Goods and Services Tax (GST)

|

Color Denotations

|

|

General Information

|

|

|

|

|

|

Positive Condition / Inclusion

|

|

|

|

|

|

Restrictive or Negative Condition / Exclusion

|

|

|

|

|

|

Exception to normal condition

|

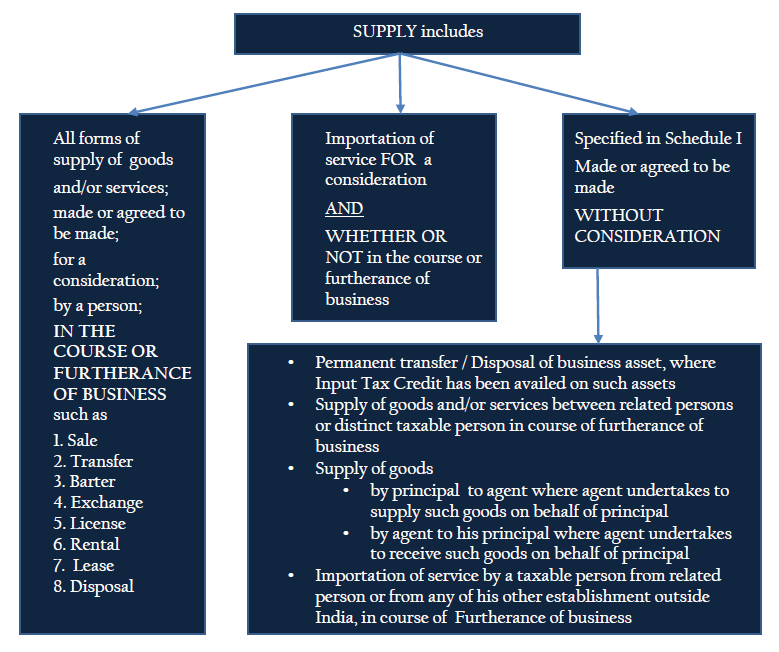

CONCEPT OF SUPPLY

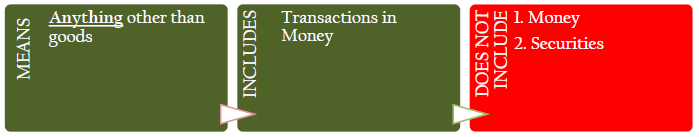

Related Definitions

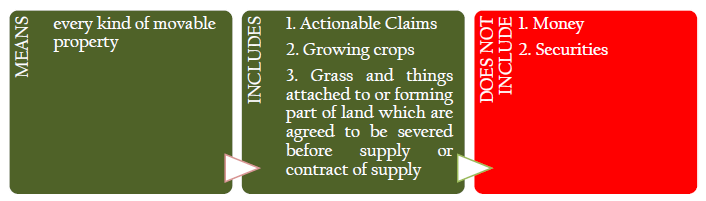

Goods

Services

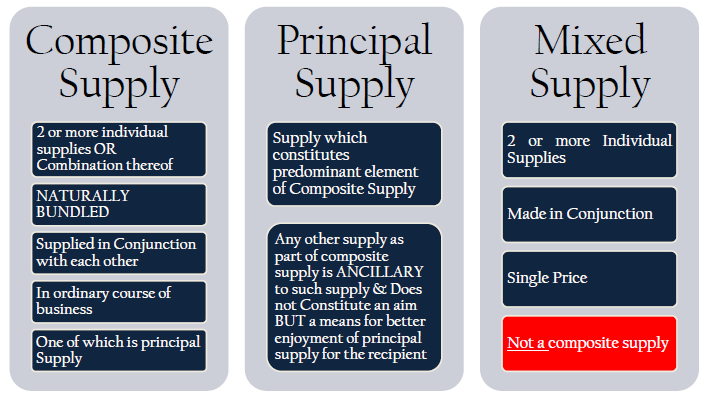

Composite Supply Vs. Principal Supply Vs. Mixed Supply

Meaning of Supply

Scope of Supply - sec 3 r.w. Schedule II

|

Sr no

|

Scenario

|

Scope

|

|

1

|

Transfer

|

|

|

a

|

Transfer of title in goods

|

Supply of Goods

|

|

b

|

Transfer of goods / Right in goods w/o transfer of title

|

Supply of Services

|

|

c

|

Transfer of title in goods under agreement that property shall be transferred at a future date

|

Supply of Goods

|

|

2

|

Land & Building

|

|

|

a

|

Any lease, tenancy, easement, license to occupy land

|

Supply of Services

|

|

b

|

Any lease or letting out of building including a commercial, industrial or residential complex for business or commerce, either wholly or partly

|

Supply of Services

|

|

3

|

Treatment or Process

|

|

|

a

|

Any treatment or process applied to other persons goods

|

Supply of Services

|

|

4

|

Transfer of Business Assets

|

|

|

a

|

Goods forming part of assets of a business transferred / disposed off with or w/o consideration

|

Supply of Goods

|

|

b

|

Under direction of person carrying business, goods held for purpose of business are put to private use with or w/o consideration

|

Supply of Services

|

|

c

|

Assets of any business shall be deemed to be supplied in furtherance of business, immediately before the taxable person ceases to be a taxable person unless

• if business transferred as going concern or

• carried on by a personal representative who is a taxable person

|

Supply of Goods

|

|

5

|

Others

|

|

|

a

|

Renting of Immovable Property

|

|

|

b

|

Construction of complex, building, civil structure, except where ENTIRE consideration has been received after Completion Certificate or first occupation whichever earlier

|

Supply of Services

|

|

c

|

Temporary transfer OR permitting use OR enjoyment of any intellectual property rights

|

Supply of Services

|

|

d

|

Development, design, programming, customisation, adaptation, upgradation, enhancement, implementation of information technology softwares

|

Supply of Services

|

|

e

|

Agreeing to the obligation to refrain from an act, or to tolerate an act or situation, or to do an act

|

Supply of Services

|

|

f

|

Works Contract including transfer of property in goods involved in execution of works contract

|

Supply of Services

|

|

g

|

Transfer of rights to use any goods for any purpose for cash, deferred payment or other valuable consideration

|

Supply of Services

|

|

h

|

Supply by way of or part of service, of goods, being food for human consumption (Other than liquor for human consumption)

|

Supply of Services

|

|

i

|

supply of goods by any unincorporated association or body of individuals to a member thereof

|

Supply of Goods

|

Scope of Supply - sec 3 r.w. Schedule III

Activities or transactions which shall be treated NEITHER AS A SUPPLY OF GOODS NOR A SUPPLY OF SERVICES

- Services by an employee to the employer in the course of or in relation to his employment.

- Services by any Court or Tribunal established under any law for the time being in force.

- (a) The functions performed by the Members of Parliament, Members of State Legislature, Members of Panchayats, Members of Municipalities and Members of other local authorities;

(b) The duties performed by any person who holds any post in pursuance of the provisions of the Constitution in that capacity; or

(c) The duties performed by any person as a Chairperson or a Member or a Director in a body established by the Central Government or a State Government or local authority and who is not deemed as an employee before the commencement of his clause.

- Services by a foreign diplomatic mission located in India.

- Services of funeral, burial, crematorium or mortuary including transportation of the deceased

Scope of Supply - sec 3 r.w. Schedule IV

Activities or transactions undertaken by the central government, a state government or any local authority which shall be treated NEITHER AS A SUPPLY OF GOODS NOR A SUPPLY OF SERVICES

- Services provided by a Government or local authority to another Government or local authority excluding the following services:

(i) services by the Department of Posts by way of speed post, express parcel post, life insurance and agency services;

(ii) services in relation to an aircraft or a vessel , inside or outside the precincts of a port or an aircraft; or

(iii) transport of goods or passengers.

- Services provided by a Government or local authority to individuals in discharge of its statutory powers or functions such as-

(i) issuance of passport, visa, driving licence, birth certificate or death certificate; and

(ii) assignment of right to use natural resources to an individual farmer for the purpose of agriculture.

- Services provided by a Government or local authority or a governmental authority by way of:

(i) any activity in relation to any function entrusted to a municipality under article 243W of the Constitution;

(ii) any activity in relation to any function entrusted to a Panchayat under article 243G of the Constitution;

(iii) health care; and

(iv) education.

- Services provided by Government towards-

(i) diplomatic or consular activities;

(ii) citizenship, naturalization and aliens;

(iii) admission into , and emigration and expulsion from India;

(iv) currency , coinage and legal tender , foreign exchange;

(v) trade and commerce with foreign countries , import and export across customs frontiers , interstate trade and commerce; or

(vi) maintenance of public order.

- Any services provided by a Government or a local authority in the course of discharging any liability on account of any tax levied by such Government or authority.

- Services provided by a Government or a local authority by way of –

(i) tolerating non-performance of a contract for which consideration in the form of fines or liquidated damages is payable to the Government or the local authority under such contract; or

(ii) assignment of right to use any natural resource where such right to use was assigned by the Government or the local authority before the 1st April, 2016:

PROVIDED that the exemption shall apply only to service tax payable on one time charge payable, in full upfront or in installments, for assignment of right to use such natural resource:

- Services provided by Government by way of deputing officers after office hours or on holidays for inspection or container stuffing or such other duties in relation to import or export of cargo on payment of Merchant Overtime Charges (MOT).

- Services provided by Government or a local authority by way of-

(i) registration required under any law for the time being in force; or

(ii) testing, calibration, safety check or certification relating to protection or safety of workers, consumers or public at large, required under any law for the time being in force.

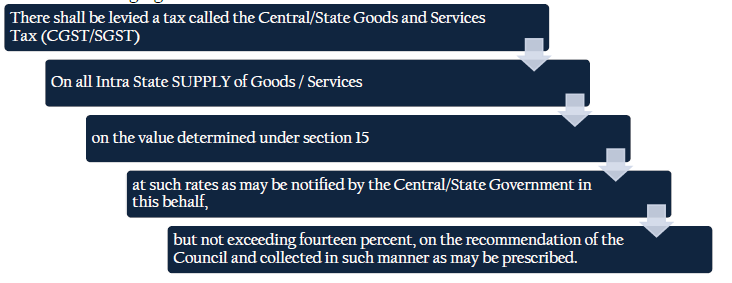

Levy / Exemption from Tax

Features of Charging Section 8

Note:

- The CGST/SGST shall be paid by every taxable person in accordance with the provisions of this Act.

- On notified specified categories of supply of goods and/or services, the tax is payable on reverse charge basis paid by the recipient of such goods and/or services

- Special Charging for e-Commerce Operators

- C/SG shall specify categories of services on which tax payable by e-Commerce Operators if supplied through it

- If e-Commerce Operators does not have a physical presence in the taxable territory, any person representing such e-Commerce operator for any purpose in the taxable territory shall be liable to pay tax

- If an e-Commerce operator does not have a physical presence in the taxable territory and also he does not have a representative in the said territory, such e-Commerce operator shall appoint a person in the taxable territory for the purpose of paying tax and such person shall be liable to pay tax.

Meaning of Aggregate Turnover

- MEANS aggregate value of

- All Taxable Supplies

- Exempt Supplies

- Export of Goods and /or Services

- Inter State Supplies

- Of a person having same PAN

- To be computed on all India basis

- EXCLUDES

- Taxes charged under C / S / IGST

- Value of Inward Supplies

- Value of Inward Supplies on which tax is payable on RCM

-

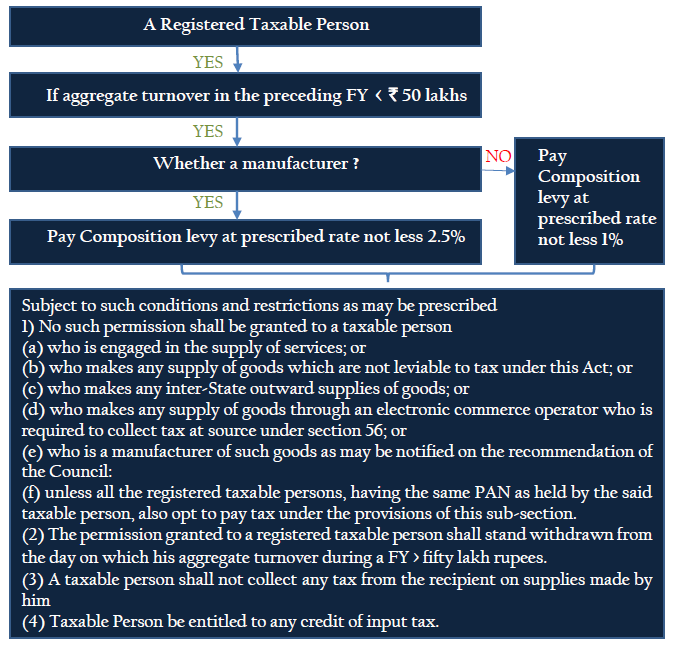

Composition Levy

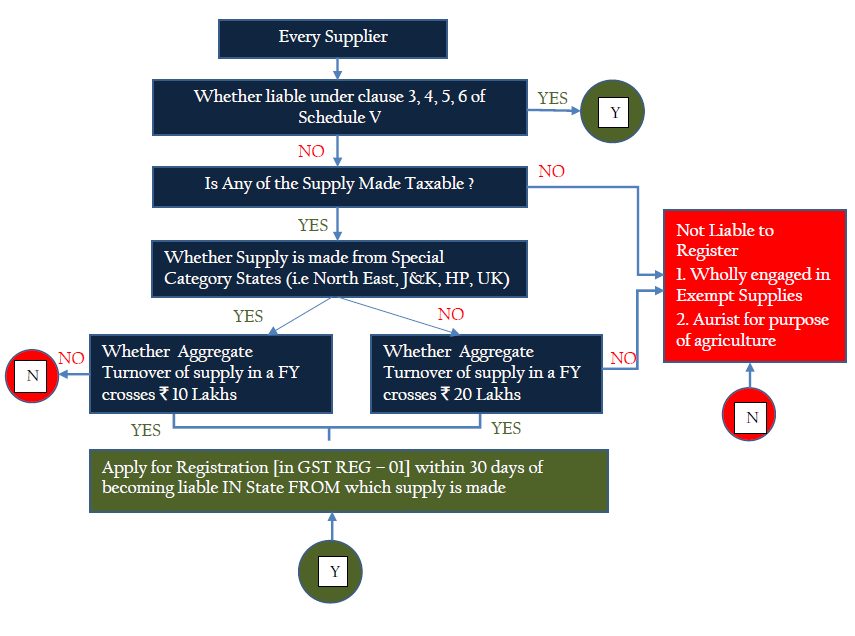

Registration

Liable for Registration w/o Threshold Limit

- TxP making Inter State Taxable Supply

- Casual Taxable Person

- Persons required to pay under Reverse Charge Mechanism (RCM)

- e-Commerce Operators

- Person required to pay tax u/s 8(4) & collect Tax u/s 56

- Other than specified services u/s 8(4) through e-Commerce

- Non Resident TxP

- Persons required to deduct TDS u/s 46

- Input Service Distributor

- Person supplying online info & database access or retrieval services from outside India to a non registered TxP in India

- Person who supplies goods and/or services on behalf of other TxP as agent or otherwise

- Notified Class of Persons

- Business carried on by registered TxP ➔ transferred as going concern to a successor on succession ➔ Successor Liable to be registered

- In scheme of amalgamation, demerger ➔ Transferee Liable ➔ w.e.f date on which ROC issue COI giving effect to court order

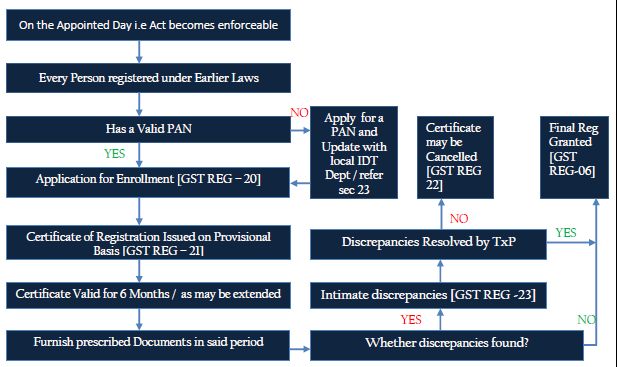

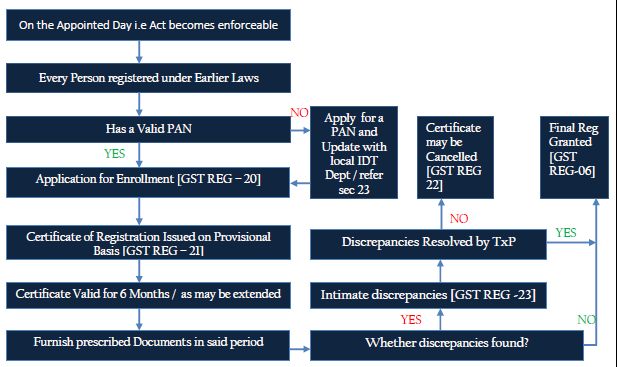

- Every person who is registered under old law ➔ on immediately preceding date to appointed date ➔ Liable to be registered w.e.f APPOINTED DATE

Structure of Registration Number

|

1st

|

2nd

|

3rd

|

4th

|

5th

|

6th

|

7th

|

8th

|

9th

|

10th

|

11th

|

12th

|

13th

|

14th

|

15th

|

|

State Code

|

PAN of Legal Entity / Assesse

|

Entity Code

|

Blank

|

Check Digit

|

|

2

|

7

|

A

|

A

|

A

|

C

|

A

|

1

|

2

|

3

|

4

|

A

|

1

|

Z

|

X

|

- Initial 2 digits – State Code

- Next 10 digits – PAN of Legal Entity

- 13th Digit – Entity Code ➔ Alpha / Numeric (1-9 & then A-Z)

- 14th Digit – Proposed to be Blank (Although practically allotted as ‘Z’)

- 15th Digit – Check Digit

Taxable Person

(1) Taxable Person means a person who is registered or liable to be registered under Schedule V of this Act.

(2) A person who has obtained or is required to obtain more than one registration, whether in one State or more than one State, shall, in respect of each such registration, be treated as distinct persons for the purposes of this Act.

(3) An establishment of a person who has obtained or is required to obtain registration in a State, and any of his other establishments in another State shall be treated as establishments of distinct persons for the purposes of this Act.

Law at Glance

- Location of Supplier & Place of Supply utmost important to determine the state in which the TxP has to register.

- Single Registration no for CGST / SGST / IGST qua state

- Multiple Business Verticals in a state ➔ May have separate registrations at option of TxP ➔ Subject to Conditions prescribed

- Not liable under Sch V ➔ Voluntary Registration allowed

- PAN issued under Income Tax Act is mandatory

- TAN issued under Income Tax Act is mandatory for Tax Deduction u/s 46

- UIN for UNO, notified UN Bodies, Consulates, Embassies

- UIN for other persons or class of persons

- Exemption from registration to notified specified categories of persons

- Rejection of Registration / UIN under C/SGST shall be deemed as rejection under S/CGST

- Registration / UIN shall be deemed granted if not rejected under C/SGST within prescribed time limit

- If person liable to register ➔ Fails to obtain registration ➔ PO may suo moto register such person

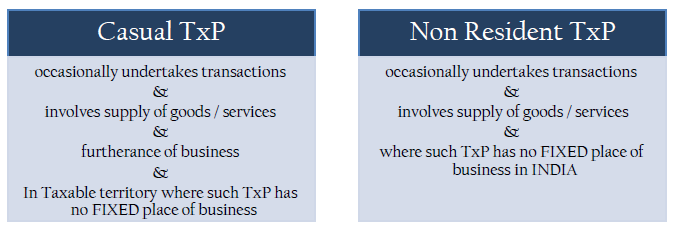

Casual Taxable Person Vs. Non-Resident Taxable Person

- Application at least 5 days prior to commencement of business

- Certificate of Registration is VALID for Earlier of

- period specified in it; or

- 90 days

- PO may extend the said period NOT more than 90 days

- Estimate tax liability [Input Credit to be considered]

- Make advance deposit of Estimated Tax Liability

Amendments to Registration - Rule 9 r.w. sec 25

- Inform any changes in info at time of registration to PO within 15 days in Form GST REG -11 electronically

- PO to issue show cause and provide ROBH to TxP for incorrect or incomplete documents within 7 days of receipt of application in Form GST REG-03

- TxP to Reply to show cause within 7 days in Form GST REG-04

- If PO fails to take action within 15 days of application or 7 days of reply to show cause, the certificate of registration shall stand amended and be made available on Common Portal

- Any Rejection or Approval under C / SGST Act shall be deemed to be rejection or approval under S / CGST Act

Cancellation of Registration sec 26

- PO to cancel in Form GST REG – 16

- on own motion after issuing show cause in Form GST REG -15 or

- application filed by TxP in Form GST REG – 14

- Reasons for cancellation

- Business Discontinued

- Transferred Fully due to death / amalgamation / demerger

- Change in constitution

- TxP no longer liable to be registered

- Registered TxP has contravened provisions of Act & Rules

- Has not filed returns for a continuous period of six months / 3 periods for composition TxP

- Has obtained voluntary registration but not commenced business within 6 months

- Registration obtained by Fraud, Wilful Misstatement, Suppression of Facts

- No effect of cancellation on the liability / other dues of TxP

- Cancellation under C / SGST shall be deemed cancellation under S / CGST

- Reg TxP to pay an amount in Electronic Cash Ledger equivalent to Input availed of Stock in Hand and Input Credit on Capital Goods reduced by prescribed % points

Revocation of cancellation – sec 27

- Any TxP whose registration is cancelled by PO on own motion can apply for revocation in Form GST REG – 17 within 30 days of service of order of cancellation in Form GST REG – 16

- PO to give show cause & ROBH in form GST REG – 19

- PO can either revoke the cancellation of registration in Form GST REG – 18 or reject the application for good and sufficient reasons

- Revocation of Cancellation of Registration under C / SGST shall be deemed revocation of cancellation of registration under S / CGST

Registration Forms

|

Particulars

|

FORM TYPE

|

|

Application for Registration

|

GST REG-01

|

|

Acknowledgement

|

GST REG-02

|

|

Notice seeking additional information/ clarification. Documents relating to application for Registration, Amendment, Cancellation

|

GST REG-03

|

|

Application for filing additional information/ clarification. Documents relating to application for Registration, Amendment, Cancellation

|

GST REG-04

|

|

Order for Rejection of Application for Registration/ Amendment/ Cancellation/ Revocation of Cancellation

|

GST REG-05

|

|

Registration Certificate U/s 23(9)

|

GST REG-06

|

|

Application for Tax Deductor or Collector at Source

|

GST REG-07

|

|

Order for Cancellation of Application for Registration Tax Deductor or Collector at Source

|

GST REG-08

|

|

Application for Allotment of Unique ID to UN Bodies/ Embassies/ Any Other Person

|

GST REG-09

|

|

Application for Registration for Non Resident Taxable Person.

|

GST REG-10

|

|

Application for Amendment in Particulars Subsequent to Registration

|

GST REG-11

|

|

Order for Amendment in Particulars to Existing Registration

|

GST REG-12

|

|

Order of Allotment of Temporary registration- Suo Moto Registration

|

GST REG-13

|

|

Application for Cancellation of Registration

|

GST REG-14

|

|

Show Cause Notice for Cancellation of Registration

|

GST REG-15

|

|

Order for Cancellation of Registration

|

GST REG-16

|

|

Application for Revocation of Cancellation of Registration

|

GST REG-17

|

|

Order for approval of application for Revocation of Cancelled of Registration

|

GST REG-18

|

|

Notice for seeking clarification/ Documents relating to application for revocation of cancelled Registration

|

GST REG-19

|

|

Application for Enrollment of existing Taxpayers

|

GST REG-20

|

|

Provisional Registration Certificate for Existing Taxpayers

|

GST REG-21

|

|

Order for Cancellation of Provisional Certificate

|

GST REG-22

|

|

Intimation of discrepancies in application for enrolment of existing taxpayers

|

GST REG-23

|

|

Application for Cancellation of Registration for Migrated Taxpayers not liable under GST Act

|

GST REG-24

|

|

Application for extension of registration period by Casual/ Non- resident Taxable Person

|

GST REG-25

|

|

Form for Field Visit Report

|

GST REG-26

|

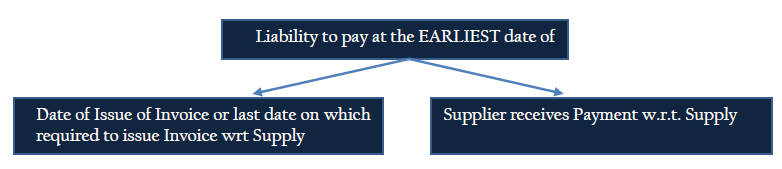

Time of Supply

Time of Supply of Goods / Service

PROVIDED that where the supplier of taxable goods receives an amount up to one thousand rupees in excess of the amount indicated in the tax invoice, the time of supply to the extent of such excess shall, at the option of the said supplier, be the date of issue of invoice.

Explanation 1.- For the purposes of clauses (a) and (b), the supply shall be deemed to have been made to the extent it is covered by the invoice or, as the case may be, the payment.

Explanation 2.- For the purpose of clause (b), “the date on which the supplier receives the payment” shall be the date on which the payment is entered in his books of accounts or the date on which the payment is credited to his bank account, whichever is earlier

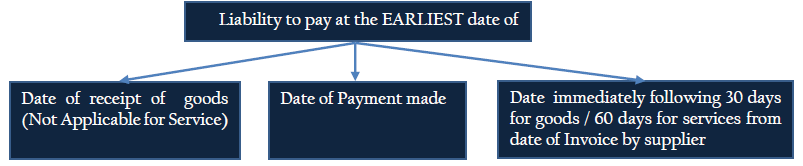

Time of Supply of Goods / Service under RCM

PROVIDED that where it is not possible to determine the time of supply under clause (a), (b) or (c), the time of supply shall be the date of entry in the books of account of the recipient of supply.

Explanation.- For the purpose of clause (b), “the date on which the payment is made” shall be the date on which the payment is entered in the books of accounts of the recipient or the date on which the payment is debited in his bank account, whichever is earlier

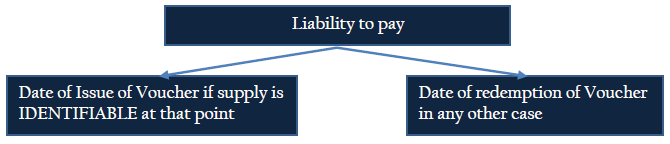

Time of Supply of Vouchers (Goods / Service)

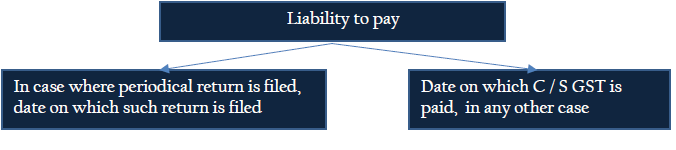

Time of Supply of Goods / Service (Residuary Case if not possible in above manner)

Time of Supply of Goods / Services – Rate Changes

|

Supplies Made

|

Issue of Invoice

|

Receipt of Payment

|

Point of Taxation

|

Applicable Rate

|

|

Before

|

After

|

After

|

Earliest Date

|

New

|

|

Before

|

Before

|

After

|

Date of Issue of Invoice

|

Old

|

|

Before

|

After

|

Before

|

Date of Receipt of Payment

|

Old

|

|

After

|

Before

|

After

|

Date of Receipt of Payment

|

New

|

|

After

|

Before

|

Before

|

Earliest Date

|

Old

|

|

After

|

After

|

Before

|

Date of Issue of Invoice

|

New

|

2 occasions out of 3 (i.e Before or After) shall prevail

PROVIDED that the date of receipt of payment shall be the date of credit in the bank account when such credit in the bank account is after four working days from the date of change in the rate of tax.

Explanation.- For the purpose of this section, “the date of receipt of payment” shall be the date on which the payment is entered in the books of accounts of the supplier or the date on which the payment is credited to his bank account, whichever is earlier:

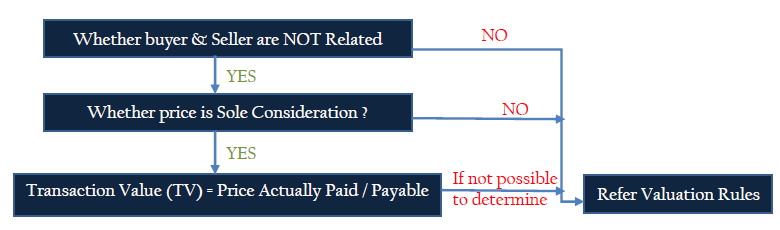

Value of Taxable Supply

Transaction Value (TV) Shall INCLUDE

- All taxes under any OTHER statute, except under S / C / IGST Act if charged seperately

- Amt incurred by Recipient ➔ supplier liable to pay ➔ not included in price paid or payable

- Incidental Expenses, e.g. Commmission / Packing / Anything incurred by supplier in connection with Supply ➔At time of / before delivery + Charged to recipient

- Interest / Late Fee / Penalty for delayed payment of any consideration for supply

- Subsidies directly linked to price, excluding CG / SG subsidies included in Value of Supply of supplier who receives it

Transaction Value (TV) Shall NOT INCLUDE Discount

- Discount allowed BEFORE / AT the time of SUPPLY, Provided such discount is Duly recorded in Invoice for Supply

- AFTER supply is effected, such discount is established in terms of an agreement entered into at or before the time of such supply and specifically linked to relevant invoices + ITC has been reversed as is attributable to the discount on basis of document issued by Supplier

PLACE OF SUPPLY

Place of Supply of Goods – IGST sec 7

|

Sec 7

|

Situation

|

Place of Supply

|

|

(2)

|

Supply INVOLVES movement of Goods, either by supplier or recipient

|

Location of Goods at the time at which Movement terminates

|

|

(3)

|

Goods delivered by Supplier to Recipient / other on direction of 3rd person, before /during movement, transfer of title documents /otherwise

|

Location of Principal place of business of such 3rd person

|

|

(4)

|

Supply does NOT INVOLVE movement of Goods, either by supplier or recipient

|

Location of Goods at the time of delivery to recipient

|

|

(5)

|

Goods are Assembled / Installed at site

|

Location of place of such installation or assembly

|

|

(6)

|

Supply on Board a Conveyance viz, vessel / aircraft / train / motor vehicle

|

Location at which goods are taken on board

|

|

(7)

|

Cannot be determined above

|

Prescribed by CG on recommendation of council

|

Place of Supply of Goods – Import / Export – IGST sec 8

|

Sec 8

|

Situation

|

Place of Supply

|

|

(1)

|

Goods imported into India

|

Location of Importer

|

|

(2)

|

Goods exported from India

|

Location outside India

|

Related Definitions

- Supplier

- In relation to any goods and/or services SHALL MEAN the person supplying the said goods and/ or services and SHALL INCLUDE and agent acting as such on behalf of such supplier in relation to the goods and/or services supplied

- Location of Supplier of Services

- Where supply is MADE FROM a place of business for which registration has been obtained, the location of such place of business

- Where a supply is MADE FROM a place OTHER THAN the place of business for which registration has been obtained, i.e say a Fixed Establishment elsewhere, the location of such fixed establishment

- Where a supply is MADE FROM more than one establishment, whether place of business/ fixed establishment, location of establishment most directly concerned with the provision of supply

- In absence of such places, the location of usual place of residence of the supplier

- Recipient

- Where the consideration is payable for the supply of goods and/or services, the person who is liable to pay that consideration

- Where no consideration is payable for the supply of goods, the person to whom the goods are delivered or made available, or to whom possession or use of the goods is given or made available,

- Where no consideration is payable for the supply of a service, the person to whom service is rendered,

- Any reference to whom a supply is made shall be construed as a reference to the recipient of the supply

- The expression recipient also includes an agent acting as such on behalf of the recipient in relation to such goods and/or services supplied

- Location of Recipient of Services

- Where supply is RECEIVED AT a place of business for which registration has been obtained, the location of such place of business

- Where a supply is RECEIVED AT a place OTHER THAN the place of business for which registration has been obtained, i.e say a Fixed Establishment elsewhere, the location of such fixed establishment

- Where a supply is RECEIVED AT more than one establishment, whether place of business/ fixed establishment, location of establishment MOST DIRECTLY concerned with the recipient of supply

- In absence of such places, the location of usual place of residence of the recipient

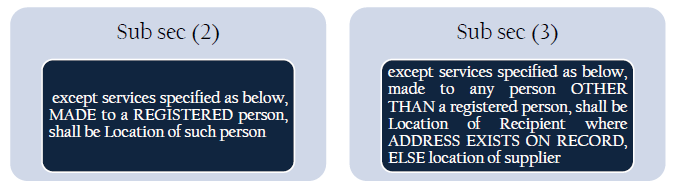

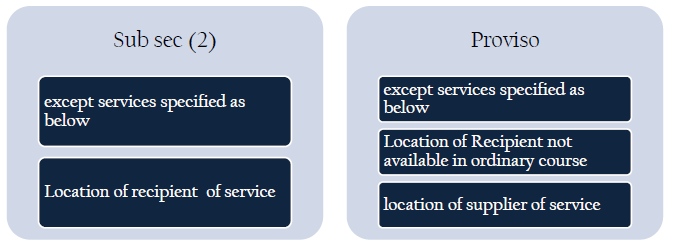

Place of Supply of Services – IGST sec 9

Location of Supplier & Recipient in India

|

Sub Sec

|

Particulars / Scenario

|

Place of Supply

|

|

4(a)

|

In relation to immovable property including architects, interior decorators, surveyors, engineers and other related experts or estate agents, grant of right to use such property, carrying out coordination of construction work

|

Location of Immovable Property

|

|

4(b)

|

Lodging by hotel, inn, guest house, homestay, club or campsite, including house boat / vessel

|

Location of such site / vessel

|

|

4(c)

|

Accommodation in immovable property for occasion or marriage / receptions / social /cultural / religious / official matter

|

Location of Immovable Property

|

|

4(d)

|

Services ancillary to (a) to (c) above

|

Location of Immovable Property / site / vessel

|

|

5

|

Restaurant / Catering / Personal Grooming / Fitness / Beauty Treatment / Health Service including Cosmetic and Plastic Surgery

|

Location where actually performed

|

|

6 (a)

|

Training and Performance appraisal to a registered taxable person

|

Location of such person

|

|

6 (b)

|

Training and Performance appraisal to person OTHER THAN a registered taxable person

|

Location where actually performed

|

|

7

|

Supply BY WAY OF ADMISSION to a cultural / artistic / sporting / scientific / educational / entertainment event / amusement park & ancillary services thereto

|

Location where event is actually held / situated

|

|

8 (a)

|

Supply BY WAY OF ORGANISING a cultural / artistic / sporting / scientific / educational / entertainment event including conference, fair, exhibition, celebration of similar events & Supply of services ancillary thereto / assigning of sponsorship to a registered taxable person

|

Location of such person

|

|

8 (b)

|

to person OTHER THAN a registered taxable person

|

Location where actually held

|

|

9

|

Supply by transportation of goods including mail or courier to a registered taxable person

|

Location of such person

|

|

9

|

Supply by transportation of goods including mail or courier to person OTHER THAN a registered taxable person

|

Location where such goods actually handed over for Transportation

|

|

9

|

Supply by transportation of goods including mail or courier to a registered taxable person

|

Location of such person

|

|

9

|

Supply by transportation of goods including mail or courier to person OTHER THAN a registered taxable person

|

Location where such goods actually handed over for Transportation

|

|

10 (a)

|

Supply by passenger transportation to a registered taxable person

|

Location of such person

|

|

10 (b)

|

Supply by passenger transportation to person OTHER THAN a registered taxable person

|

Location where passenger embarks on conveyance for continuous journey

|

|

11

|

Supply of service on board a conveyance such as vessel / aircraft / train /motor vehicle

|

Location of first schedule point of departure

|

|

12(a)

|

Telecommunication services including data transfer / broadcasting / cable / DTH by way of fixed telecommunication line, leased / internet circuits, cable / dish antenna

|

Location where telecommunication line, leased / internet circuits, cable / dish antenna is installed

|

|

12(b)

|

Telecommunication services by way of Mobile connection for telecommunication / internet services on post paid basis

|

Location of billing address of recipient on records of provider

|

|

12(c)

|

Telecommunication services by way of Mobile connection for telecommunication / internet services on pre paid through voucher

|

Location where such prepayment is received / prepaid voucher is sold

|

|

13

|

Supply of banking / financial including stock broking if linked to account

|

Location of recipient on records of provider

|

|

14 (a)

|

Insurance to a registered person

|

Location of recipient

|

|

14(b)

|

Insurance to other than registered person

|

Location of recipient on records of provider

|

|

15

|

Advt to CG / SG / stat body / local authority for identifiable states

|

Location of Such state

|

- Proviso to sub sec 4: that if the location of the immovable property or boat or vessel is located or intended to be located outside India, the place of supply shall be the location of the recipient.

Explanation: Where the immovable property or boat or vessel is located in more than one State, the supply of service shall be treated as made in each of the States in proportion to the value for services separately collected or determined, in terms of the contract or agreement entered into in this regard or, in the absence of such contract or agreement, on such other reasonable basis as may be prescribed in this behalf

- PROVISO to sub sec 8: that if the event is held outside India, the place of supply shall be the location of the recipient.

Explanation: Where the event is held in more than one State and a consolidated amount is charged for supply of services relating to such event, the place of supply of such services shall be taken as being in the each of the States in proportion to the value of services so provided in each State as ascertained from the terms of the contract or agreement entered into in this regard or, in absence of such contract or agreement, on such other reasonable basis as may be prescribed in this behalf

- PROVISO to sub sec 10: that where the right to passage is given for future use and the point of embarkation is not known at the time of issue of right to passage, the place of supply of such service shall be determined in the manner specified in sub-sections (2) or (3), as the case may be.

Explanation: For the purposes of this sub-section, the return journey shall be treated as a separate journey even if the right to passage for onward and return journey is issued at the same time.

- PROVISO to sub sec 12: that where address of the recipient as per records of the supplier of service is not available, the place of supply shall be location of the supplier of service:

PROVIDED FURTHER that if such pre-paid service is availed or the recharge is made through internet banking or other electronic mode of payment, the location of the recipient of services on record of the supplier of services shall be the place of supply of such service.

Explanation: Where the leased circuit is installed in more than one State and a consolidated amount is charged for supply of services relating to such circuit, the place of supply of such services shall be taken as being in each of the States in proportion to the value of services so provided in each State as ascertained from the terms of the contract or agreement entered into in this regard or, in absence of such contract or agreement, on such other reasonable basis as may be prescribed in this behalf

- PROVISO to sub sec 13 that if the location of the recipient of services is not on the records of the supplier, the place of supply shall be location of the supplier of services.

Place of Supply of Services – IGST sec 10

Location of Supplier or Recipient is outside India

|

Sub Sec

|

Particulars

|

Place of Supply

|

|

3(a)

|

services supplied in respect of goods that are required to be made physically available by the recipient of service to the supplier of service, or to a person acting on behalf of the supplier of service in order to provide the service

|

location where the services are actually performed

|

|

3(b)

|

services supplied to an individual, represented either as the recipient of service or a person acting on behalf of the recipient, which require the physical presence of the receiver or the person acting on behalf of the recipient, with the supplier for the supply of the service

|

location where the services are actually performed

|

|

4

|

directly in relation to an immovable property, including services supplied in this regard by experts and estate agents, supply of hotel accommodation by a hotel, inn, guest house, club or campsite, by whatever name called, grant of rights to use immovable property, services for carrying out or coordination of construction work, including architects or interior decorators

|

Location of immovable property or intended to be located

|

|

5

|

supplied by way of admission to, or organization of, a cultural, artistic, sporting, scientific, educational, or entertainment event, or a celebration, conference, fair, exhibition, or similar events, and of services ancillary to such admission

|

Location where event is actually held

|

|

6

|

any service referred to in sub-sections (3), (4), or (5) is supplied at more than one location, including a location in the taxable territory

|

location in the taxable territory where the greatest proportion of the service is provided.

|

|

7

|

services referred to in sub-sections (3), (4), (5) or (6) are supplied in more than one State,

|

the place of supply of such services shall be taken as being in each of the States in proportion to the value of services so provided in each State as ascertained from the terms of the contract or agreement entered into in this regard or, in absence of such contract or agreement, on such other reasonable basis as may be prescribed in this behalf

|

|

8

|

(a) services supplied by a banking company, or a financial institution, or a nonbanking financial company, to account holders;

(b) intermediary services;

(c) services consisting of hiring of means of transport other than aircrafts and vessels except yachts, upto a period of one month.

|

location of the supplier of service

|

|

9

|

services of transportation of goods, other than by way of mail or courier

|

place of destination of the goods.

|

|

10

|

in respect of a passenger transportation service

|

Place where the passenger embarks on the conveyance for a continuous journey

|

|

11

|

services provided on board a conveyance during the course of a passenger transport operation, including services intended to be wholly or substantially consumed while on board

|

first scheduled point of departure of that conveyance for the journey

|

|

12(a)

|

online information and database access or retrieval services

|

location of recipient of service

|

- Proviso to sub sec 3(a): that when such services are provided from a remote location by way of electronic means, the place of supply shall be the location where goods are situated at the time of supply of service: PROVIDED FURTHER that this clause shall not apply in the case of a service supplied in respect of goods that are temporarily imported into India for repairs and are exported after repairs without being put to any use in India, other than that which is required for such repairs;

- For the purposes of sub-section 12, person receiving such services shall

be deemed to be located in the taxable territory if any two of the following non-contradictory conditions are satisfied, namely:-

- the location of address presented by the recipient of service via internet is in taxable territory;

- the credit card or debit card or store value card or charge card or smart card or any other card by which the recipient of service settles payment has been issued in the taxable territory;

- the billing address of recipient of service is in the taxable territory;

- the internet protocol address of the device used by the recipient of service is in the taxable territory;

- the bank of recipient of service in which the account used for payment is maintained is in the taxable territory;

- the country code of the subscriber identity module (SIM) card used by the recipient of service is of taxable territory;

- the location of the fixed land line through which the service is received by the recipient is in taxable territory.

Determination of Intra/ Inter State Transaction

|

Location of Supplier

|

Place of Supply

|

Type of Transaction

|

Levy

|

|

State A

|

State A

|

Intra State

|

CGST + SGST

|

|

State A

|

State B

|

Inter State

|

IGST

|

|

State A

|

Other than a State

|

Inter State

|

IGST

|

|

Union Ter A

|

Union Ter A

|

Inter State

|

IGST [Note 1]

|

- Any supply of goods and/or services in the taxable territory, not being an intra-State supply and not covered elsewhere in this section, shall be deemed to be a supply of goods and/or services in the course of inter-State trade or commerce

- “State” with reference to articles 246A, 268, 269, 269A and article 279A includes a Union territory with Legislature [i.e for purposes of this Act, State means 29 states, Delhi & Pudhucherry]

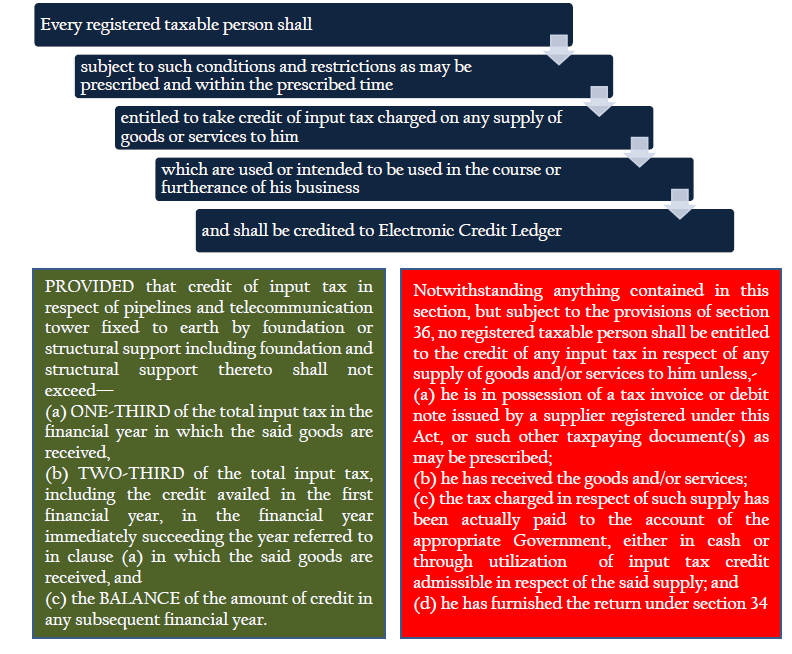

Input Tax Credit

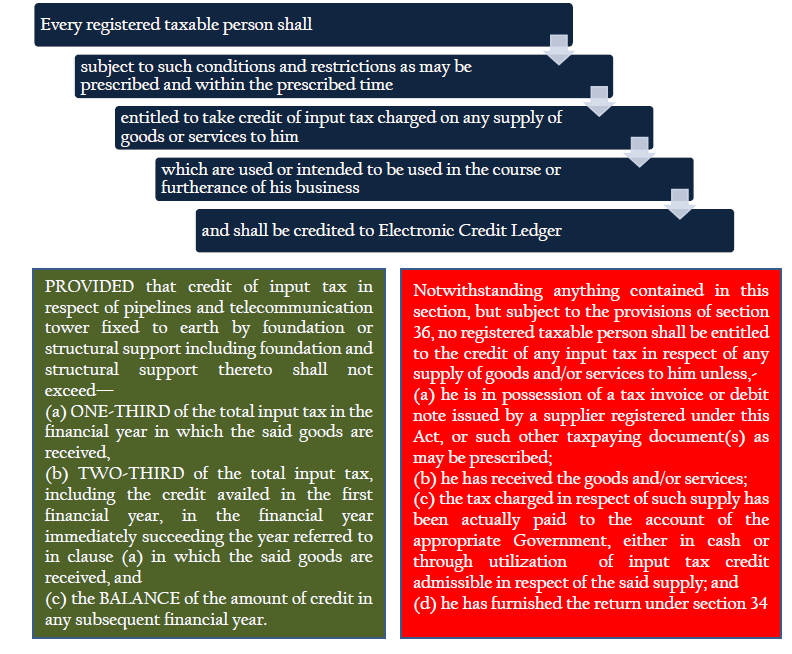

Sec 16. Eligibility and conditions for taking input tax credit

Notes

PROVIDED that where the goods against an invoice are received in lots or instalments, the registered taxable person shall be entitled to take credit upon receipt of the last lot or installment:

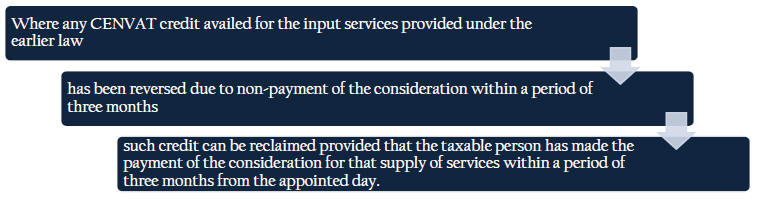

PROVIDED FURTHER that where a recipient fails to pay to the supplier of services, the amount towards the value of supply of services along with tax payable thereon within a period of three months from the

date of issue of invoice by the supplier, an amount

equal to the input tax credit availed by the recipient shall be added to his output tax liability, along with interest

thereon, in the manner as may be prescribed.

Explanation.—For the purpose of clause (b), it shall be deemed that the taxable person has received the goods where the goods are delivered by the supplier to a recipient or any other person on the direction of such taxable person, whether acting as an agent or otherwise, before or during movement of goods, either by way of transfer of documents of title to goods or otherwise.

(3) Where the registered taxable person has claimed depreciation on the tax component

of the cost of capital goods under the provisions of the Income Tax Act, 1961(43 of 1961), the input tax credit shall not be allowed on the said tax component.

(4) A taxable person shall not be entitled to take input tax credit

in respect of any invoice or debit note for supply of goods or services after furnishing of the return under section 34 for the month of September following the end of financial year to which such invoice or invoice relating to such debit note pertains or furnishing of the relevant annual return, whichever is earlier.

17. Apportionment of credit and blocked credits

(1) Where the goods and/or services are used by the registered taxable person partly for the purpose of any business and partly for other purposes, the amount of credit shall be restricted to so much of the input tax as is attributable to the purposes of his business.

(2) Where the goods and / or services are used by the registered taxable person partly for effecting taxable supplies including zero-rated supplies under this Act or under the IGST Act, 2016 and partly for effecting exempt supplies under the said Acts,

the amount of credit shall be restricted to so much of the input tax as is attributable to the said taxable supplies including zero-rated supplies.

Explanation.- For the purposes of this sub-section, exempt supplies shall include supplies on which recipient is liable to pay tax on reverse charge basis under subsection (3) of section 8.

(3) A banking company or a financial institution including a non-banking financial company, engaged in supplying services by way of accepting deposits, extending loans or advances shall have the option to either comply with the provisions of sub-section (2), or avail of, every month, an amount equal to fifty per cent of the eligible input tax credit on inputs, capital goods and input services in that month.

Explanation.- The option once exercised shall not be withdrawn during the remaining part of the financial year.

(4) Notwithstanding anything contained in sub-section (1) of section 16 and subsection (1), (2), (3) and (4) of section 18, input tax credit shall not be available in respect of the following:

(a) motor vehicles and other conveyances except when they are used

(i) for making the following taxable supplies, namely

(A) further supply of such vehicles or conveyances ; or

(B) transportation of passengers; or

(C) imparting training on driving, flying, navigating such vehicles or conveyances;

(ii) for transportation of goods.

(b) supply of goods and services, namely,

(i) food and beverages, outdoor catering, beauty treatment, health services, cosmetic and plastic surgery except where such inward supply of goods or services of a particular category is used by a registered taxable person for making an outward taxable supply of the same category of goods or services;

(ii) membership of a club, health and fitness centre,

(iii) rent-a-cab, life insurance, health insurance except where the Government notifies the services which are obligatory for an employer to provide to its employees under any law for the time being in force; and

(iv) travel benefits extended to employees on vacation such as leave or home travel concession.

(c) works contract services when supplied for construction of immovable property, other than plant and machinery, except where it is an input service for further supply of works contract service;

(d) goods or services received by a taxable person for construction of an immovable property on his own account, other than plant and machinery, even when used in course or furtherance of business;

Explanation 1.- For the purpose of this clause, the word “construction” includes re-construction, renovation, additions or alterations or repairs, to the extent of capitalization, to the said immovable property.

Explanation 2.- ‘Plant and Machinery’ means apparatus, equipment, machinery, pipelines, telecommunication tower fixed to earth by foundation or structural support that are used for making outward supply and includes such foundation and structural supports but excludes land, building or any other civil structures.

(e) goods and/or services on which tax has been paid under section 9 i.e Composition Scheme;

(f) goods and/or services used for personal consumption;

(g) goods lost, stolen, destroyed, written off or disposed of by way of gift or free samples; and

(h) any tax paid in terms of sections 67, 89 or 90.

(5) The Central or a State Government may, by notification issued in this behalf, prescribe the manner in which the credit referred to in sub-sections (1) and (2) above may be attributed.

Sec 18. Availability of credit in special circumstances

(1) A person who has applied for registration under the Act within thirty days from the date on which he becomes liable to registration

and has been granted such registration shall, subject to such conditions and restrictions as may be prescribed, be entitled to take credit of input tax in respect of inputs held in stock and inputs contained in semi-finished or finished goods held in stock on the day immediately preceding the date from which he becomes liable to pay tax under the provisions of this Act.

(2) A person, who takes registration under sub-section (3) of section 23 shall, subject to such conditions and restrictions as may be prescribed, be entitled to take credit of input tax in respect of inputs held in stock and inputs contained in semi-finished or finished goods held in stock on the day immediately preceding the date of grant of registration.

(3) Where any registered taxable person ceases to pay tax under section 9 i.e Composition Scheme, he shall, subject to such conditions and restrictions as may be prescribed, be entitled to take credit of input tax in respect of inputs held in stock, inputs contained in semi-finished or finished goods held in stock and on capital goods on the day immediately preceding the date from which he becomes liable to pay tax under section 8:

PROVIDED that the credit on capital goods shall be reduced by such percentage points as may be prescribed in this behalf

(4) Where an exempt supply of goods or services by a registered taxable person becomes a taxable supply, such person shall, subject to such conditions and restrictions as may be prescribed, be entitled to take credit of input tax in respect of inputs held in stock and inputs contained in semi-finished or finished goods held in stock relatable to such exempt supply and on capital goods exclusively used for such exempt supply on the day immediately preceding the date from which such supply becomes taxable:

PROVIDED that the credit on capital goods shall be reduced by such percentage points as may be prescribed in this behalf.

(5) A taxable person shall not be entitled to take input tax credit under sub-section (1), (2), (3) or (4), as the case may be, in respect of any supply of goods and / or services to him after the expiry of one year from the date of issue of tax invoice relating to such supply.

(6) Where there is a change in the constitution of a registered taxable person on account of sale, merger, demerger, amalgamation, lease or transfer of the business with the specific provision for transfer of liabilities, the said registered taxable person shall be allowed to transfer the input tax credit that remains unutilized in its books of accounts to such sold, merged, demerged, amalgamated, leased or transferred business in the manner prescribed.

(7) Where any registered taxable person who has availed of input tax credit

switches over as a taxable person for paying tax under Composition Scheme section 9 or, where the goods and / or services supplied by him become exempt absolutely under section 11, he

shall pay an amount, by way of debit in the electronic credit or cash ledger, equivalent to the credit of input tax in respect of inputs held in stock and inputs contained in semi-finished or finished goods held in stock and on capital goods, reduced by such percentage points as may be prescribed, on the day immediately preceding the date of such switch over or, as the case may be, the date of such exemption:

PROVIDED that after payment of such amount, the balance of input tax credit, if any, lying in his electronic credit ledger shall lapse.

(8) The amount payable under sub-section (7) shall be calculated in such manner as may be prescribed.

(9) The amount of credit under sub-section (1), (2), (3) and (4) shall be calculated in such manner as may be prescribed.

(10) In case of supply of capital goods or plant and machinery, on which input tax credit has been taken, the registered taxable person shall pay an amount equal to the input tax credit taken on the said capital goods or plant and machinery reduced by the percentage points as may be specified in this behalf or the tax on the transaction value of such capital goods or plant and machinery under sub-section (1) of section 15, whichever is higher:

PROVIDED FURTHER that where refractory bricks, moulds and dies, jigs and fixtures are supplied as scrap, the taxable person may pay tax on the transaction value of such goods under sub-section (1) of section 15.

19. Recovery of Input Tax Credit and Interest thereon

Where credit has been taken wrongly, the same shall be recovered from the registered taxable person in accordance with the provisions of this Act.

20. Taking input tax credit in respect of inputs sent for job work

(1) The “principal” referred to in section 55 shall, subject to such conditions and restrictions as may be prescribed, be allowed input tax credit on inputs sent to a job-worker for job-work.

(2) Notwithstanding anything contained in clause (b) of sub-section (2) of section 16, the “principal” shall be entitled to take credit of input tax on inputs even if the inputs are directly sent to a job worker for job-work without their being first brought to his place of business.

(3) Where the inputs sent for job-work are not received back by the “principal” after completion of job-work or otherwise or are not supplied from the place of business of the job worker in accordance with clause (b) of sub-section (1) of section 55 within a period of one year of their being sent out, it shall be deemed that such inputs had been supplied by the principal to the job-worker on the day when the said inputs were sent out:

PROVIDED that where the inputs are sent directly to a job worker, the period of one year shall be counted from the date of receipt of inputs by the job worker.

(4) The “principal” shall, subject to such conditions and restrictions as may be prescribed, be allowed input tax credit on capital goods sent to a job-worker for job-work.

(5) Notwithstanding anything contained in clause (b) of sub-section (2) of section 16, the “principal” shall be entitled to take credit of input tax on capital goods even if the capital goods are directly sent to a job worker for job-work without their being first brought to his place of business.

(6) Where the capital goods sent for job-work are not received back by the “principal” within a period of three years of their being sent out, it shall be deemed that such capital goods had been supplied by the principal to the jobworker on the day when the said capital goods were sent out:

PROVIDED that where the capital goods are sent directly to a job worker, the period of three years shall be counted from the date of receipt of capital goods by the job worker.

(7) Nothing contained in sub-section (3) or sub-section (6) shall apply to moulds and dies, jigs and fixtures, or tools sent out to a job-worker for job-work.

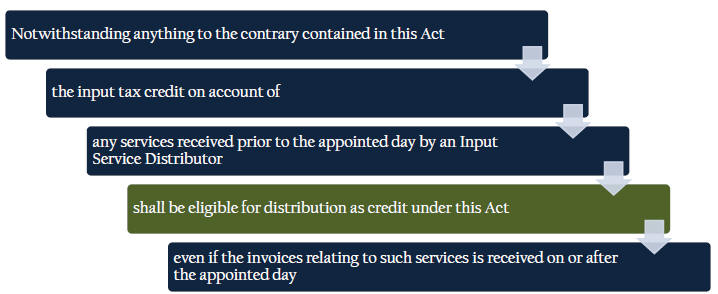

21. Manner of distribution of credit by Input Service Distributor

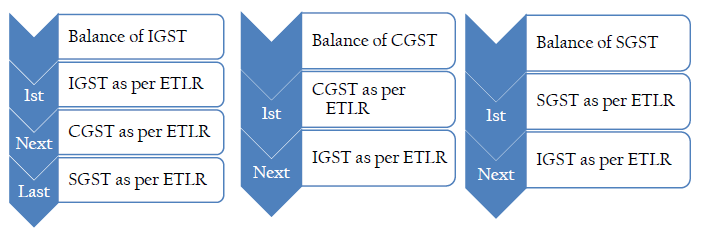

(1) The Input Service Distributor shall distribute, in such manner as may be prescribed, the credit of CGST as CGST or IGST and IGST as IGST or CGST or SGST as SGST or IGST by way of issue of a prescribed document containing, inter alia, the amount of input tax credit being distributed or being reduced thereafter, where the Distributor and the recipient of credit are located in different States.

(2) The Input Service Distributor shall distribute, in such manner as may be prescribed, the credit of CGST and IGST as CGST or SGST as SGST and IGST as IGST, by way of issue of a prescribed document containing, inter alia, the amount of input tax credit being distributed or being reduced thereafter, where the Distributor and the recipient of credit, being a business vertical, are located in the same State.

(3) The Input Service Distributor may distribute the credit subject to the following conditions, namely:

- the credit can be distributed against a prescribed document issued to each of the recipients of the credit so distributed, and such document shall contain details as may be prescribed;

- the amount of the credit distributed shall not exceed the amount of credit available for distribution;

- the credit of tax paid on input services attributable to a recipient of credit shall be distributed only to that recipient;

- the credit of tax paid on input services attributable to more than one recipient of credit shall be distributed only amongst such recipient(s) to whom the input service is attributable and such distribution shall be pro rata on the basis of the turnover in a State of such recipient, during the relevant period, to the aggregate of the turnover of all such recipients to whom such input service is attributable and which are operational in the current year, during the said relevant period;

- the credit of tax paid on input services attributable to all recipients of credit shall be distributed amongst such recipients and such distribution shall be pro rata on the basis of the turnover in a State of such recipient, during the relevant period, to the aggregate of the turnover of all recipients and which are operational in the current year, during the said relevant period.

Explanation 1. –For the purposes of this section, the “relevant period” shall be

(a) if the recipients of the credit have turnover in their States in the financial year preceding the year during which credit is to be distributed, the said financial year; or

(b) if some or all recipients of the credit do not have any turnover in their States in the financial year preceding the year during which the credit is to be distributed, the last quarter for which details of such turnover of all the recipients are available, previous to the month during which credit is to be distributed.

Explanation 2. - For the purposes of this section, ‘recipient of credit’ means the supplier of goods and / or services having the same PAN as that of Input Service Distributor.

Explanation 3. – For the purposes of this section, ‘turnover’ means aggregate value of turnover, as defined under sub-section (6) of section 2.

22. Manner of recovery of credit distributed in excess

Where the Input Service Distributor distributes the credit in contravention of the provisions contained in section 21 resulting in excess distribution of credit to one or more recipients of credit, the excess credit so distributed shall be recovered from such recipient(s) along with interest, and the provisions of section 66 or 67, as the case may be, shall apply mutatis mutandis for effecting such recovery.

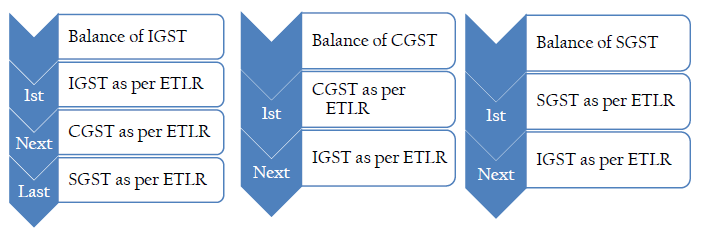

Payments

Modes

- Every deposit of payment of Tax / Interest / Penalty / Other Amount shall be made by

- Internet Banking;

- Debit Card

- Credit Card of Taxable Person Registered with GSTN;

- NEFT

- RTGS

- OTC upto Rs. 10,000/- in Cash, DD, Cheque of same bank or Local cheque of any bank

- Any other mode as prescribed.

Law at Glance

- Amount paid under above methods shall be credited to ECL (GST PMT – 3) of tax payer

- Payment to be made by generating GST PMT 4, valid for 15 days

- Copy of challan shall be available on GSTN for downloading / printing

- Bank Charges, viz commission, payment gateway, etc. to be borned by tax payer

- Input Tax Credit as self assessed shall be credited in ECrL (GST PMT – 2)

- Unique Identification Number (UIN) shall be generated on GSTN Common Portal for each credit / debit to ECL

- This UIN is indicated at time of discharging liability in Electronic Tax Liability Ledger (ETLR) (GSTN PMT – 1)

- Debits in ETLR shall be towards tax liability, interest or mismatch under sec 37, 38 & 56

- Payment of liability shall be made by Crediting ETLR through balances in Electronic Cash / Credit ledgers

Utilisation of Balances in Electronic Credit Ledgers to set off liability as per Electronic Tax Liability Ledger (ETLR)

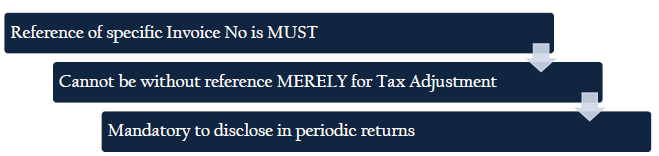

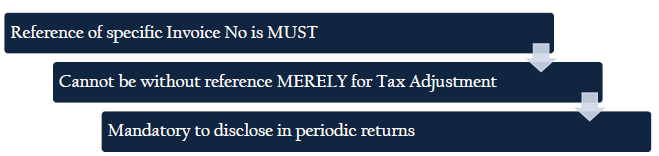

Credit / Debit Notes

Payment Forms / Ledgers

|

Form No

|

Purpose

|

|

GST PMT 1

|

Electronic Tax Liability Register of Taxpayer (ETLR)

(Part–I: Return related liabilities)

Electronic Tax Liability Register of Taxpayer (ETLR)

(Part–II: Other than return related liabilities)

|

|

GST PMT - 2

|

Electronic Credit Ledger (ECrL)

|

|

GST PMT – 2A

|

Order for re-credit of the amount to cash or credit ledger

|

|

GST PMT – 3

|

Electronic Cash Ledger (ECL)

|

|

GST PMT – 4

|

Challan for deposit of Goods and Service Tax

|

|

GST PMT – 5

|

Payment register of temporary ID’s / Unregistered Taxpayers

|

|

GST PMT – 6

|

Application for credit of missing payment (CIN not generated)

|

Refund

Situations of Refund

- Excess payment due to mistake and inadvertence,

- The situations where the tax payer has made excess payment of tax either by mistake or by inadvertence resulting in more payment of tax than due to the Government. Such excess payment may be on account of:-

- wrong mention of nature of tax (CGST / SGST / IGST),

- wrong mention of GSTIN, or

- wrong mention (deposit) of tax amount.

- In first two situations i.e. in case of wrong mention of nature of tax (CGST / SGST / IGST) or in case of wrong mention of GSTIN, the tax administration is required to verify the correctness of the taxpayer’s claim and therefore the taxpayer may file a refund application which should be decided within a period to be prescribed by the GST Law.

- In the first and third situation, the refund of excess amount of tax, at the option of the taxpayer, would either be automatically carried forward for adjustment against future tax liabilities or be refunded

- Export (including deemed export),

- Finalization of Provisional Assessment,

- Refund of pre deposit in case of Appeal or Investigation,

- Refund for Tax payment on transactions by UN bodies, CSD Canteens, Para-military forces canteens, etc.

- Refund from Manufacturing / Generation/ Production/ Creation of Tax- free supplies or Non-GST Supplies,

- Refund of Carry Forward Input Tax Credit may arise due to

- Inverted Duty Structure i.e. GST on output supplies is less than the GST on the input supplies;

- Stock accumulation;

- Capital goods; and

- Partial Reverse charge mechanism for certain services

- Tax refunds for International Tourists

- Refund of GST will be available at designated airports and ports only and the refund of the GST paid on retail purchase by the foreign tourists during their stay in India is allowed.

- A part of the eligible amount of refund will be deducted as handling fee for services rendered

Law at Glance

- Proof of satisfying Principle of Unjust Enrichment is on tax payer

- Self Certification by Tax payers for refund below ₹ 5 lakhs

- CA / CMA Certificates for taxpayers beyond threshold limit of ₹ 5 lakhs

- Date of communication shall be the relevant date for interest liability

- Interest shall be paid on delayed refunds at notified rate if delay in paying refund after 60 days of receipt of application.

- A period of TWO YEARS from the relevant date may be allowed for filing of refund application

- A period of SIX MONTHS from the last day of the month in which such supply is received, Refund application be allowed for Embassy/International Organizations

Relevant dates for Filing of Refund

|

Situation

|

Relevant Date for Filing Refund

|

|

On account of Export of Goods where a refund of tax paid is available in respect of the goods themselves or, as the case may be, the inputs or input services used in such goods

|

|

|

if the goods are exported by sea or air

|

the date on which the ship or the aircraft in which such goods are loaded, leaves India

|

|

if the goods are exported by land

|

the date on which such goods pass the frontier

|

|

if the goods are exported by post

|

the date of despatch of goods by the Post Office concerned to a place outside India

|

|

in the case of supply of goods regarded as deemed exports where a refund of tax paid is available in respect of the goods

|

the date on which the return relating to such deemed exports is filed

|

|

On account of Export of Services where a refund of tax paid is available in respect of services themselves or, as the case may be, the inputs or input services used in such services

|

|

|

where the supply of service had been completed prior to the receipt of such payment

|

Date of receipt of payment in convertible foreign exchange

|

|

where payment for the service had been received in advance prior to the date of issue of the invoice

|

Date of issue of invoice

|

|

In pursuance of an appellate authority, Appellate Tribunal or Court order in favour of the taxpayer.

|

Date of communication of the such judgement, decree, order or direction of respective authority

|

|

On account of refund of accumulated ITC due to inverted duty structure.

|

Last day of the financial Year

|

|

On account of finalization of provisional assessment for tax paid provisionally

|

Date of adjustment of tax after the final assessment

|

|

in the case of a person, other than the supplier,

|

the date of receipt of goods or services by such person

|

|

For refund arising out of payment of GST on petroleum products, etc. to Embassies or UN bodies or to CSD canteens, etc. on the basis of applications filed by such persons.

|

Date of payment of GST

|

|

Any other Case

|

Date of payment of GST

|

Refund Forms

|

Form Number

|

Content

|

|

GST RFD-01

|

Refund Application form

–Annexure 1 Details of Goods

–Annexure 2 Certificate by CA

|

|

GST RFD-02

|

Acknowledgement

|

|

GST RFD-03

|

Notice of Deficiency on Application for Refund

|

|

GST RFD-04

|

Provisional Refund Sanction Order

|

|

GST RFD-05

|

Refund Sanction/Rejection Order

|

|

GST RFD-06

|

Order for Complete adjustment of claimed Refund

|

|

GST RFD-07

|

Show cause notice for reject of refund application

|

|

GST RFD-08

|

Payment Advice

|

|

GST RFD-09

|

Order for Interest on delayed refunds

|

|

GST RFD-10

|

Refund application form for Embassy/International Organizations

|

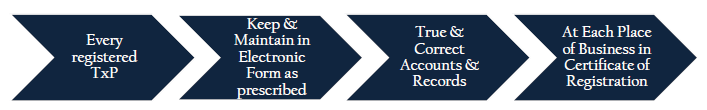

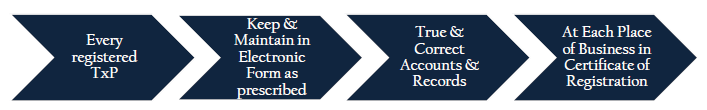

Accounts & Records

- True & Correct Records to be maintained of

- Production or Manufacture of Goods

- Inward or Outward Supply of Goods / Services

- Stock of Goods

- Input Tax Credit Availed

- Output Tax Payable / Paid

- Other Particulars as may be prescribed

- Additional particulars for notified class of persons, prescribed by Commissioner

- If not possible to maintain as such, then other records as prescribed by Commissioner for such class of persons

- Every registered TxP whose turnover exceeds prescribed limit in a FY, i.e ₹ 1 crore

- has to get accounts audited by CA / CMA

- Submit copy of audited accounts to PO

- Submit Reconciliation statement u/s 39(2) to PO

- Other documents in form and manner prescribed

- Every owner / operator of warehouse / godown / other place used for storage of goods irrespective whether registered TxP or not shall maintain

- Records of Consignor / Consignee

- Other relevant records as may be prescribed

- If TxP fails to account for goods/ services as prescribed

- PO shall determine tax payable on unaccounted goods / services u/s 66 / 67 as if supplied by such TxP

- Accounts & Records to be maintained by TxP until 60 months from due date of filing of annual return

- If TxP is party to appeal / Revision / any proceeding before appellate authority / Tribunal / court shall retain accounts & records for said period under consideration, LATER of

- upto 1 year from FINAL DISPOSAL of such appeal / Revision / any proceeding before appellate authority / Tribunal / court

- 60 months from due date of filing of annual return

Types of Returns

|

Return Form No

|

Particulars to be furnished

|

Due date of filing

|

|

GSTR-1

|

Details of outward supplies of taxable goods and/or services effected

|

File by 10th of next month

|

|

GSTR-1A

|

Details of outward supplies as added, corrected or deleted by the recipient

|

Reconcile by 17th of next month prior to filing GSTR 3

|

|

GSTR-2

|

Details of inward supplies of taxable goods and/or services claiming input tax credit

|

File by 15th of next month

|

|

GSTR-2A

|

Details of inward supplies made available to the recipient on the basis of FORM GSTR-1 furnished by the supplier

|

Reconcile prior to filing GSTR 2

|

|

GSTR-3

|

Monthly return on the basis of finalization of details of outward supplies and inward supplies along with the payment of amount of tax

|

File by 20th of next month

|

|

GSTR-3A

|

Notice to a registered taxable person who fails to furnish return under section 34 and section 31

|

To be prescribed

|

|

GSTR-4

|

Quarterly Return for compounding Taxable persons

|

File by 18th of the month succeeding the quarter

|

|

GSTR-4A

|

Details of inward supplies made available to the recipient registered under composition scheme on the basis of FORM GSTR-1 furnished by the supplier

|

Reconcile prior to filing GSTR 4

|

|

GSTR-5

|

Return for Non-Resident foreign taxable person

|

File with 7 days of validity period or 20 days of end of tax period

|

|

GSTR-6

|

ISD return

|

File by 13th of next month

|

|

GSTR-6A

|

Details of inward supplies made available to the ISD recipient on the basis of FORM GSTR-1 furnished by the supplier

|

Reconcile prior to filing GSTR-6

|

|

GSTR-7

|

Return for authorities deducting tax at source

|

File by 10th of next month

|

|

GSTR-7A

|

TDS Certificate

|

Made available on Common Portal after GSTR-7 is filed by deductor

|

|

GST-ITC-1

|

Communication of acceptance, discrepancy or duplication of input tax credit claim

|

After 15th of next month or before last date of the month in which matching is carried out.

|

|

GSTR-8

|

Details of supplies effected through e-commerce operator and the amount of tax collected as required under sub-section (3) of section 56

|

File by 10th of next month

|

|

GSTR-9

|

Annual return

|

By 31st December of next FY

|

|

GSTR-9A

|

Simplified Annual return by Compounding taxable persons registered under section 9

|

By 31st December of next FY

|

|

GSTR-9B

|

Audited Annual accounts & Reconciliation Statement whose Aggregate T/o > ₹ 1 crore

|

By 31st December of next FY

|

|

GSTR-10

|

Final return

|

Within 3 months of LATER of date of application of cancellation; or date of cancellation order

|

|

GSTR-11

|

Details of inward supplies to be furnished by a person having UIN

|

|

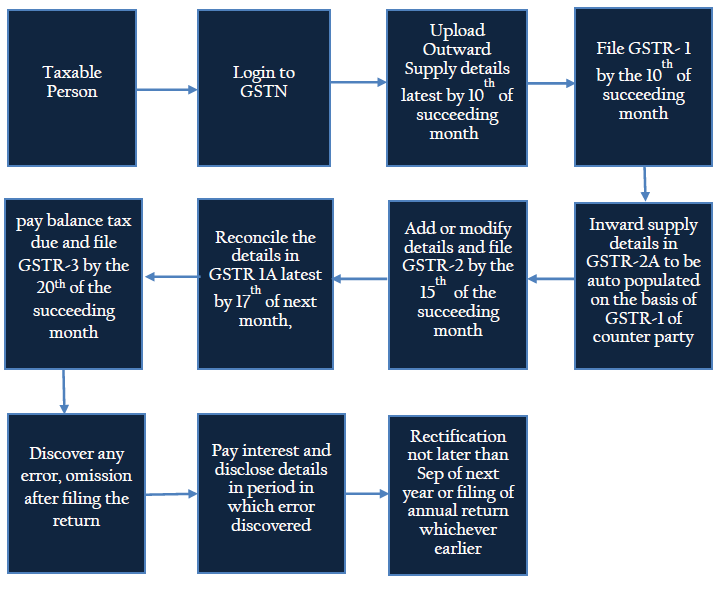

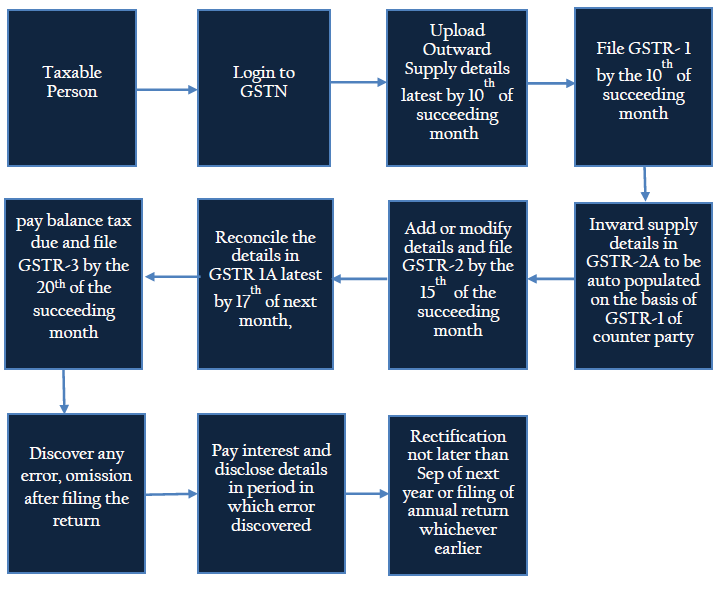

Flow of activities per month for Generic Returns under GST

Law at Glance

- Monthly Returns Compulsory

- Quarterly Returns only for Dealers opting for Composition Levy u/s 9

- Returns to be filed even if no supplies have been effected in the said period

- Self assessment of tax liability by the tax payer

- Tax Due is to be paid till the last day of furnishing the return

- Revision of Returns NOT ALLOWED

- Omissions / Discovery of incorrect particulars by the dealer, other than those found by departmental enquires, to be RECTIFIED IN RETURN for the PERIOD in which mistake is discovered.

- Rectifications NOT ALLOWED AFTER due date for filing return for period ending September immediate next year or actual date of filing annual return whichever is earlier.

- B2B transactions proposed on Invoice wise ➔ GSTIN, Invoice No, Date, description, rate of tax, value of taxable supply & value of tax

- B2C invoice wise only for Inter State Supply above Rs. 100/-

- Separate Data Input fields for Debit / Credit Notes / TDS / ISD

- Common e-Return for CGST, SGST & IGST with different fields First return u/s 35- To disclose details of outward supplies in period between date on which TxP become liable for registration till the date on which registration is granted

- Final Return u/s 40 within 3 months of cancellation of registration

- Notice to Defaulters u/s 41 to furnish return within 15 days in prescribed manner

- Tax Return Preparers u/s 43

- Annual Return u/s 39

- Reconciliation Statement to be filed

- Audit required for crossing prescribed turnover of ₹ 1 crore

- Levy of Late Fee

- Annual Return – ₹ 100/- per day, Max 0.25% of turnover of the state

- Other than Annual Return – ₹ 100/- per day, Max ₹ 5000/- i.e. for all other types of returns

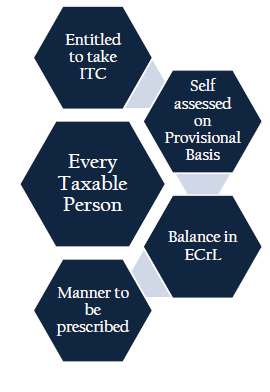

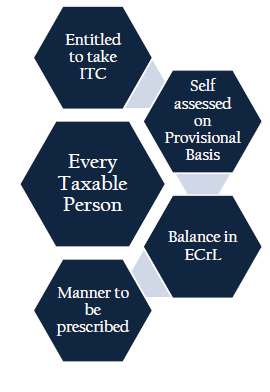

Input Tax Credit Claim sec 36

Note: Input Tax Credit Claim shall be matched with outward supplies filed by corresponding tax payer

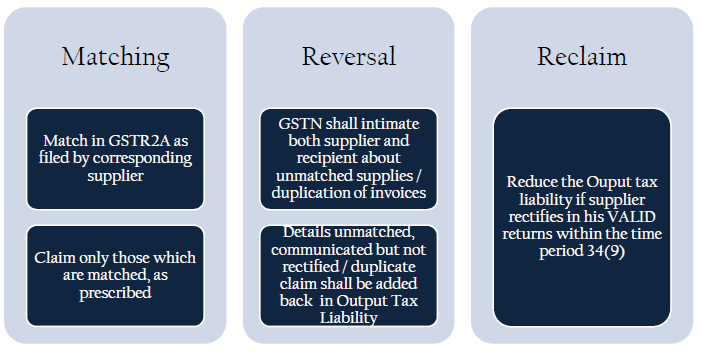

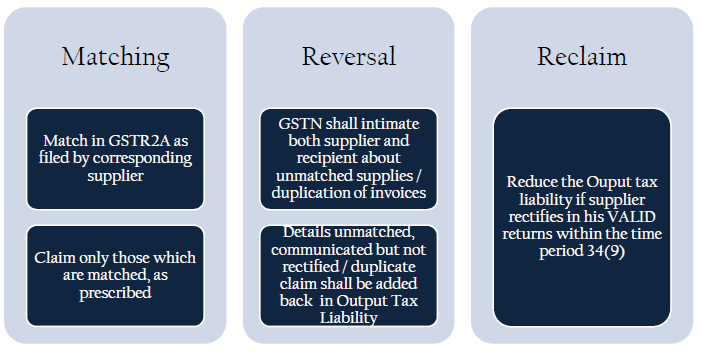

Matching, Reversal, Reclaim of

ITC sec 37 / Output Tax Liability sec 38

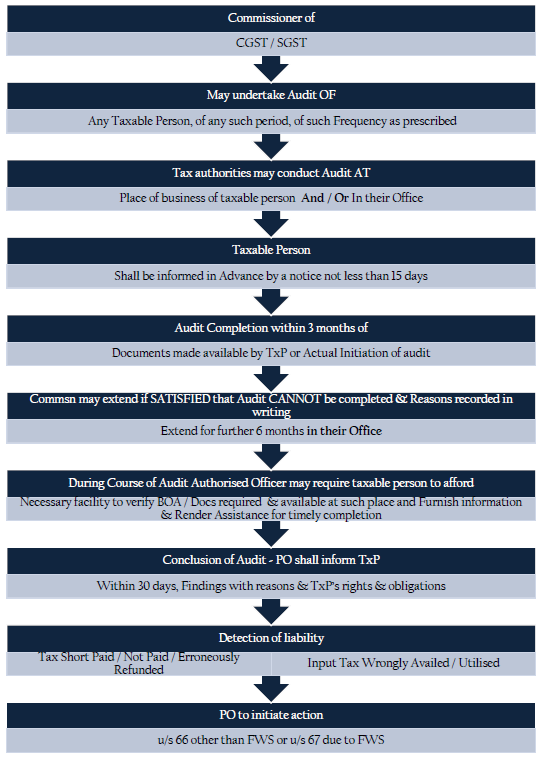

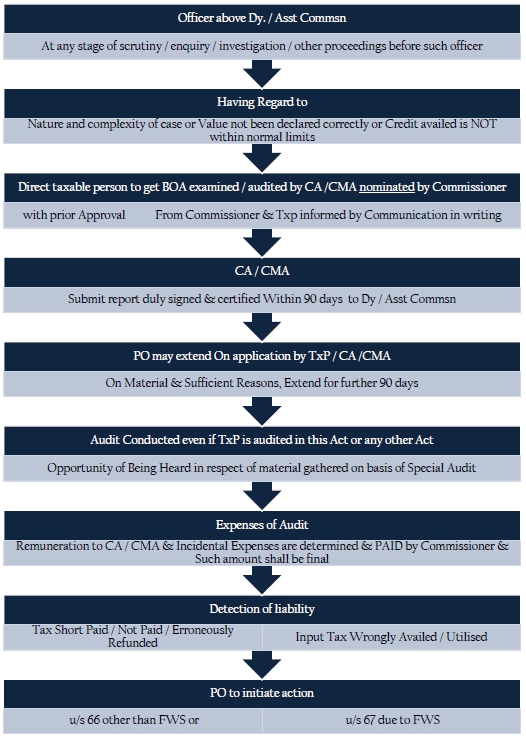

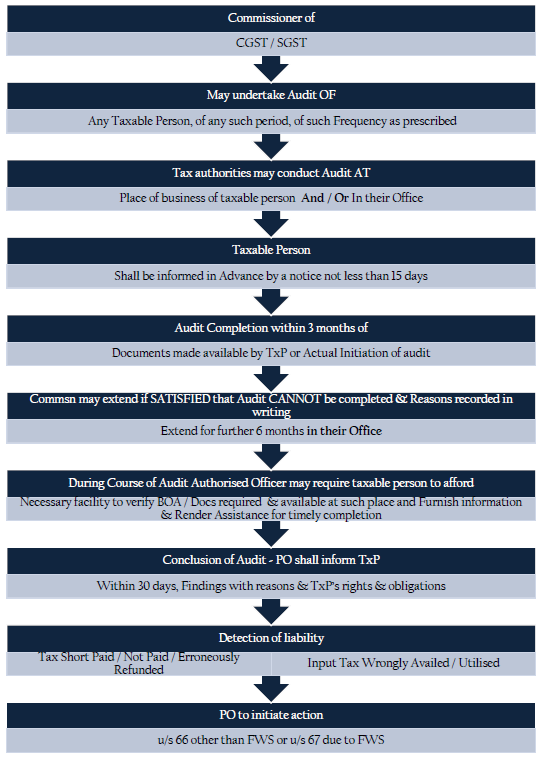

Audit by Tax Authorities

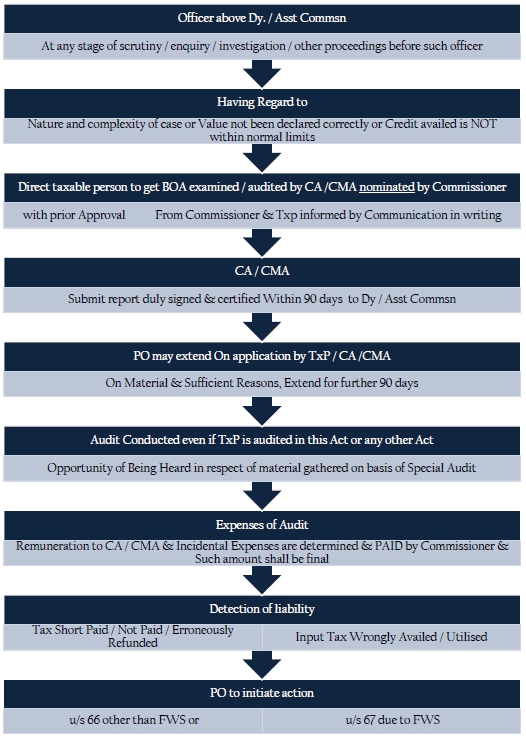

Special Audit

Assessments

- Self-Assessment

Every registered taxable person shall himself assess the taxes payable under this Act and furnish a return for each tax period as specified under section 34.

- Provisional Assessment

(1) Where the taxable person is unable to determine the value of goods and/or services or determine the rate of tax applicable thereto, he may request the proper officer in writing giving reasons for payment of tax on a provisional basis and the proper officer may pass an order allowing payment of tax on provisional basis at such rate or on such value as may be specified by him.

(2) The payment of tax on provisional basis may be allowed, if the taxable person executes a bond in such form as may be prescribed in this behalf, and with such surety or security as the proper officer may deem fit, binding the taxable person for payment of the difference between the amount of tax as may be finally assessed and the amount of tax provisionally assessed.

(3) The proper officer shall, within a period not exceeding six months from the date of the communication of the order issued under sub-section (1), pass the final assessment order after taking into account such information as may be required for finalizing the assessment:

PROVIDED that the period specified in this sub-section may, on sufficient cause being shown and for reasons to be recorded in writing, be extended by the Joint/Additional Commissioner for a further period not exceeding six months and by the Commissioner for such further period as he may deem fit.

(4) The taxable person shall be liable to pay interest on any tax payable on the supply under provisional assessment but not paid on the due date specified under sub-section (7) of section 34 or the rules made thereunder at the rate specified under sub-section (1) of section 45, from the first day after the due date of payment of tax in respect of the said goods and/or services till the date of actual payment, whether such amount is paid before or after the issue of order for final assessment.

(5) Where the taxable person is entitled to a refund consequent to the order for final assessment under sub-section (3), subject to sub-section (8) of section 48, interest shall be paid on such refund as provided in section 50.

- Scrutiny of returns

(1) The proper officer may scrutinize the return and related particulars furnished by the taxable person to verify the correctness of the return in such manner as may be prescribed.

(2) The proper officer shall inform the taxable person of the discrepancies noticed, if any, after such scrutiny in such manner as may be prescribed and seek his explanation thereto.

(3) In case the explanation is found acceptable, the taxable person shall be informed accordingly and no further action shall be taken in this regard.

(4) In case no satisfactory explanation is furnished within a period of thirty days of being informed by the proper officer or such further period as may be permitted by him or where the taxable person, after accepting the discrepancies, fails to take the corrective measure in his return for the month in which the discrepancy is accepted, the proper officer may initiate appropriate action including those under section 63, 64 or section 79, or proceed to determine the tax and other dues under sub-section (7) of section 66 or under sub-section (7) of section 67.

- Assessment of non-filers of returns

(1) Where a registered taxable person fails to furnish the return required under section 34 or section 40, even after the service of a notice under section 41, the proper officer may proceed to assess the tax liability of the said person to the best of his judgement taking into account all the relevant material which is available or which he has gathered and issue an assessment order within the time limit specified in sub-section (8) of section 67.

(2) Where the taxable person furnishes a valid return within thirty days of the service of the assessment order under sub-section (1), the said assessment order shall be deemed to have been withdrawn.

Explanation.— Nothing in this section shall preclude the liability for payment of interest under section 45 and/or for payment of late fee under section 42.

- Assessment of unregistered persons