relation to the goods specified in the Third Schedule, involves packing or repacking of such goods in a unit container or labeling or re-labeling of containers including the declaration or alteration of retail sale price on it or adoption of any other treatment on the goods to render the product marketable to the consumer.”

The definition given hereinabove is an inclusive definition. It is a well-settled law that in case of any inclusive definition, the term being defined has to be understood in normal parlance. The inclusive phrase needs to be taken into consideration for expanding the meaning of the term so normally understood. Accordingly, in the present case, it is essential to understand the meaning of ‘manufacture’ in normal parlance, in addition to the definition as provided by Central Excise Law.

The meaning of ‘manufacture’ can be found in various dictionaries. Moreover, the term has also been explained by various Courts from time to time under Central Excise Laws. One of such landmark decision is Delhi Cloth and General Mills Co. Ltd. 1977 (1) ELT (J199) (SC).

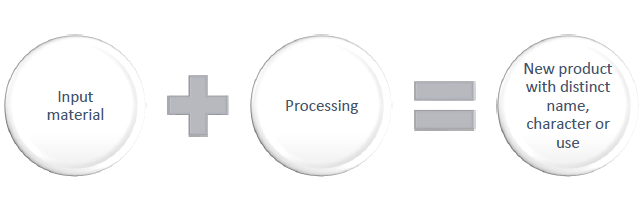

In the said case the Apex Court observed that 'Manufacture' implies a change but every change in raw material is not manufacture. Something more is necessary. There must be such transformation of raw material into a new and different article emerges having a distinct name character and use.

- Certain Judicial Pronouncements on ‘manufacture’:

- In order to levy central excise duty, it is necessary that a new article should come into existence as a result of manufacturing activity. Unless there is manufacture, excise duty is not payable. (Hawkins Cookers Ltd. vs. Collector - 1997 ELT 507 S.C.).

- In the case of State of Maharashtra Vs. Mahalaxmi Stores 152 ELT 30 S.C, the Hon. Supreme Court observed that "Every type of variation of goods or finishing of goods would not amount to manufacture unless it results in emergence of new commercial commodity. Repair or reconditioning of an article does not amount to manufacture because no new goods come into existence.”

- The general concept of manufacture has been a subject matter of discussions in a number of cases by the Supreme Court. Some of the leading case laws on the subject which may be referred from time to time by readers are:

- South Bihar Sugar Mills vs. UOI 2 ELT J 336 (SC);

- Empire Industries Ltd. Vs. UOI 20 ELT 179 (SC);

- Food Packers 6 ELT 343 (SC);

- Sterling Goods vs. State of Karnataka 26 ELT 3 (SC);

- Siddheshwari Cotton Mills P. Ltd. vs. UIO 39 ELT 498 (SC);

- Mafatlal Fine Spg. & Mfg. Co. Ltd. vs. CCE 40 ELT 218 (SC).

Therefore, on a conjoint reading of the dictionary meanings as well as various Central Excise decisions in place, ‘manufacture’ is understood to mean a process due to which an input material is transformed into a new and different article i.e. a new product comes into existence with a distinct name, character or use. The essence of manufacture is the transformation of the parts or basic components into another article of a different character.

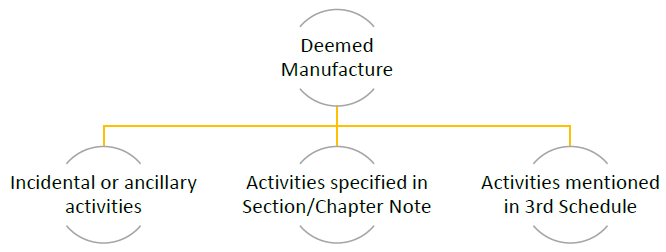

- Deemed Manufacture:

As provided earlier, manufacture is defined under CEA in inclusive manner. All the 3 limbs of the definition are explained in brief hereunder:

- Incidental or ancillary activities to the completion of a manufactured product are considered to be manufacture. Therefore, packing and labelling if are necessary for completion of manufacture of articles, the same may be treated as manufacturing activity.

- Certain activities if are specified in the relevant Chapter Notes/Section Notes of CETA to be amounting to manufacturing activity, would also amount to manufacture. To illustrate, normally an activity of repacking from a bulk pack to smaller packs would not amount to manufacture since no new product comes into existence. However, such activity is specified in Chapter Note of Chapter 29 of CETA, as amounting to manufacture. Therefore, repacking of articles falling under Chapter 29 from bulk to small packs would be treated as manufacturing activity. However, such activity would be considered to be a manufacturing activity only for specified Chapters and Products and not for all the products.

- Following activities when carried out on goods specified in Third Schedule to CETA are considered as manufacture:

- Packing or repacking in a Unit container

- Labeling or rebelling of containers

- Declaration or alteration of retail sale price or

- adoption of any other treatment on the goods to render the product marketable to the consumer

Therefore, sometimes a person carrying out only packing or repacking may also be required to pay Central Excise Duty if the product is falling under Third Schedule to CETA. In all such cases, Central Excise Duty needs to be paid on RSP less abatement which is discussed in later part of the Referencer.

3. Excisable Goods

"Excisable goods" means goods specified in the first schedule and the second Schedule to CETA as being subject to a duty of excise and includes salt

“Goods” includes any article, material or substance which is capable of being bought and sold for a consideration and such goods shall be deemed to be marketable

- Actual sale of the article is not important but it must be capable of being bought and sold

- The concept of goods' and test of marketability has been discussed in detail by Supreme Court ruling in the case of Moti Laminates Pvt. Ltd. vs. CCE 76 ELT 241 (SC), wherein it is observed that "The duty of excise is being on production or manufacture which means bringing out a new commodity, it is implicit that such goods must be usable, moveable and marketable. The duty is on manufacture or production but the production or manufacture is carried on for taking such goods to the market for sale. The obvious rationale for levying excise duty, linking it with production or manufacture is that the goods so produced must be a distinct commodity known as such in common parlance or to the commercial community for purposes of buying and selling"

- Immovable property or articles embedded to earth, buildings and civil structures are permanently affixed to earth and hence, do not possess characteristics of goods. Consequently, no Central Excise Duties on such activities.

- In a nut shell, goods should be movable as well as marketable.

4. Classification

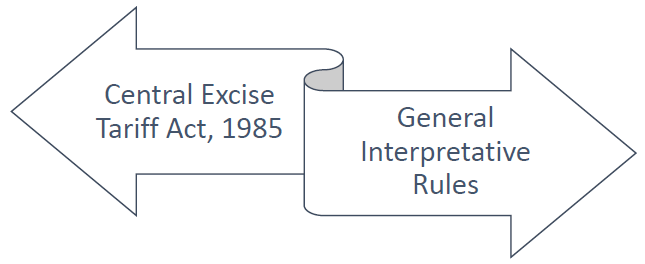

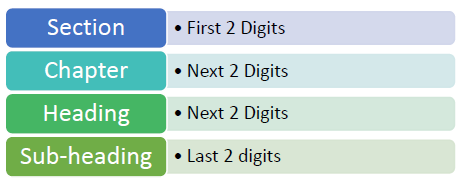

- One of the conditions to levy Central Excise Duty is that it should be mentioned in CETA. Therefore, classification is a vital aspect. Further, it also assists in ascertaining rate of Duty.

- Products are classified under CETA on the basis of HSN i.e. Harmonised System of Nomenclature. HSN is developed internationally and the same are adopted by India with certain modifications.

- To crystalise classification of any product, one needs to refer the following:

- To ascertain 8 digit HSN code, CETA needs to be referred in following hierarchy sequentially:

- Since there are 98 Chapters grouped in 20 Sections covering thousands of products, one should refer to ‘General Interpretative Rules’ as provided hereunder:

- Title of Section/Chapter are for reference purposes and has only persuasive value

- Incomplete goods to be classified as complete goods

- Unfinished goods to be classified as finished goods

- Specific to prevail over general

- In case of composite/mixed goods, classify as per the essential character of the goods

- If classifiable under more than 1 heading, later the better

- Akin Rule: If the product is not classified under CETA then classify with the product most similar to the one manufactured

- If the products are not classified as above, one may also follow following non-statutory principles:

- Common/Trade parlance

- Dictionary meaning

- Expert opinions

- ISI specifications

- CBEC Circulars

- HSN Explanatory Notes

- In view of dynamic nature of businesses and subjective matter, ‘classification’ is an area prone to litigations. Therefore, every assessee should carefully classify the goods in order to determine correct effective rate of duty.

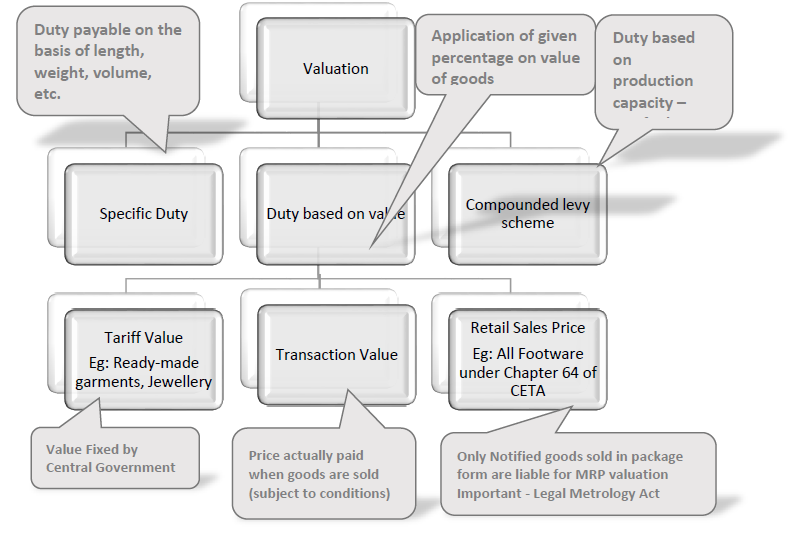

5. Valuation

A chart providing summary of valuation mechanism is provided hereunder:

Important concepts of valuation are provided hereunder:

- Tariff Value –

In respect of few products Tariff Value is fixed by the Central Government which are incorporated in the relevant tariff entry itself.

- Transaction Value. –

Generally, Central Excise Duty is levied on transaction value, of each removal of goods, provided following conditions are fulfilled cumulatively:

- The Goods are sold at the time and place of removal

- Buyer and assessee are not related and

- Price is the sole consideration for sale.

Following are some of the important facets of transaction value:

- It includes all elements of cost on the basis of the principles enunciated by Supreme Court in the cases of

Bombay Tyre International Ltd. 1983 (12) ELT 869 (SC).

- In cases where the sale price is cum duty price, transaction value will be considered as inclusive of excise.

- Department Circular No.354/81/2000 dated 30.6.2000 clarifies that following charges, even if separately recovered from buyers, would be includible in value of goods (a) Packing charges, ordinary or special (b) Warranty charges for optional or mandatory warranty (c) Advertising or publicity charges recovered from buyers.

- Since each transaction would have unique features and expenses, this is one area of higher litigations. Therefore, one needs to ascertain value of a product thoroughly.

- It may be noted that if either of the above conditions are not satisfied, one needs to check Valuation Rules i.e. Central Excise Valuation (Determination of Price of Excisable Goods) Rules, 2000. A summary of Valuation Rules is provided hereunder for ready reference:

|

Rules

|

Description

|

|

Rule 4

|

Value at the time nearest to the removal after making reasonable adjustment for the time difference

|

|

Rule 5

|

When goods are sold for delivery at a place other than place of removal: Cost of transportation to be deducted

|

|

Rule 6

|

When price is not the sole consideration for sale: Additional consideration flowing directly or indirectly to be included

|

|

Rule 7

|

When goods are transferred to depot, premises of consignment agent or any other place from where goods are sold: Normal transaction value i.e. the transaction value at which greatest aggregate quantity of such goods are sold from such place

|

|

Rule 8

|

When goods are captively consumed: 110% of cost of production

|

|

Rule 9 & 10

|

When goods are sold to or through a related person/inter connected undertakings: Price at which such related person sells to unrelated person

If no sale to independent buyers then Price at which goods are sold to related person who sells such goods in retail

|

|

Rule 10A

|

When goods are cleared by a job worker: Transaction value of the principal manufacturer

|

|

Rule 11

|

Residuary rule: reasonable basis

|

- Following would not be includible in determining value:

- Interest charged or receivable for delayed period if shown separately in invoice

- Discounts - Cash discount, quantity discount, year-end discount and like if known prior to clearance of goods.

- If goods are sold at loss, whether transaction value may be adopted or not, was a matter of litigation. Hon’ble Supreme Court in case of

Fiat India Pvt. Ltd. 2012 (283) ELT 161 (SC) held that since this was done to penetrate the market, some additional consideration was flowing indirectly and therefore, transaction value should not be adopted. However, since the decision was given in peculiar circumstances, valuation rules are amended to clarify that, no additional consideration is flowing directly or indirectly from the buyer to assessee, when excisable goods are sold by manufacturer at a price less than its manufacturing cost.

- RSP based levy –

On specified goods, Central Excise Duty is levied on Retail Sales Price (RSP) of the product less abatements. Only when there is a requirement to mention RSP on such product as per Legal Metrology Act, 2009, such goods would fall under RSP based valuation. Typically, under this levy, Duty burden is heavy since RSP is the maximum price at which excisable goods in packaged forms are sold to ultimate consumer. It includes all taxes, freight, transport charges, commission payable to dealers and all charges towards advertisement, delivery, packing, forwarding charges etc.

This being a unique levy, Central Excise (Determination of Retail Sale price of Excisable Goods) Rules, 2008 are notified to provide manner of determination of RSP where the same is not declared on the packages or tempered or altered. For example, in case the RSP is amended to a higher RSP post clearance of goods, excise duty would be leviable on the basis of such higher RSP.

- Capacity based levy –

In this levy, Central Excise Duty is levied on the basis of capacity of production as against actual production. Currently, such levy is in existence for Pan Masala products, stainless steel pattas and pattis etc.

6. Person liable for making payment

Central Excise Duty is payable by a manufacturer including a job worker.

7. Cenvat

- In order to remove cascading effect between major Central Indirect taxes, CENVAT Credit Rules were introduced in 2004 wherein Central Excise Duties and specific Customs Duties paid on goods is allowed as CENVAT Credit for provision of output services and vice versa

- CENVAT Credit is allowed in respect of eligible inputs, inputs services and capital goods when used in relation to manufacture of final product

- Elaborate discussion on CENVAT Credit can be found in Service tax section of this reference. Specific points relevant for manufacturer are highlighted under this section

- Specified Duties (SD) which are eligible as CENVAT Credit:

- Excise duty as specified in the First Schedule to CETA

- Excise duty as specified in the Second Schedule to CETA

- Additional duty of excise leviable under Section 3 of the Additional Duties of Excise (Textile and Textile Articles) Act, 1978

- Additional duty of excise leviable under section 3 of the Additional Duties of Excise (Goods of Special Importance) Act, 1957

- National Calamity Contingent Duty leviable under Clause 129 of Finance Act, 2001 as amended by clause 161 of the Finance Act, 2003

- Additional duty leviable under section 3 of the Customs Tariff Act, equivalent to the duty of excise specified under clauses (i), (ii), (iii), (iv), (v) above

- Additional duty leviable under Section 3 (5) of the Customs Tariff Act which is in lieu of VAT/CST (Not eligible to service providers)

- Additional excise duty leviable under section 157 of the Finance Act, 2003

- Service tax leviable under section 66, 66A or 66B of the Finance Act, 1994

- Additional excise duty leviable under Section 85 of the finance Act, 2005

- Krishi Kalyan Cess leviable under Section 161 of the Finance Act, 2016

- Some of the above duties and taxes are allowed to be utilized only against respective duties or taxes such as Krishi Kalyan Cess

- CENVAT Credit on capital goods is available even if said goods are received outside the factory of manufacturer for generation of electricity for captive use within the factory

- CENVAT Credit on inputs for Articles of Jewellery: CENVAT credit of duty paid on inputs may be taken immediately on receipt of such inputs in the registered premises of the person who get such final products manufactured on his behalf, on job work basis, subject to the condition that the inputs are used in the manufacture of such final product by the job worker.

- CENVAT Credit shall be allowed even if any inputs as such or after being partially processed are sent to a job worker for further processing, testing, repair, re-conditioning or for the manufacture of intermediate goods necessary for the manufacture of final product, or for any other purpose, and it is established form the records, Challans or memos or any other document produced by the assessee that the goods are received back in the factory within 180 days of their being sent to a job worker.

- Similarly, CENVAT credit on capital goods shall be allowed if such capital goods are sent to the factory of job-worker, for use in the manufacture of its products. However, such capital goods shall be received back in the factory of the manufacturer within 2 years.

- If the inputs or the CGs are not received back within 180 days or 2 years respectively then the manufacturer shall pay an amount equivalent to the CENVAT Credit attributable to the inputs or CGs by debiting the CENVAT Credit or otherwise. However, the manufacturer can take the CENVAT Credit again when the inputs or CGs are received back in his factory. Now, principal manufacturer can obtain CENVAT credit of inputs transferred to all subsequent job workers in a chain.

- CENVAT Credit shall also be allowed in respect of Jigs, fixtures, moulds and dies sent by the principal manufacturer to another manufacturer or to a job worker for the production of goods on his behalf and according to his specifications

- CENVAT Credit can be taken by the manufacture on the basis of following documents such as:

- an invoice issued by:

- manufacturer for clearances of:

- inputs or capital goods from his factory or from his depot or from the premises of the consignment agent of the said manufacturer or from any other premises from where the goods are sold by or on behalf of the said manufacturer

- Inputs or capital goods as such

- an importer

- a first stage dealer or a second stage dealer

- a supplementary invoice, issued by a manufacturer or importer of inputs or capital goods, from his factory or from his depot or from the premises of the consignment agent of said manufacturer or importer or from any other premises from where the goods are sold by, or on behalf of, the said manufacturer or importer, in case additional amount of excise duties or additional duty of customs leviable under section 3 of the Customs Tariff Act, has been paid. In case, the additional amount of duty is recoverable on account of any non-levy or short-levy by reason of fraud, collusion, willful misstatement, suppression of facts or contravention of any provisions of the Act or of the Customs Act, 1962 with intent to evade payment of duty, the manufacturer or importer would not be able to issue supplementary invoice

- an invoice, a bill or challan issued by a provider of input service

- a challan evidencing payment of service tax on reverse charge basis

- a bill of entry

- a certificate issued by an appraiser of customs in respect of goods imported through a Foreign Post Office

- An invoice, a bill or challan issued by an input service distributor

CENVAT Credit of additional customs duty under Section 3 (5) of the Customs Tariff Act, 1975, popularly known as “SACD”, shall not be allowed if invoice/supplementary invoice bears an indication that no credit of the said additional duty shall be admissible.

- Exporter can apply for refund of credit of SD paid on inputs and input services used in final products cleared for export, subject to fulfillment of specific conditions provided the manufacturer does not avail duty drawback or claim rebate of duty under CER. The claim for refund needs to be made within 1 year from relevant date i.e. date of export. Further, CENVAT credit of SD on inputs/input services used for final products exported can be utilised against duty liability on domestic clearances.

8. SSI Exemption

- A manufacturer may opt not to pay Central Excise Duty upto the first aggregate value of clearances of ₹ 1.50 Crores. The exemption limit in case of Jewellery Manufacturer is ₹ 10 Crores in the year.

- To avail such exemption, popularly known as, SSI exemption, the aggregate value of clearances in the preceding financial year shall not exceed ₹ 4 Crores. ₹ 15 Crores in case of Jewellery Manufacturer.

- The aforesaid limit will apply to clearances affected by (i) A single manufacturer from one or more factories or (ii) One or more manufacturers from the same factory.

- It would be pertinent to note that exemption is not available to goods bearing brand name or trade name of other person. In case the goods are manufactured in rural area, the same shall be eligible for SSI exemption even if goods bear the brand name or trade name of other person.

- It may be noted that SSI exemption is available for most of the products except few specified products.

- Following clearances shall be counted for calculation of ₹ 150 Lakhs/ 10 Crores:

- Clearance of goods for home consumption including free gifts, donations, captive consumption etc.

- Clearances for home consumption shall include exports made to Bhutan

- For the purpose of availing exemption of the first clearances of ₹ 150 Lakhs/ 10 Crores, the following clearances shall not be taken into account:

- Clearances chargeable to NIL rate of duty or exempted from payment of duty (other than exemption based on quantity or value of clearances)

- Clearances bearing brand name or trade name of another person, which are ineligible for the grant of this exemption scheme

- Clearances of specified goods which are used as inputs for manufacture of specified goods within the factory

- Clearances of goods for export

- For the purpose of determining the eligibility limit of ₹ 4 Crores /15 Crores of aggregate value of clearances of all excisable goods for home consumption in the preceding financial year, the following clearances shall not be taken into account:

- Clearances to FTZ/SEZ/100% EOU/EHTP/STP/UNO/International Organization

- Clearances bearing the brand name or trade name of another person

- Exports

- Clearances of specified goods which are used as inputs for manufacture of specified goods within the factory

- Clearances exempt under specific job work notifications

- Turnover of Non-excisable Goods

- The manufacturer shall not avail the CENVAT Credit of duty on inputs

- CENVAT Credit on capital goods is not allowed to be utilized until the exemption limit of ₹ 150 Lakhs/ 10 Crores is crossed.

9. Registration under Central Excise

- Any person, who produces, manufactures, carried on trade, holds private show room or warehouse or otherwise uses excisable goods or an importer who issues invoices on which CENVAT Credit can be taken, is required to get registered under Central Excise Laws

- However, following persons are exempted from taking registration:

- Manufacturer of excisable goods chargeable to NIL rate of duty or fully exempted subject to fulfillment of specific conditions including filing of a declaration

- If the manufacturer claims benefit of SSI exemption, declaration needs to be filed only when the limit of 90 Lakhs is crossed in preceding financial year. In case, the manufacturer is new, declaration needs to be filed only if the current financial year’s turnover is expected to cross 90 Lakhs. Jewellers need not file any declaration until crossing the turnover of 10 Crores.

- Principal manufacturer if he authorises job worker to comply with all procedural formalities under Central Excise Laws

- Job worker undertaking job work for goods falling under Chapter 61 or 62 of the First Schedule to CETA if Principal manufacturer comply with all procedural formalities under Central Excise Laws

- The persons manufacturing excisable goods by following the warehousing procedure as required by or under the Customs Act, 1962 subject to the specified conditions

- Godown or retail outlet of Duty Free Shop licensed under Customs Laws

- The person who carries on wholesale trade or deals in excisable goods except first stage dealer or second stage dealer

- The person who uses excisable goods for any purpose other than for processing or manufacturer of any goods availing benefit of exemption extending concessional rate of duty

- 100% EOU/SEZ licensed under Customs Act who does not have operations with Domestic Tariff Area (DTA) i.e. neither procurement nor removal to DTA, are deemed to be registered under Central Excise Laws

- The application for registration is required to be made prior to the commencement of manufacture or engaging in the specified activities.

- The Application for registration has to be made online in Form A-1 and a copy of the printout signed by the manufacturer alongwith requisite documents are required to be submitted to jurisdictional Central Excise Office.

- Physical verification of the premises shall be done within 7 days from the date of online application for registration and Registration shall also be granted within 7 days of receipt of complete application.

- Upon transfer of business by a registered person to another person, the transferee should obtain a fresh certificate.

- If registered person ceases to carry on the operations, he shall surrender his Registration Certificate. Where there are no dues pending recovery, application for de-registration shall be approved within 30 days from the date of filing of online declaration and the assessee shall be informed, accordingly.

- Any change in constitution of a Firm, Company or Association of persons like change in Partners/Directors etc. shall be intimated to the Central Excise office within 30 days of such change by way of amendment in registration. However, new registration is required to be obtained in the case involving change in PAN Number.

- Other important points

- Registration is required to be obtained in respect of every manufacturing premise. In the context of manufacturers, premises would include factory where manufacturing activity is carried out or godown where goods are stored.

- A person having 2 or more manufacturing unit can obtain single registration for all the premises if such premises are located within a close area in the jurisdiction of a Range Superintendent and such units have interlinked manufacturing process. Further, such units must not be availing area based exemption.

- Manufacturers of Jewellery have been granted the option of Centralized registration irrespective of the jurisdiction of its various premises provided he has centralised billing or accounting system.

10. Payment

|

Particulars

|

Periodicity

|

Payment due date

|

|

Assessee eligible for SSI exemption

|

Quarterly

|

- April to December-6th of the month following the quarter

- In case payment other than electronic mode-5th of the month following the quarter

- January to March-31st March

|

|

Other assesses

|

Monthly

|

- April to February-6th of next month

- In case payment other than electronic mode-5th of the month following the quarter

- March-31st March

|

11. Returns

|

Type of Return

|

Person

|

By Whom

|

Periodicity

|

Due Date for filing

|

|

ER-1

|

Manufacturer

|

For Production and removal of goods and other relevant particulars and CENVAT Credit

|

Monthly

|

10th of next month

|

|

ER-2

|

EOU

|

For goods manufactured, goods cleared and receipt of inputs and capital goods

|

Monthly

|

10th of next month

|

|

ER-3

|

Manufacturer- SSI exemption

|

For Production and removal of goods and other relevant particulars and CENVAT Credit

|

Quarterly

|

10th of next month following each quarter

|

|

ER-4

|

Manufacturer – Annual Return of Information

|

Every manufacturer who has paid excise duty of Rs. 1 Crore or more in the preceding FY

|

Yearly

|

30th November of the succeeding financial year

|

|

AIRA-II

|

Information Return

|

Electricity Boards

|

Yearly

|

31st December of the succeeding financial year

|

|

Other Forms

|

Assessees, Income tax authorities, VAT or Sales tax authorities, Registrar of Companies etc.

Forms are not yet notified

|

|

Dealer

|

Importer/First / Second Stage Dealer

|

Details of Invoice issued by them and documents based on which credit was passed on

|

Quarterly

|

15th of next month following each quarter

|

|

ER-8

|

Specified person

|

Manufacturers paying 2% duty and specified manufacturers claiming exemption benefit under Notification no. 12/2012-CE dated 17thMarch 2012

|

Quarterly

|

10th of next month following each quarter

|

- Late filing of return attracts late filing fees of Rs. 100/- per day which may extend upto maximum Rs. 20,000/-

- A manufacturer can also revise its periodical return by the end of the month in which original return is filed. However, annual return may be revised within 1 month from the date of submission of annual return.

12. Central Excise Audit

- Department Audit - The CED has a separate audit wing which conducts selective audit of the manufacturing concerns. The new norms introduce risk based selection of assessees for audit based on identified/quantified risk parameters and also introduce jurisdictional specific criteria (as opposed to uniform norm across the country) for segmenting the taxpayer into large, medium & small categories. The selection as well as frequency of the audit usually depends upon revenue potential and risk evaluation of the unit.

- Statutory Audit under CEA - Sections 14A and 14AA of the CEA, empowers department to carry out Statutory Audit under specified circumstances.

- Valuation Audit - If at any stage of enquiry, investigation or any other proceeding, the Assistant Commissioner/Deputy Commissioner of Central Excise or higher ranked officer, having regard to the nature of the case and interest of revenue is of the opinion that the value have not been correctly declared or determined by the manufacturer or any other person, he may, with the prior approval of the Chief CCE direct such manufacturer or such person to get the accounts of his factory, office, depot, distribution or any other place audited by the cost accountant/chartered accountant nominated by the Chief CCE. The said cost accountant/chartered accountant shall submit the report within the period specified by CCE duly signed and certified by him mentioning therein particulars as may be specified.

- Special CENVAT Audit - If the CCE has reasons to believe that a manufacturer has availed or utilized credit of duty which is not within the normal limit having regard to nature of excisable goods manufactured, the type of inputs used and other relevant factors as he may deem appropriate or has availed/utilised duty by reason of fraud, collusion or willful misstatement or suppression of facts, he may direct such manufacturer to get the accounts of his establishment audited by a Cost Accountant/Chartered Accountant nominated by him. Cost Accountant/Chartered Accountant so nominated shall submit a report for such audit duly signed and certified by him to the said CCE.

- Internal Audit by Assessee – Since Central Excise Laws are stringent in nature and also in view of self-assessment system, the assesee may carry out internal audits or can get such audit done from experts such as Chartered Accountants/Cost Accountants. It would be pertinent to note that Central Excise is recoverable from customers and therefore, it is of utmost importance to take appropriate legal stands at the time of entering into the transactions to avoid any future risk. If collectible Central Excise is not collected, it is difficult and sometimes, impossible to recover Central Excise Duty at a later stage. Further, if Central Excise Duty if charged when it was not required to be charged, the assessee may not be able to face competition and it may affect the business of the assessee heavily.

13. Show Cause Notices/Adjucation and Appeals

- In case of non-levy, short-levy, non-payment, short payment or erroneous refund, SCN may be issued within specific time limit. In case of bona fide cases, the time limit is 2 years from relevant date. However, if the case is of mala fides, the time limit is increased to 5 years from relevant date. Relevant date is defined to mean as under:

- In case of excisable goods where excise returns are not filed: Due date of filing excise returns

- In case of excisable goods where excise returns are filed: Date of filing excise returns

- In other cases: Due date of payment of Central Excise Duty

- In case of provisional assessment: Date of adjustment of duty after final assessment

- In case of erroneous refund: Date of refund

- In case of recovery of interest only: Date of payment of duty on which interest is recoverable

- After providing an opportunity of being heard to the assessee, adjudication order is passed.

- A manufacturer can file an Appeal to Commr. of CE (Appeals) against order of CEO within 60 days from the date of receipt of order. No fees payable for this appeal.

- In case of adverse order from Commr. of CE or Commr. of CE (Appeals), appeal may be filed before CESTAT (Central Excise, Service tax within 3 months.

- Cases of following nature are not allowed to be appealed before CESTAT:

- Loss of goods: where the loss occurs in transit from a factory to a warehouse or to another factory, or from one warehouse to another, or during the course of processing of the goods in a warehouse or in storage, whether in factory or in warehouse

- Rebate of excise duty on exported goods or on excisable materials used in the exported goods

- Exported goods (except to Nepal or Bhutan) without payment of duty

- CENVAT Credit of any duty allowed to be utilised towards payment of excise duty and such order is passed by the Commissioner (Appeals)

- Fees for filing appeal before CESTAT:

|

Quantum involved in appeal

|

CESTAT Fees in INR

|

|

5 Lakhs or less

|

₹ 1,000/-

|

|

More than 5 Lakhs but not exceeding ₹ 50 Lakhs

|

₹ 5,000/-

|

|

More than ₹ 50 Lakhs

|

₹ 10,000/-

|

- Mandatory pre-deposit to be paid by assesse preferring an appeal before first appellate authority and CESTAT as under:

|

Appeal before

|

% of mandatory pre-deposit

|

|

First appellate authority

|

7.5%

|

|

Second appellate authority

|

10%

|

- An appeal against the order of CESTAT may be filed before the Hon. Jurisdictional High Court if the dispute involves determination of any question pertaining to law other than valuation and rate of duty. Appeal shall be filed within 180 days from the date of communication of such order.

- Appeal against the order of High Court and CESTAT orders related to valuation and rate of duty, will lie before the Hon. Supreme Court.

14. Penal Provisions and Interest

- In case of non-levy, short-levy, non-payment, short payment or erroneous refund, penalty may be levied. The following table summarizes the quantum of penalty to be borne by assesse in such cases:

|

Particulars

|

Penalty under Section 11AC (Bona fide cases)

|

Penalty under Section 11AC (Mala fide cases)

|

|

Cases covered

|

Cases other than

- Fraud

- Collusion

- Wilful mis-statement

- Suppression of facts

- Contravention of provisions of the Act with intent to evade Excise Duty

|

Cases of

- Fraud

- Collusion

- Wilful mis-statement

- Suppression of facts

- Contravention of provisions of the Act with intent to evade Excise Duty

|

|

SCN for Non-levy/Non-payment/Short-levy/Short-payment/Erroneous refund of Excise Duty

|

Penalty not exceeding 10% of amount of duty or ₹ 5,000/-, whichever is higher

|

Penalty equal to 100% of Excise Duty

|

|

Excise Duty with interest paid before or within 30 days from the date of service of SCN

|

No penalty

|

Reduced penalty of 15% of Excise Duty provided such reduced penalty is also paid within 30 days from the date of service of SCN

|

|

Excise Duty with interest and reduced penalty as per this Section is paid within 30 days from the date of receipt of Adjudication Order

|

25% of the penalty imposed

|

25% of Excise Duty

|

|

If Commissioner (Appeals), Appellate Tribunal or Court increased Excise duty liability, penalty to be modified accordingly. Benefit of reduced penalties would be available provided Excise duty, interest and reduced penalty is paid within 30 days from the date of receipt of the Order increasing Excise Duty liability.

|

- The above penal provisions have been brought by Finance Act 2015-16 and it could be applied for transitory cases wherein no SCN is issued before 14.05.2015 or SCN is issued but no Adjudication order is passed before 14.05.2015.

- Interest on delayed payment of duty is levied at 15% p.a. Also, in case of delay in payment beyond one month, an additional penalty @ 1% of duty amount per month is applicable.

15. Refund of central excise duty and other miscellaneous provisions

- A manufacturer can claim refund of any duty of excise and interest, if he has made application for refund within a period of 1 year from the relevant date. The refund shall be granted subject to the condition that the incidence of duty is borne by the manufacturer himself and is not passed on to the buyer of excisable goods. Generally, the amount is credited to Consumer Welfare Fund. However, in following cases, assessee receives refund and the amount is not credited to Consumer Welfare Fund:

- Rebate on export of excisable goods or on excisable material used in manufacture of exported goods

- Unspent advance deposits lying in balance in the applicant’s account current maintained with the Principal Commissioner of Central Excise or Commissioner of Central Excise

- Refund of CENVAT Credit of duty paid inputs as per specified Rules/Notifications

- Excise duty with interest if incidence of such duty and interest is borne by the manufacturer/buyer/notified persons

- Application for such refund shall be made within 1 year from relevant date. Relevant date means:

- in the case of export goods:

- Export by sea or air: Date on which the ship or the aircraft leaves India

- Export by land: Date on which such goods pass the frontier

- Export by post: Date of dispatch of goods by concerned Post Office to a place outside India

- in the case of goods returned for being remade, refined, reconditioned, or subjected to any other similar process, in any factory, the date of entry into the factory for such purposes

- in the case of goods to which banderols are required to be affixed if removed for home consumption but not so required when exported outside India, if returned to a factory after having been removed from such factory for export out of India, the date of entry into the factory

- in a case where a manufacturer is required to pay a sum, for a certain period, on the basis of the rate fixed by the Central Government by notification in full discharge of his liability for the duty leviable on his production of certain goods, if after the manufacturer has made the payment on the basis of such rate for any period but before the expiry of that period such rate is reduced, the date of such reduction

- in the case of a person, other than the manufacturer, the date of purchase of the goods by such person

- in the case of exempted goods vide a special order, the date of issue of such order

- in case of provisional assessment, the date of adjustment of duty after the final assessment

- in case where the duty becomes refundable as a consequence of judgment, decree, order or direction of appellate authority, Appellate Tribunal or any court, the date of such judgment, decree, order or direction

- in any other case, the date of payment of duty.

- In case of refund, interest is paid @ 6% from the day immediately after expiry of 3 months from the date of application of refund till the date of refund.

- Prosecution:

- In cases of specific offences where evasion of duty exceeds ₹ 50 Lakhs, the assessee is punishable with imprisonment up to maximum 7 years and fine. Such an offence is cognizable and non bailable.

- If evasion of duty is for an amount not exceeding ₹ 50 Lakhs, assessee is punishable with imprisonment upto 3 years and/or fine.

16. Settlement of Cases

- If any case is pending before adjudicating authority, he may apply to settlement commission alongwith providing the following information:

- Full and true disclosure of his undisclosed duty liability

- Manner in which such liability has been derived, the additional excise duty accepted to be payable by him and

- Such other particulars as may be prescribed including the particulars of such excisable goods in respect of which he admits short levy on account of misclassification, under-valuation, inapplicability of exemption notification or Cenvat credit or otherwise

No application for settlement commission unless:

(a) the applicant has filed returns showing production, clearance and Central excise duty paid in the prescribed manner

(b) SCN for recovery of duty issued by the Central Excise Officer has been received by the applicant

(c) the additional amount of duty accepted by the applicant in his application exceeds 3 lakhs; and

(d) the applicant has paid the additional amount of excise duty accepted by him along with interest

- Any person other than assessee, may also make an application in respect of SCN issued to him in a case relating to an assessee which is settled or pending before settlement commission

- Applications cannot be made:

- If case is pending before Appellate Tribunal or any Court

- For interpretation of classification of excisable goods

- Application to be made with prescribed fees and is not allowed to be withdrawn

- Power of Settlement Commission to grant immunity from prosecution and penalty:

- If Settlement Commission is satisfied that the applicant has co-operated and has disclosed full and true liability, immunity may be granted from prosecution, full or partial penalty and fine subject to specified conditions

- If proceedings for prosecution has been instituted before the date of receipt of application, no immunity shall be granted by Settlement Commission

- Immunity granted shall be withdrawn if the applicant fails to pay the order amount within specified time or fails to comply with conditions subject to which immunity was granted

- Immunity granted may be withdrawn in cases of concealment of any material particular or false evidence and thereupon such person may be tried for the offence with respect to which the immunity was granted or for any other offence of which he appears to have been guilty in connection with the settlement and shall also become liable to the imposition of any penalty to which such person would have been liable, had no such immunity been granted

- Settlement Commission’s Order is conclusive and cannot be reopened

- Bar on Subsequent Application for Settlement if:

- Settlement Commission’s Order imposes penalty on the ground of concealment of particulars of his duty liability

- After Settlement Commission’s Order, the person is convicted of any offence

- Case is sent back to Central Excise Officer

And thereafter, the applicant shall not be entitled to apply for settlement in relation to any other matter.

- Following changes are proposed vide Finance Bill, 2017 which shall be effective from the date of enactment of the said Finance Bill:

- Settlement commission may, within 3 months from the date of passing of the Order, amend the said order to rectify any error apparent on the face of records, either suo-motto or on such error brought to notice by Departmental authorities such as Principal Commissioner/Commissioner etc.

- In case where such rectification results into enhancement of liability of assessee, then, opportunity of being heard shall be given to applicant first before passing such order.

17. Advance Rulings

- “advance ruling” means the determination, by the authority of a question of law or fact specified in the application regarding the liability to pay duty in relation to an activity proposed to be undertaken, by the applicant

- Following persons are allowed to apply for advance ruling:

- A non-resident setting up a joint venture in India in collaboration with a non-resident or a resident

- A resident setting up a joint venture in India in collaboration with a non-resident

- Wholly owned subsidiary Indian company, of which the holding company is a foreign company, who or which, as the case may be, proposes to undertake any business activity in India

- A joint venture in India

- Notified residents such as:

- Resident Public Limited Company

- Resident Private Limited Company

- Resident firms

- Application may be made, for activity of manufacturing proposed to be undertaken by new manufacturer or existing manufacturer for his new business, stating the question on which advance ruling is sought

- Advance ruling can be sought for questions in respect of classification, rate of duty, valuation, admissibility of credit of Service tax or Excise Duty or determining Central Excise Duty liability

- Application to be made in quadruplicate with a fees of Rs. 2,500/- and it can be withdrawn in 30 days from the date of application.

- Application may be accepted or rejected. In case of rejection, an opportunity of being heard shall be provided to the applicant

- If case is already pending before Central Excise Officer, Appellate Tribunal or Court or the matter is decided by Appellate Tribunal or Court, application is not allowed

- Advance Ruling shall be pronounced within 90 days from the date of receipt of application

- Applicability of advance ruling: Advance Ruling shall be binding only on the applicant and on Commr. of CE and his subordinate officers in respect of the applicant. Advance Ruling is applicable unless there is a change in law or facts on the basis of which the advance ruling has been pronounced.

- Following changes are proposed vide Finance Bill, 2017 which shall be effective from the date of enactment of the said Finance Bill:

- Advance ruling authority constituted under the Income Tax Act would be deemed to be advance ruling authority for Customs Act

- Fees for application is increased from Rs. 2,500/- to Rs. 10,000/-

- The advance ruling shall be pronounced within 6 months from the date of receipt of application as against only 90 days.

Back to Top

|