Borrowings from Non-residents

External Commercial Borrowings [ECB]

ECB is an important component of India’s overall external debt. ECB refers to commercial loans raised by eligible resident entities from recognised non-resident entities and should conform to parameters such as minimum maturity, permitted and non- permitted end-uses, maximum all-in-cost ceiling, etc. The parameters apply in totality and not on a standalone basis.

ECB cannot be raised by Individuals, partnership firms & LLP. Start-up enterprises have been permitted to access loans under ECB subject to eligibility conditions. Entities engaged in micro- finance activities can raise ECB:

- If they have a satisfactory borrowing relationship for at least 3 years with a bank in India.

- If they have a certificate of due diligence on ‘fit and proper’ status from a bank in India.

ECB can be raised in any freely convertible foreign currency as well as in Indian Rupees. Change of currency of ECB from one convertible foreign currency to any other convertible foreign currency as well as to INR is freely permitted. Change of currency from INR to any foreign currency is, however, not permitted.

Depending on the currency of borrowing and maturity period ECB is divided in the following three tracks:

|

Track I

|

Medium-term foreign currency denominated ECB with minimum average maturity of 3/5 years.

|

|

Track II

|

Long-term foreign currency denominated ECB with minimum average maturity of 10 years.

|

|

Track III

|

Indian Rupee (INR) denominated ECB with minimum average maturity of 3/5 years.

|

ECB can be in the following forms:

- Loans including bank loans.

- Securitised instruments – floating rate notes and fixed rate bonds, non-convertible (except those issued to Registered Foreign Portfolio Investors (RFPI), optionally convertible or partially convertible preference shares / debentures.

- Buyers’ credit/Suppliers’ credit.

- Foreign Currency Convertible Bonds (FCCB).

- Financial Lease.

- Foreign Currency Exchangeable Bonds (FCEB) – only Approval Route.

The various parameters for raising loans through ECB under the different tracks are mentioned hereunder:

- Minimum Average Maturity

|

Track I

|

Track II

|

Track III

|

|

Up to US $ 50 million or equivalent – 3 Years

|

10 years

(Irrespective of the amount of borrowing)

|

Same as that of Track I

|

|

Beyond US $ 50 million or equivalent – 5 Years

|

|

For eligible borrowers (Irrespective of the amount of borrowing) – 5 Years

|

|

Foreign Currency Convertible Bonds (FCCB) / Foreign Currency Exchangeable Bonds (FCEB)** (Irrespective of the amount of borrowing) – 5 Years

|

|

** The call and put option, if any, for FCCBs shall not be exercisable prior to 5 years.

|

- Eligible Borrowers

|

Track I

|

Track II

|

Track III

|

|

SIDBI, Units in SEZs

|

All entities under Track I

|

All entities under Track II

|

|

Shipping and airlines companies

|

Real Estate Investment Trusts (REITs) – Falling under the framework of SEBI

|

All NBFCs – Falling under the purview of RBI & NBFC-Micro Finance Institutions (NBFC-MFI)

|

|

Companies in manufacturing and software development sectors

|

Infrastructure Investment Trusts (INVITs) – Falling under the framework of SEBI

|

Not for Profit companies registered under the Companies Act, 1956/2013,

|

|

Exim Bank (only under the approval route)

|

|

Developers of Special Economic Zones (SEZ) / National Manufacturing and Investment Zones (NMIZ).

|

|

Infrastructure Companies, Non- Banking Financial Companies – Infrastructure Finance Companies (NBFC-IFC)

|

|

Companies engaged in, R&D, training (excluding education institutes), companies supporting infrastructure, companies providing logistics services.

|

|

NBFC-Asset Finance Companies (NBFC-AFC)

|

|

Societies, trusts and co-operatives (registered under the respective Acts.

|

|

Holding Companies and Core Investment Companies (CIC)

|

|

Non-Government Organisations (NGOs) engaged in micro finance activities.

|

- Recognized Lenders

|

Track I

|

Track II

|

Track III

|

|

International banks.

|

All the Recognized Lenders under Track I, excluding overseas branches / Subsidiaries of Indian Banks

|

All Recognized lenders under Track II

NBFCs-MFIs, other eligible MFIs, not for profit companies and NGOs can raise ECB from overseas organisations and individuals.

|

|

International capital markets.

|

|

Export credit agencies

|

|

Suppliers of equipment.

|

|

Foreign equity holders.

|

|

Multilateral financial institutions / regional financial institutions and Government owned (either wholly or partially) financial institutions.

|

|

Overseas branches /subsidiaries of Indian banks.

|

|

Overseas long-term investors, Prudentially regulated financial entities, Pension funds, Insurance companies, Sovereign Wealth Funds, Financial institutions located in International Financial Services Centres in India

|

- All-in-Cost (AIC)

|

Track I

|

Track II

|

Track III

|

|

Is prescribed through a spread over the benchmark:

ECB with minimum average maturity period of 3 to 5 years – 300 basis points per annum over 6 months LIBOR or applicable bench mark for the respective currency.

ECB with average maturity period of more than 5 years – 450 basis points per annum over 6 months LIBOR or applicable bench mark for the respective currency.

|

The maximum spread over the benchmark will be 500 basis points per annum.

Remaining Conditions are same as they apply under Track I

|

In line with the market conditions.

|

Note: Penal interest, if any, for default or breach of covenants should not be more than 2 per cent over and above the contracted rate of interest

- Permitted End-Use

|

Track I

|

Track II

|

Track III

|

|

ECB can be utilised for capital expenditure by way of import of capital goods, payment towards import of services, technical know-how and license fees (Being a part of capital goods), Local sourcing of capital goods, New project, Modernization /expansion of existing units, ODI in JV/WOS, Acquisition of shares of PSUs at any stage of disinvestment under the disinvestment programme of the GOI, Refinancing of existing trade credit/ ECB raised for import of capital goods/ provided the residual maturity is not reduced and Payment of capital goods already shipped / imported.

|

The ECB proceeds can be used for all purposes excluding :

- Real estate activities

- Investing in capital market – Using the proceeds for equity investment domestically;

- On-lending to other entities with any of the above objectives;

- Purchase of land

|

NBFCs can use ECB proceeds only for:

- On-lending for any activities, (Including infrastructure sector as permitted by RBI)

- Providing hypothecated loans to domestic entities for acquisition of capital goods/equipment; and

- Leasing out or hire purchase of capital goods/equipment to domestic entities

|

|

Import of second hand goods as per the DGFT guidelines & On-lending by Exim Bank – Approval Route

|

|

Developers of SEZs/ NMIZs –Providing infrastructure facilities within SEZ/ NMIZ.

|

|

ECB proceeds can be used for general corporate purpose (including working capital) – ECB is raised from the direct / indirect equity holder or from a group company for a minimum average maturity of 5 years.

|

|

NBFCs-MFI, other eligible MFIs, NGOs, not for profit companies registered under the Companies Act, 1956/2013 - On-lending to self-help groups /micro-credit /bona fidemicro finance activity (including capacity building)

|

|

Holding Companies and CICs – On-lending to infrastructure Special Purpose Vehicles (SPVs).

|

|

For other eligible entities, ECB proceeds can be used for all purposes excluding the ones prohibited in Track II

|

|

NBFC-IFCs & NBFCs-AFCs – Financing infrastructure.

|

|

|

|

Shipping and airlines companies - Import of vessels and aircrafts respectively.

|

|

|

|

Units of SEZs – For their own requirements

|

|

|

|

SIDBI – On-lending to the borrowers in the MSME sector

|

|

|

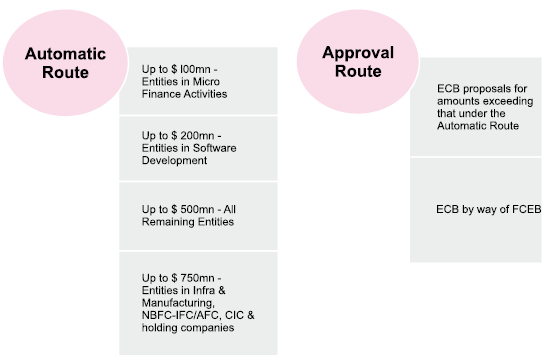

Automatic & Approval Route under ECB

Notes:

- Although ECB may have been raised under the Automatic Route, any draw-down as well as payment of any fees / charges for raising an ECB can happen only after obtaining LRN from RBI.

- For computation of individual limits under Track III, exchange rate prevailing on the date of agreement has to be considered.

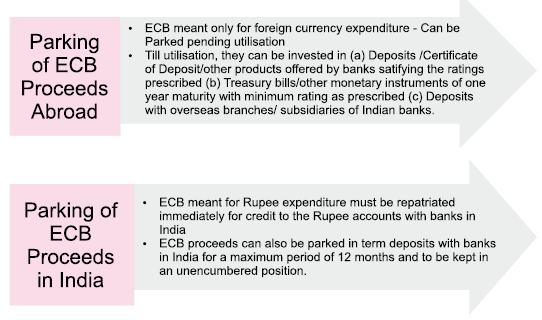

Parking of ECB Proceeds Abroad

TRADE CREDITS

Trade Credits (TC) refer to credits extended for imports directly by the overseas supplier, bank and financial institution for maturity of less than five years. Trade Credits can be supplier’s trade credits or buyer's trade credits.

Supplier's Trade Credit – credit for imports into India extended by the overseas supplier.

Buyer's Trade Credit – loans from overseas bank or financial institution.

Amount and Maturity

Automatic Route - Up to US $ 20 million per import transaction

Approval Route - Beyond US $ 20 million per import transaction

For import of permissible non-capital goods the maturity period is up to one year from the date of shipment or the operating cycle whichever is less. For import of permissible capital goods the maturity period is up to five years from the date of shipment. No roll-over/extension will be permitted beyond the permissible period. The maturity period is the same for transactions under the Automatic Route or the Approval Route.

All in-cost ceiling for Trade Credits is 350 basis points over 6 months LIBOR for the respective currency of credit or applicable benchmark. It includes arranger fee, upfront fee, management fee, handling/processing charges, out of pocket and legal expenses, if any.

Borrowings through Loans / Deposits

- Indian Companies, other Body Corporates, Indian Proprietary Concerns and Firms can accept fresh deposits from NRI only if the deposit is by way of debit to the NRO account of the lender and the amount deposited does not represent inward remittances or transfer from NRE/FCNR (B) Accounts into the NRO Account of the lender. However, they are permitted to hold and renew on maturity existing deposits received by them on repatriation as well as non- repatriation basis.

- Resident Individuals are permitted to avail of interest free loans up to US $ 250,000 from their NRI / PIO relative(s) (as defined under the Companies Act, 2013) subject to certain conditions.

- iii. Special permission of RBI will be required in case where deposits / loans do not fulfil the specified criteria or where the deposits/loans are on repatriation basis in the case of proprietary concerns and firms.

- Banks can grant loans without any ceiling but subject to usual margin requirements (in Indian Rupees in India and in foreign currency in India or overseas) against NRE and FCNR (B) deposits either to the depositors or third parties in India or overseas.

- Resident entities/companies in India, with prior approval of Government of India, can issue tax-free, secured, redeemable, non-convertible bonds in Rupees to persons resident outside India and use such borrowed funds for the following purposes:

- For on lending/re-lending to the infrastructure sector; and

- For keeping in fixed deposits with banks in India pending utilisation by them for permissible end- uses.

Back to Top

|